Coronavirus pandemic has dealt a severe blow to the Hong Kong economy. With many facing unemployment or reduced incomes, it may become necessary for some to take out loans to make ends meet. A financing platform earlier announced that the number of loan applications initiated through its website in the first quarter of this year soared some 65% year on year, while the demand for loans is expected to increase.

Loan applicants facing financial problems would probably be most concerned with whether their loan applications will be approved. While solving the imminent problem is important, financial considerations in repaying the debt should not be overlooked. It is equally important to ensure that we are capable of repaying the debt. Your monthly repayment starts one month after obtaining the loan, and lasts throughout the entire loan period, which can be one or two years, or even longer. In the event that you underestimate the repayment amount and fail to repay the loan, the lending institution could initiate debt recovery based on the loan agreement, or may even take legal actions. Furthermore, overdue payments will not only involve late payment penalties but also affect your credit score. With the ongoing pandemic and current political and economic complications, the financial future remains uncertain. It is therefore crucial to carefully evaluate your ability to repay.

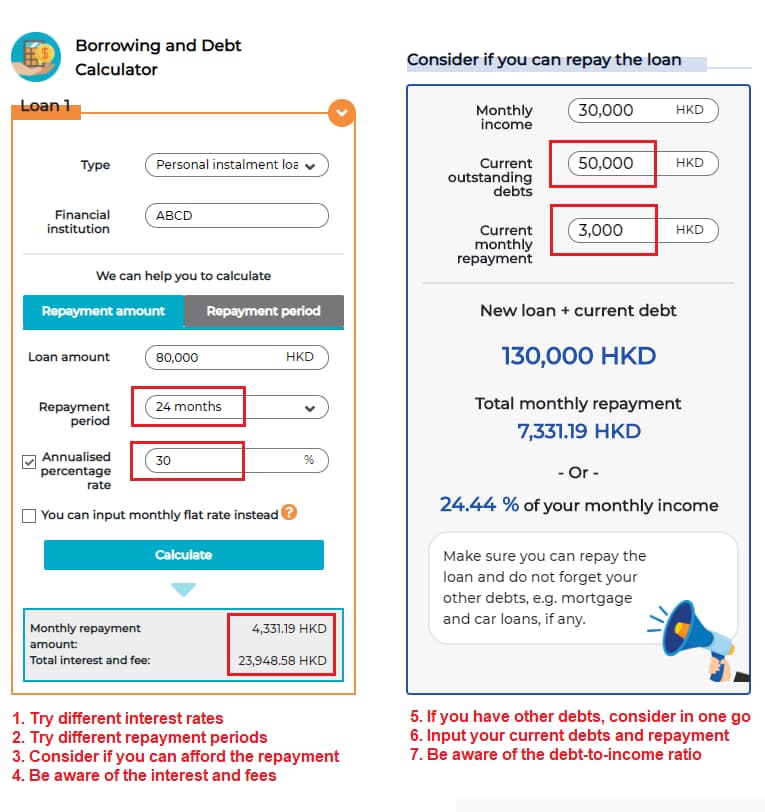

Do the maths before taking out a loan

If you have a genuine need to borrow, use the Borrowing and Debt Calculator to work out your monthly repayment amount based on different loan amounts, loan terms and interest rates. This can help you identify an affordable loan solution. For example, if you plan to borrow $80,000 and intend to repay within two years, try inputting a higher interest rate (such as 30%) and a lower rate (such as 10%) to calculate the monthly repayment amount and see if you can afford it. The calculation can also help you understand the impact of interest rate on the repayment amount and the cost of interest. Do understand that the lowest interest rate offered by lending institutions generally applies to selected clients and large loan amounts only, rather than the average customers. With the Borrowing and Debt Calculator, you can also enter different loan periods to find out which one suits you best. Do note that the longer the term, the more overall interest will apply. After careful calculations, if you are confident about repayments, you may consider taking out a loan from a loan institution.

Making hay while the sun shines is better than seeking help at the last minute

Some in need of money may choose to obtain cash advances on their credit cards, which is to take out cash from the credit cards. While this may be a quick and easy fix to their money problem, it comes with a fairly high interest rate, generally over 30% per annum. Also, the interest period for cash advances starts right away, as interest-free repayment period enjoyed when shopping with a credit card do not apply to cash advances. You may also need to pay a handling fee. Meanwhile, some lending institutions offer loans that do not require proof of income or credit check, but they usually charge higher interest.

If you do have the need to borrow do not rush headlong, carefully consider your options first and then look for the most suitable loan products. Review your financial circumstances and study the different loan products on the market. Leaving everything to the last minute may translate into a high interest rate loan.