Virtual asset futures ETF

Virtual asset futures ETFs are now listed and traded on HKEX. These products may provide investors who wish to gain exposure to virtual assets (VA) a listed product option.

A virtual asset futures ETF obtains exposure to VA primarily through futures contracts, which are traded on conventional regulated exchanges, rather than spot VA that are typically traded on less regulated platforms. As such, investors in virtual asset futures ETFs are mainly subject to market risks of the underlying VA and relevant futures risks while investing in spot VA or other overseas virtual asset spot ETFs will be directly exposed to additional significant risks related to custody, platform, manipulation and fraud etc. Unlike passively managed ETFs that track certain underlying indices, virtual asset futures ETFs in Hong Kong generally adopt active investment strategies, to allow flexibility in portfolio composition, rolling strategy and handling of market disruption events.

Virtual asset futures ETFs do not invest directly in VA and do not seek to deliver a return of the spot price of VA. Investors should note that VA futures are relatively new investments with limited history. They are subject to unique and substantial risks, and historically, have been subject to significant price volatility.

You should know how VA and virtual asset futures ETF work and the risks involved before making an investment decision. Intermediaries will also assess whether you have knowledge of investing in VA or VA-related products before effecting a transaction in virtual asset futures ETFs on your behalf. The following pointers help you understand more about this type of products.

- A virtual asset futures ETF is indirectly exposed to the risks of the underlying VA through investment in the relevant VA futures, such as VA is highly speculative, VA prices are extremely volatile and affected by numerous events or factors that are unforeseeable, regulations on VA are still developing and increasing, etc.

- A virtual asset futures ETF is a derivative product and is targeted at investors who understand its nature and risks, such as:

- extremely high price volatility of VA futures and the value of the VA futures may decline significantly, including to zero;

- concentration risk in a single reference asset (e.g., bitcoin or ether) and/or a single futures contract;

- potentially large roll costs of VA futures which may adversely affect the ETF’s net asset value (NAV); and

- operational risks related to VA futures, including additional margin requirements, potential size limits on and/or mandatory liquidation of the ETF’s VA futures positions imposed by relevant parties without advance notice.

- The performance of a virtual asset futures ETF can significantly deviate from that of the VA’s spot price, because the virtual asset futures ETF invests in VA futures but not in the VA directly.

- You should exercise caution when trading a virtual asset futures ETF. Before investing in such ETF, particularly if you wish to adopt a buy-and-hold strategy, you should read this page and its offering documents carefully and fully understand its features, exposure, operation and risks. You should also have a clear understanding of how VA futures contracts work and the rollover mechanism involved. You should pay particular attention to the risks under exceptional market circumstances, such as significant or total loss of your investment in the ETF in a short period of time and how rollover of futures contracts may adversely affect the value and performance of the ETF.

- Investment in virtual asset futures ETFs should only be ancillary in your portfolio because they are highly volatile and do not necessarily provide any diversification effect.

- If you are not prepared to accept significant and unexpected changes in the value of a virtual asset futures ETF (including dropping to zero) and the possibility that you could lose your entire investment in the virtual asset futures ETF, you should not invest in it.

Key facts about VA and VA futures

VA are digital representations of value which may be in the form of digital tokens (such as utility tokens or security or asset-backed tokens), any other virtual commodities, crypto assets or other assets of essentially the same nature. VA may be (or are often claimed to be) a means of payment, may confer a right to present or future earnings or enable the VA holder to access a product or service, or a combination of any of these functions. Two of the more popular VA are bitcoin and ether.

VA, including bitcoin and ether, are typically based on distributed ledger technology that offers an anonymous way to digitally record their ownership and facilitates peer-to-peer trading. They are “stored” on a digital transaction ledger commonly known as a “blockchain”, where the ownership and transaction records are protected through public-key cryptography. While proponents of VA have identified various potential benefits, critics also raised a number of concerns, such as high price volatility, custody risk, no guarantee or backing by authorities and banks, fraud, cybersecurity risk, trading on less regulated or unregulated platforms and their potential association with illegal activities. In particular, over the course of history of VA, some of the major players, including trading platforms and lending platforms that were less regulated and lacked transparency on their financial soundness, collapsed due to mismanagement and potential fraud. These events resulted in significant losses to related VA investors. Compared to conventional investment assets such as equities and bonds, risks of investing in VA and VA-related products are unique and substantial. For more details, please refer to the Virtual assets page.

There are futures contracts on VA too. Among VA futures traded on conventional regulated exchanges, the mostly traded ones are bitcoin futures and ether futures on Chicago Mercantile Exchange (CME). On CME, each of bitcoin futures contract and ether futures contract is USD-denominated and cash settled. The contract unit of the former is 5 bitcoins, whereas the contract unit of the latter is 50 ethers. CME also offers micro bitcoin futures and micro ether futures which have smaller contract units (0.1 bitcoin and 0.1 ether respectively) as well as contracts dominated in euro.

The value of a VA futures is affected by, among others, the factors driving the value of the underlying VA as described above. In extreme cases where the value of the underlying VA declines significantly, including to zero, the value of the relevant VA futures may be affected similarly.

How does a virtual asset futures ETF work?

A virtual asset futures ETF (such as a bitcoin futures ETF or an ether futures ETF) obtains exposure to VA primarily through futures contracts (such as bitcoin futures or ether futures traded on CME). In Hong Kong, virtual asset futures ETFs adopt active investment strategies to allow flexibility in portfolio composition, rolling strategy and handling of market disruption events. Such ETFs do not seek to track any index or benchmark. Depending on the ETF’s investment strategy, the fund manager may invest in futures contracts with short-term or longer-term maturities or a mixture of different maturities, and adjust the portfolio composition from time to time.

The SFC authorizes virtual asset futures ETFs to provide retail investors access to regulated VA products. At the initial stage, the SFC will only authorize CME Bitcoin / Ether futures-based ETFs. You should note that some overseas exchange traded products may provide exposure to other VA and may also be risky. As these products and their offering documents are not reviewed and authorized by the SFC, investors will have no protection under the SFO in terms of product structure, features and documentation.

While a virtual asset futures ETF offers investors a way to gain exposure to VA, investors should understand that its performance can significantly deviate from that of the VA’s spot prices. This is because the price of VA futures contracts may not always go in line with the VA’s spot price and there are risks involved in rolling over the futures contracts (please refer to the section “Key risks” below for more details).

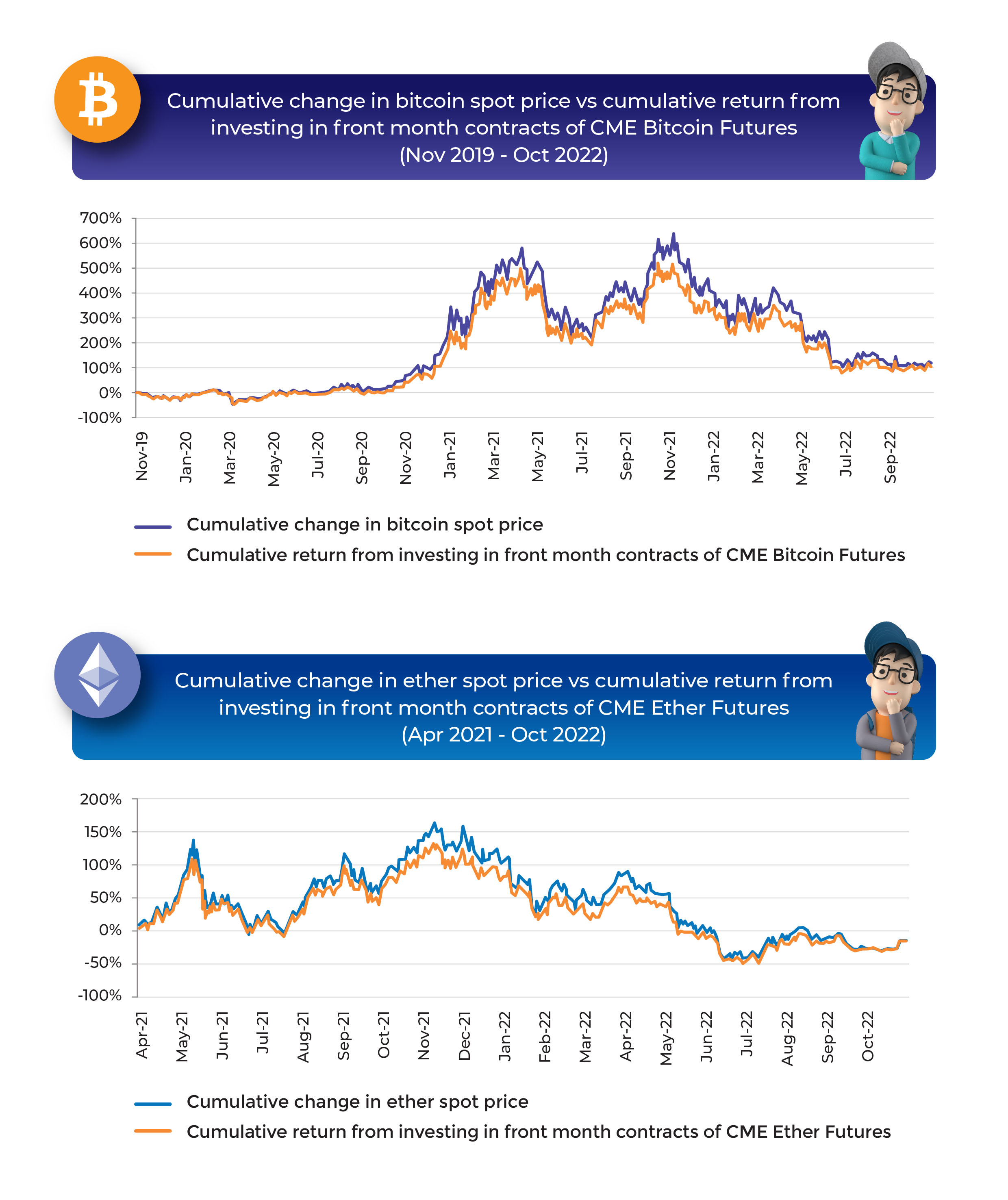

As illustrative examples, the charts below compare the cumulative change in bitcoin and ether spot price, against the cumulative return from investing in CME Bitcoin Futures and CME Ether Futures. As shown in the charts, the deviation between spot and futures performance may not be favorable to investors. Specifically,

- From Nov 2019 to Oct 2022, bitcoin spot price increased by 120% while investing in bitcoin futures contracts yielded a gain of 106% only.

- From Apr 2021 to Oct 2022, ether spot price dropped by 15% while investment in ether futures suffered a loss of 17%.

In the examples, the returns of CME Bitcoin Futures and CME Ether Futures are calculated based on (i) changes in the price of the nearest (i.e. front month) futures contracts; and (ii) the gain and loss resulting from the rolling of the nearest contracts to the next nearest contracts as the nearest contracts approach maturity. Rolling is assumed to take place on the last trading day of the nearest contract.

Key risks

Apart from the major risks of ETFs and the specific risks involved in futures-based ETFs, investors should be aware of the below risks when trading virtual asset futures ETFs.

Risk related to the underlying VA

Virtual asset futures ETFs are indirectly exposed to the risks of the underlying VA through investment in the relevant VA futures. Therefore, risks that adversely affect the price of the underlying VA may also affect the price of the relevant virtual asset futures ETFs. In this regard, VA prices are extremely volatile and affected by numerous events or factors that are unforeseeable and potentially difficult to evaluate. They include changes in overall market sentiment, changes in acceptance of the VA, regulatory changes, security failures of the underlying network or related trading platforms, related fraud, market manipulation, contagious effect from collapses of major players in the VA market and other further development of the underlying network. In particular,

- VA is a relatively new innovation and part of a rapidly changing industry. VA and the VA industry are therefore subject to substantial speculative interest, rapid price swings and uncertainty. In addition, VA operates without central authority (such as a bank) and is generally not backed by government. The slowing, stopping or reversing of the development or acceptance of a particular VA may adversely affect the VA’s price.

- Regulations on VA are still developing and increasing. Regulatory changes or actions may materially alter the nature of an investment in a VA, restrict the use and exchange of the VA, or restrict the operations of the blockchain network or venues on which the VA trades, in a manner that adversely affects the value of the VA. In extreme cases, governmental interventions may make VA illegal.

- VA trading venues are relatively new and, in most cases, largely unregulated. They are typically not subject to the same robust regulation as trading platforms in traditional financial markets, and are not typically required to protect customers to the same extent that regulated securities exchanges or futures exchanges are required. VA trading platforms may therefore be more exposed to theft, fraud, failure, security breaches, market manipulation and insider dealing, compared to established, regulated exchanges for securities, derivatives and other currencies. In particular, some VA trading venues collapsed or closed due to the above issues. As a result, the prices of VA may be subject to larger and/or more frequent sudden declines than assets traded on more traditional exchanges.

- VA is vulnerable to cybersecurity attack. Cybersecurity risks relating to a VA’s underlying network and entities that custody or facilitate the trading of the VA may result in a loss of public confidence in the VA and a decline in the value of the VA. In particular, malicious actors may exploit flaws in the VA’s underlying network to, among other things, steal VA held by others, control the network or issue significant amounts of the VA in contravention of the network protocols. The occurrence of any of these events is likely to have a significant adverse impact on the value and liquidity of the VA.

- As VA network is generally an open-source project, the developers may suggest changes to a particular VA’s software from time to time. If the updated software is not compatible with the original software and a sufficient number (but not necessarily a majority) of users and miners elect not to migrate to the updated software, this would result in a “hard fork” of the VA’s network, with one prong running the earlier version of the software and the other running the updated software, resulting in the existence of two versions of VA network running in parallel and a split of the blockchain underlying the VA network. This could impact demand for the VA and adversely impact the VA’s prices.

Under exceptional market circumstances, the price of VA and hence the price of VA futures may drop to zero in a short period of time. An investor should be prepared to lose the full principal value of their investment in virtual asset futures ETFs within a single day.

Historically, the prices of bitcoin / ether and CME Bitcoin / Ether Futures have been extremely volatile. Their price volatilities are much higher than stocks, bonds and other conventional commodities. As illustrated in the chart below, between 22 November 2020 and 22 November 2021, the prices of bitcoin and ether rose by 206% and 633% respectively. However, in the year that followed (i.e. from 22 November 2021 to 22 November 2022), the prices of bitcoin and ether fell by 71% and 72% respectively.

Risks of rolling futures contracts

A VA futures contract is a commitment to buy or sell a predefined amount of the VA at a predetermined price on a specified future date. "Rollover" means selling existing futures contracts that are about to expire and replacing them with futures contracts that will expire at a later date (i.e. longer-term contracts). If the prices of the longer-term contracts are higher than those of the expiring contracts, also commonly known as a “contango” market, the proceeds from selling the expiring contracts will not be sufficient to buy the same number of longer-term contracts. Given that a futures-based ETF needs to rollover the futures contracts to maintain the exposure to the VA, a loss may incur (i.e. a roll cost, or a negative roll yield) and would adversely affect the NAV of the ETF. Historically, CME Bitcoin Futures and CME Ether Futures have experienced extended periods of contango, resulting in substantial roll costs. You should fully understand this risk before you invest in a virtual asset futures ETF, particularly if you wish to adopt a buy-and-hold strategy.

You should note that save for the transaction cost incurred, a “rollover” in itself is not a loss or return-generating event. That is, the NAV of the virtual asset futures ETF will not suffer an immediate loss or enjoy an immediate gain due to “rollover”. To illustrate, let’s consider an example that a virtual asset futures ETF with NAV $100 is holding 5 VA futures contracts expiring in June whose price is $20. Currently, the price of VA futures contracts expiring in July is $25. If the ETF carries out “rollover” by replacing the June futures contracts with July futures contracts, assuming no transaction cost, the ETF will close out 5 June futures contracts at $20 and buy 4 July futures contracts at $25. In this case, the NAV of the ETF will remain at $100 although the number of VA futures contracts it holds will decrease from 5 to 4.

Subsequently, if the futures market is in contango (i.e. the price of near-term contracts is lower than the price of longer-term contracts), a negative roll yield may be realized over time and reflected in the NAV of the ETF when (i) the ETF repeatedly buys the longer-term contracts at a price higher than the selling price of the near-term contracts and (ii) the price of the futures contracts moves down over time to converge to the spot price.

Virtual asset futures ETFs in Hong Kong generally adopt active investment strategies, allowing ETF managers more flexibility in managing the roll cost, for example, via adjusting the portfolio compositions and timing of the rollover. Investors should carefully study the investment strategy of the ETF. For more details about the nature and major risks of a futures-based ETF, you may refer to the "Futures-based ETF".

Risk of volatility of a single asset or a single futures contract

The ETF has risk exposure concentrated in the VA market. Unlike conventional ETFs that track equity indices which are typically diversified, a virtual asset futures ETF is subject to the price volatility of a single asset only (e.g., bitcoin or ether). Such volatility may be extremely high and substantially higher than the volatility experienced by equity indices or a commodity index which is made up of multiple types of commodities. If a virtual asset futures ETF holds only a single futures contract (e.g. the ETF holds only a single month VA contracts), this may also result in large concentration risk and the price volatility of the ETF may be higher than that of an ETF which holds futures contracts with different expiry months.

Liquidity risk

The market for VA futures is still developing and may be subject to periods of illiquidity. During such times it may be difficult or impossible to buy or sell a position at the desired price. Market disruptions or volatility can also make it difficult to find a counterparty willing to transact at a reasonable price and sufficient size. Also, unlike other futures markets, some VA futures, particularly the longer-term ones, may have very thin trading volume and the most liquid contracts are typically only available at near term and next near term. The large size of the positions which the virtual asset futures ETF may acquire increases the risk of illiquidity, may make its positions more difficult to liquidate, and increase the losses incurred while trying to do so. The rolling strategy of the virtual asset futures ETF and the ability of the ETF in diversifying its futures position may also be adversely affected.

Operational risks

Risks of mandatory measures imposed by relevant parties – Regarding the ETF’s futures positions, relevant parties (such as clearing brokers, execution brokers, participating dealers and futures exchanges) may impose certain mandatory measures under extreme market circumstances. These measures may include limiting the size and number of the ETF’s futures positions and/or mandatory liquidation of part or all of the ETF’s futures positions without advance notice to the ETF manager. In response to such mandatory measures, the ETF manager may have to take corresponding actions, including suspension of creation of ETF units and/or secondary market trading, implementing alternative investment strategies and/or termination of the ETF. These corresponding actions may have an adverse impact on the operation, secondary market trading and the NAV of the virtual asset futures ETF.

Position limit risk – There is a statutory position limit restricting the holding of CME Bitcoin / Ether Futures contracts to no more than a specific number of such futures contracts. If the holding of such futures contracts of a virtual asset futures ETF grows to the limit, this may prevent the creation of units of the ETF due to the inability to acquire further futures contracts. This may lead to differences between the trading price and the NAV of the virtual asset futures ETF units listed on the HKEX.

Margin risk – If the market moves against the futures position, the virtual asset futures ETF may be required to pay additional margins, to maintain the trading positions on short notice. Margin requirements for CME Bitcoin / Ether Futures may be substantially higher than margin requirements for many other types of futures contracts. A virtual asset futures ETF may need to liquidate its assets at unfavorable prices in order to meet these margin calls and suffer substantial losses.

13 December 2022