Notices of tax assessment are gradually reaching us as we step into the fourth quarter of 2022. Banks and financial institutions are also rolling out tax loan packages. Over the past few years when interest rates were very low, tax loans have been available at low interest rates. Yet, as the global economy enters a rate hike cycle, the interest rates for mortgages and fixed deposits have already risen. The same is also happening for different types of loans; tax loans are no exception. If you are planning to take out a tax loan, you should note the following four points.

1. The lowest interest rates may not be applicable to you

Although the interest rates for tax loans are generally raised, many advertisements are still highlighting annualised percentage rates that are under 2%. Do note that tax loan advertisements usually refer to the lowest interest rates being offered, which are available with conditions, e.g. loan amount at or above HK$800,000. Depending on your loan amount, the interest rate may be higher than the advertised ones. Therefore, make sure you check the applicable lending rate before taking out a tax loan.

2. Work out the monthly repayment

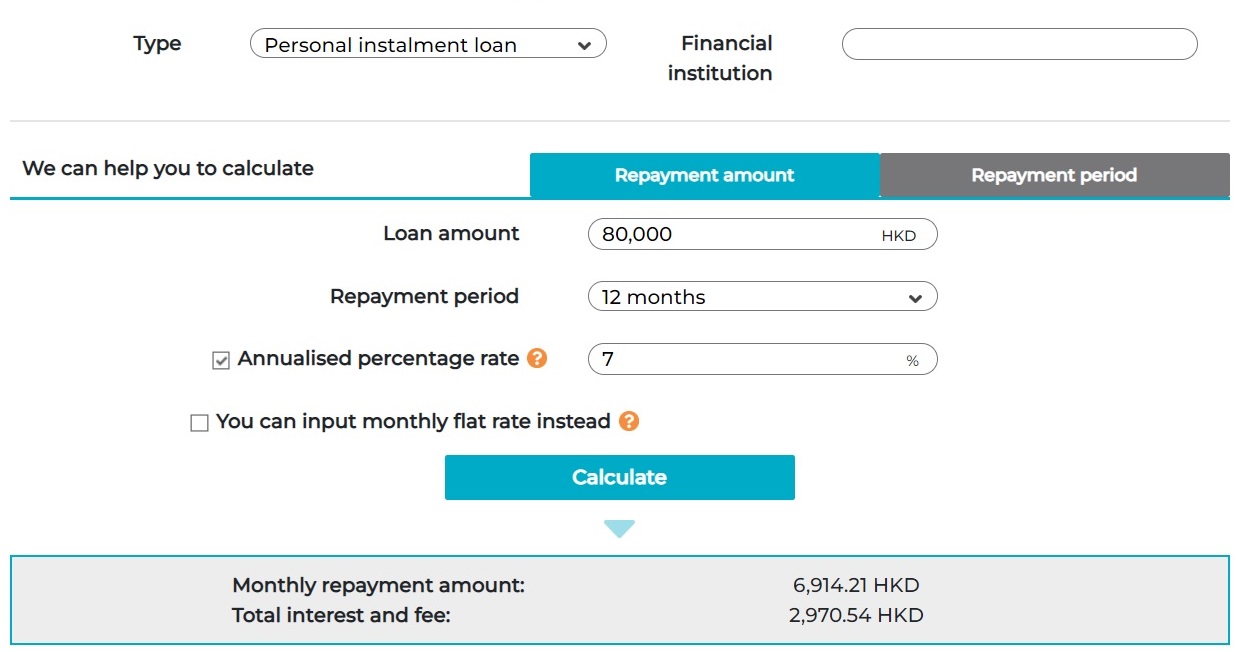

The raise of interest rate will increase the cost of borrowing and the monthly repayment amount. You should carefully assess your affordability. To plan ahead, make use of the IFEC Borrowing Calculator and run the numbers first. Simply input the loan amount and the repayment period, and try different interest rates, you will see a clear picture of the respective monthly repayment amounts and the costs for taking out a loan.

3. Extending the repayment period make you pay more interest

For the same loan amount, you pay less each month with a longer repayment period. Yet, it also means paying more in terms of the total interest. Besides, as you may need to take out a tax loan again in the following year, a repayment period that exceeds 12 months can be an increased burden. Don’t underestimate the pressure of paying two loans at the same time. Therefore, better repay a tax loan within one year.

4. Attractive gifts come from interest-payers

Some lending institutions offer cash rebates or gifts as incentives such as the latest smart phones, game consoles, hotel packages, etc. These may appear attractive but do note that they are subject to terms and conditions. The best gifts are usually given to lenders of substantial loan amounts. Smaller loan amounts are paired with less impressive gifts. Besides, the value of the rebates or gifts is usually reflected in the borrowing costs. You should prudently consider your actual needs and personal financial circumstances. Do not apply for a loan or increase the loan amount simply because of rebates or gifts.