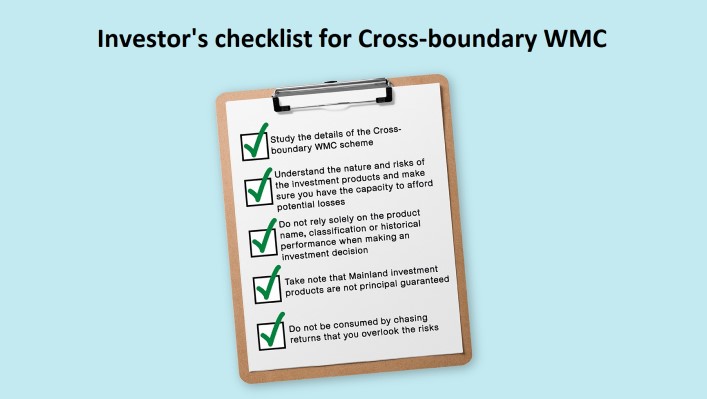

The Cross-boundary Wealth Management Connect ("Cross-boundary WMC") scheme offers investors more investment opportunities and product choices. Given there are specific cross-boundary remittance and investment arrangements in place for Cross-boundary WMC, and that the general public of Hong Kong may not be too familiar with Mainland investment products, investors interested in the scheme should first do their research and pay close attention to the following items.

Arrangements and rules of Cross-boundary WMC

Investors should thoroughly understand the details of the Cross-boundary WMC scheme, including the respective roles and obligations of Hong Kong banks and/or brokers and Mainland partner banks and/or brokers, funding and remittance arrangements, closed-loop funds flow and two-way fund transfer management requirements, quota management and complaint handling mechanism. For example, there is an aggregate quota and an individual investor quota under Cross-boundary WMC. When the Northbound quota is exhausted, the bank and/or broker may suspend the Northbound remittance of funds in the investor’s dedicated remittance account so that new investment cannot be made. (Learn about the operational arrangements, account opening and remittance of Northbound WMC)

Mainland investment products and their risks

Eligible northbound WMC investment products cover 1) Renminbi-denominated deposit products distributed by Mainland banks, 2) low-to-medium risk public fixed income wealth management products and equity wealth management products issued by subsidiary wealth management firms of Mainland banks and eligible joint ventures between Mainland banks and foreign partners and distributed by Mainland banks, and 3) low-to-medium-high risk public securities investment funds (excluding Commodity futures funds) distributed by Mainland banks and brokers. (Learn about eligible investment products under the Northbound WMC)

After opening an account, investors can access investment product information and trade via the online or mobile platforms of Mainland banks and/or brokers. With so much information at disposal, investors may be drawn to return figures, such as performance benchmark, annualized rate of return or historical returns, etc. However, investors should note that estimates of returns can only serve as a reference, and that past performance cannot be taken as an indication or a guarantee of future performance.

As all investments carry risks, you should note that Cross-boundary WMC investment products are not principal protected or interest/dividend guaranteed. Investors should not be consumed by chasing returns and overlook the risks (Learn about the key risks of Northbound WMC). In addition, the classification and naming of Mainland investment products may differ from those in Hong Kong. Do not rely solely on the product name or classification in making an investment decision. Investors should refer to the offer documents of Mainland investment products to understand product features and the associated risks, select products according to personal circumstances and risk tolerance levels. When in doubt, ask questions and seek clarifications from the banks/ brokers.

Investor protection

Hong Kong investors buying Mainland investment products through the Cross-boundary WMC scheme are protected under Mainland laws and regulatory regime. Cross-boundary WMC has a complaint handling mechanism in place, through which investors may lodge complaints about investment products and services with the concerned Mainland banks and/or brokers. Banks and/or brokers in Hong Kong will also assist investors by referring their complaints to Mainland partner banks and/or brokers for follow-ups. For complaints involving Mainland banks and/or brokers, Hong Kong investors may lodge complaints with the Mainland regulatory authorities (Learn about the complaint mechanism).