In March 2021, a digital artwork entitled “Everydays: The First 5,000 Days” by American artist Beeple was auctioned for US$ 69.3 million. During the same month, Twitter CEO sold the first-ever tweet for US$ 2.9 million. These two sales have made headlines in the crypto world.

As the saying goes, “beauty, or value in this case, is in the eyes of the beholder”. While it is not rare for works of art or collectibles to be sold for astronomical figures, but for digital images and even posts, we know that it costs almost close to nothing to duplicate them online. So how is it possible to claim their ownership and how are these digital assets being transacted?

What is an NFT?

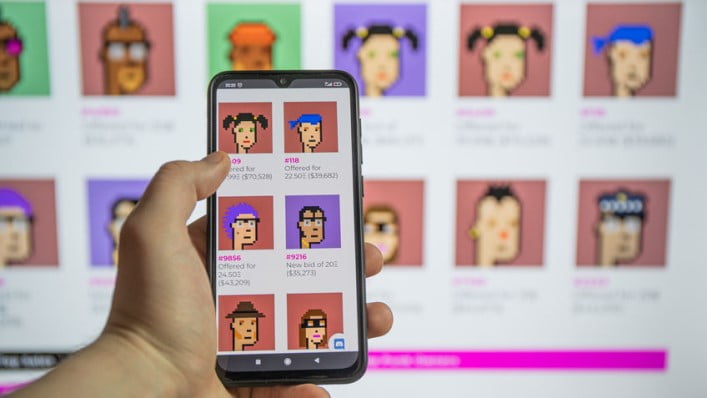

The said digital assets are bought and sold as non-fungible tokens (NFTs). Simply put, an NFT is a virtual asset which encrypts specific messages into a blockchain to represent ownership of an item, and is bought and sold online. Common NFTs include digital images, artwork, audio-visual files, video clips, avatars or gears of online games or animations. NFTs can also represent other items, or even physical ones.

Both NFTs and cryptocurrencies are on blockchains, and their differences lie in their “fungibility”. A cryptocurrency is a fungible token. For instance, bitcoins which are at the same value can be mutually interchangeable and divisible into smaller units. Whereas, NFTs are each unique and irreplaceable. As data recorded in a blockchain ledger cannot be altered or deleted, and all purchases and sales records are made public, hence the NFTs stored in a blockchain cannot be counterfeited.

Are NFTs valuable?

By “tokenising” items such as digital art or collectibles, NFTs enables their buying and selling on the market. However, not all NFTs are valuable. For example, if I were to make a digital self-portrait and turn it into an NTF, the NTF may indicate the portrait’s authenticity as the one-and-only copy in the world, but whether it would get any buyer’s interest is another question.

Collections by famous artists or popular collectibles can become well-sought after, but exactly how much they are worth is extremely subjective. For example, TopShot of the National Basketball Association (NBA) is an officially licensed marketplace where NBA highlights and digital artwork are bought and sold as NFTs (similar concept as trading basketball cards). For basketball fanatics, these NFTs can be regarded as priceless. For example, a NFT of special slam dunk shots of a top basketball star could sell for tens of thousands of US dollars. But for those with zero or little interest in basketball, these may appear to be worthless.

Following the speculative herd can be high-risk

Some consider NFTs as art or collectibles, while others look to trade NFTs as a form of speculation. Like other digital assets, the price of NFTs can be highly volatile and one can hardly be assured of their actual value. NFT buying and selling also involves risks in terms of online platforms, liquidity, digital wallets, its cross-border nature and lack of regulation. Furthermore, NFTs are generally bought and sold with cryptocurrencies, and the price volatility itself can affect the value of NFTs.

The NFT hype is catching much attention, but it is nevertheless highly risky and not suitable for everyone. Without full knowledge of their features and risks, it is better to err on the side of caution and not participate in speculative activities.