Mr. Chin: These days, financial products seem to be getting more and more complex. What do you think?

In the financial world, products without any special features are usually referred as “plain vanilla”, presumably because they are in their most basic form. When special features are added to a financial product, it is no longer considered as plain vanilla. For example, when bonds come with special terms, such as subordination, conversion to stocks, with no maturity date or extendable maturity date, on top of the standard and basic terms, such as principal, coupon rate, maturity date, they are transformed from a simple debt instrument into a complex one, bringing additional risks to bondholders.

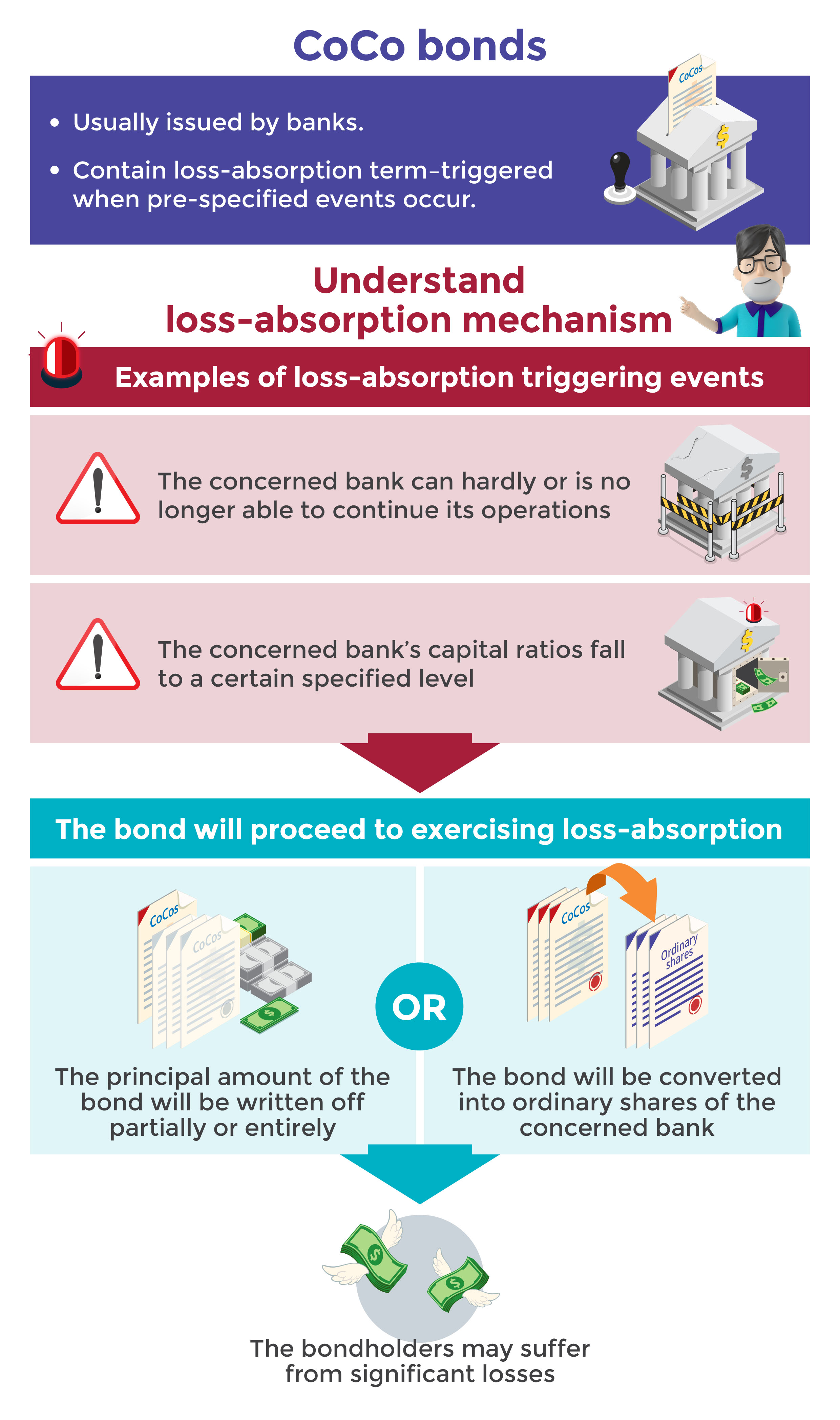

For example, banks sometimes may issue contingent convertible bonds (commonly known as CoCo bonds or CoCos) for capital replenishment. Such bonds would contain loss-absorption term.

Understanding CoCo bonds

Just like other special features, the loss-absorption mechanism is highly complex. It is also highly unpredictable whether or when the loss-absorption triggering event will occur – making it difficult for investors to estimate potential losses from such investments. Bonds with loss-absorption features generally offer higher yields, but they also have higher risk exposures and complex nature. Investors should fully understand the structure, operation and risks of these products, as well as carefully read the terms and conditions to ensure that they understand that loss-absorption will be triggered when certain events occur, such as when the concerned financial institution’s capital ratio falls below a certain level or it becomes non-viable, and the mechanism for determining its non-viability. Investors should ensure that they have sufficient net worth to assume the risks and bear the potential losses before investing.

Though plain vanilla products are not essentially low-risk investments, their structures and mechanisms are relatively easier to understand. The special features of investment products and their associated risks can be quite complicated, even experienced investors may not be able to fully understand. Bonds with loss-absorption features are usually not subject to SFC authorisation. The product disclosure in offering documents and marketing documents of these bonds may not be adequate.