Airbag

An airbag, also known as knock-in, is a special feature often made available by issuers. It adds a pre-condition for the put option on the reference stock of the ELI, before the option becomes exercisable by the issuers.

Before we explain how airbag functions, let us introduce the three following common terms:

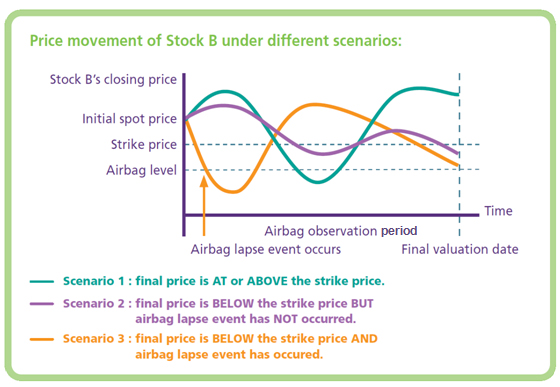

- Airbag level for a reference stock is usually expressed as a percentage of its initial spot price. It is usually set lower than the strike price (e.g. 70% of the initial spot price).

- Airbag observation period can be set as each exchange business day or certain periodic dates (e.g. monthly, quarterly) during the investment term.

- Airbag lapse event occurs when the closing price of the reference stock on any exchange business day during the airbag observation period is at or below its airbag level.

| Example: Bull ELI linked to Stock B with an airbag feature | |

| Nominal amount | $20,600 |

|---|---|

| Purchase price | $20,000 |

| Initial spot price of Stock B | $50 |

| Strike price | 80% of initial spot price (i.e. $40) |

| Airbag level | 70% of initial spot price (i.e. $35) |

| Issue date | 1 January |

| Final valuation date | 30 June |

| Maturity date | 2 July |

| Investment period | 6 months |

| Airbag observation period | Each exchange business day from 2 January to 30 June |

| Mode of settlement in case the final price is below the strike price | Physical delivery |

On final evaluation date:

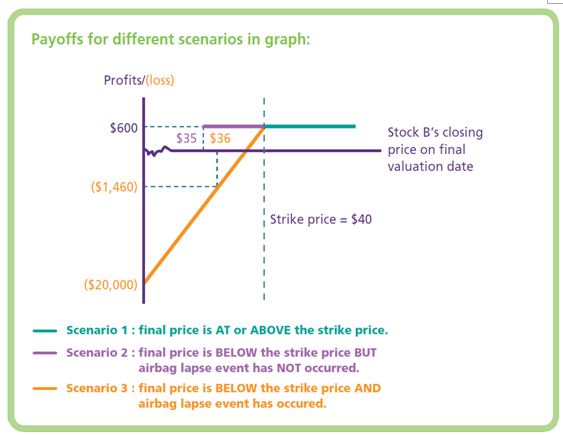

Scenario 1: Final price is at or above the strike price of $40

You will receive the nominal amount of $20,600 in cash, a gain of

$20,600-$20,000 = $600

Scenario 2: Final price is $36 (below the strike price of $40) and its closing prices on all exchange business days during the airbag observation period is ABOVE its airbag level of $35

You will receive the nominal amount of $20,600 in cash, a gain of

$20,600-$20,000 = $600

Scenario 3: Final price is $36 (below the strike price of $40) and its closing prices on all exchange business days during the airbag observation period is not ABOVE its airbag level of $35

You will receive Stock B:

(Nominal amount / Strike price ) = $20,600 / $40 = 515 shares

Based on the final price, the market value of your shares will be worth less than your original investment, representing a paper loss of:

$20,000 - ($36 x 515 shares) = $1,460

|

|

Please note that the examples and figures used in this section are purely hypothetical and are for illustrative purposes only.