Investor Education Centre Survey Reveals Young Adults' Financial Struggles

More than 60% of Hong Kong’s young working adults overspend and around one-third are in debt

31 May 2017

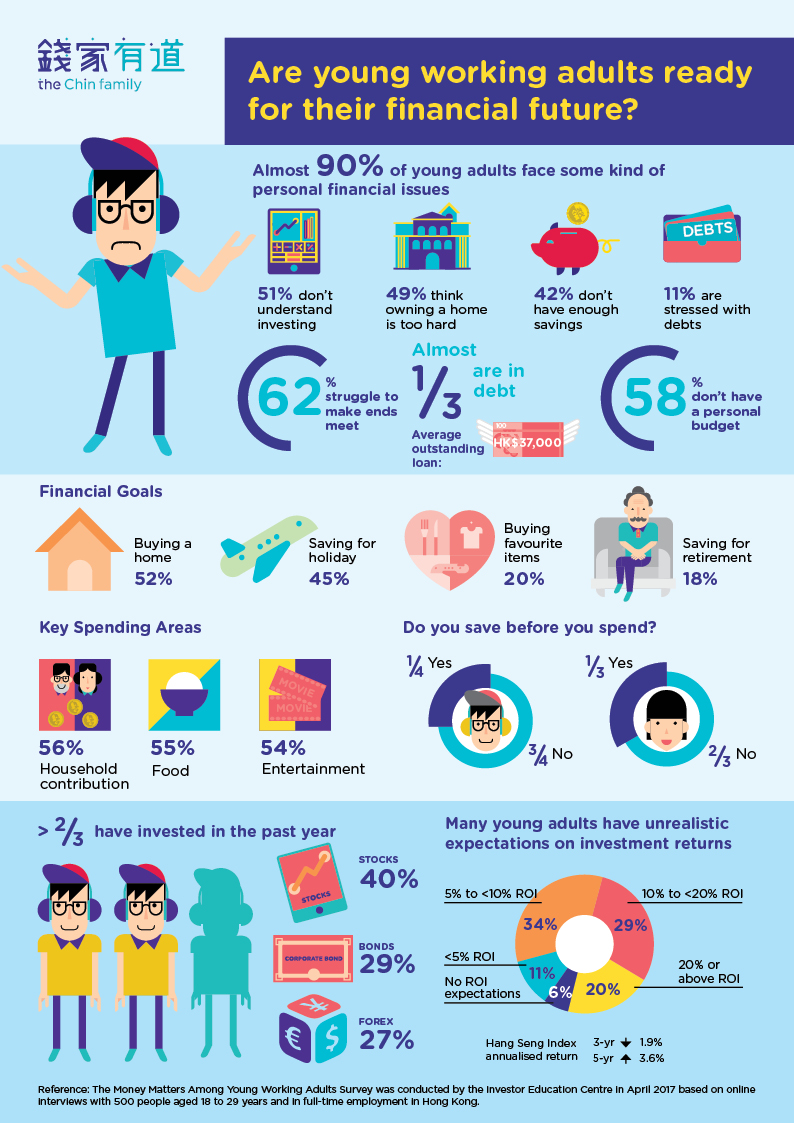

- The vast majority (86%) of young working adults in Hong Kong face personal financial hurdles. More than 60% have trouble covering their expenses, and almost one-third are in debt.

- Almost 40% of those surveyed don’t have any financial goals. Many others prioritise short-term goals, such as holidays, over long-term objectives.

- Young workers admit that they know little about investing. While 32% have not engaged in investment activity in the past year, many of those who do invest tend to seek short-term gains and have unrealistic expectations on investment returns.

Hong Kong’s young working adults are failing to manage their personal finances and plan for the long-term, a new study has found. More than 60% of those interviewed in the Investor Education Centre survey said they have overspent over the past year, and almost one-third admit to being in debt. Few are saving or investing for the future.

The survey of 500 working adults aged between 18 and 29 years in April 2017 found that 86% face one or more personal financial challenges. Lack of investment know-how (51%), the challenge of buying a home (49%) and insufficient savings in general (42%) were ranked the most common concerns. Eleven percent are stressed about debt.

About one-third (31%) of the young people surveyed carry outstanding loans of an average of HK$37,000with 7% owing $50,000 or more. The majority (88%) own a credit card, but about one-fifth of them do not settle card bills in full each month. The average credit card debt is about HK$20,000.

Reluctance to budget and save regularly

Poor budgeting was a common issue: 62% confessed to having trouble covering their expenses in the past 12 months, while 58% said they do not have a personal budget. Nor are Hong Kong’s young working adults saving regularly. More than 60% said they saved only sporadically, while another 8% admitted they do not save at all.

"It is challengeable these days for students and those new to the workforce to save when they have relatively lower incomes but increasing expenses. Under these circumstances it is even more important for them to stay on top of their personal finances and plan for the future. But interestingly, more than a third of those interviewed said they had stayed in a job for a year or less on average, with 44% having quit without another job to go to. This places even more pressure on their financial stability," Mr David Kneebone, General Manager of the IEC, said.

Almost 40% of the survey respondents had failed to set any financial goals. For those who have financial goals, buying a home (52%) and saving for an emergency (34%) were important objectives. However, many of the young adults surveyed revealed that they were giving priority to short-term goals, such as saving for a holiday (45%) and buying favourite items (20%), over long-term goals, such as saving for retirement (18%).

"A strong financial future is possible for Hong Kong young adults, but it requires them to take action today, beginning with careful planning. Saving regularly and having a long-term approach is always the best way to prepare for a future of financial stability," added Mr Kneebone.

Unrealistic expectations on investment returns

While 68% of the young working adults surveyed had held or traded in a financial investment product in the past 12 months, 86% admitted to knowing little or nothing about financial investment products. Of those who had made an investment, stocks were the most common investment vehicle at 40%, followed by bonds, including government iBonds, at 29%. Foreign exchange was also a popular choice at 27%.

Majority (69%) of those who had invested in stocks had a relatively short investment horizon of less than a year, and less than half of them (43%) had a stop-loss strategy. These young investors had widely differing expectations: 11% anticipated a modest return of less than 5%, while 20% expected an aggressive annual return of 20% or above.

"Young working adults can improve their money management skills and financial knowledge by making use of the available information around them. Our impartial financial education platform, The Chin Family, features a range of blogs, tools and guides that can help young people in Hong Kong make more informed financial decisions to plan and improve their financial well-being for the long-term." said Mr Kneebone.

To help young working adults navigate their financial future with more confidence, The Chin Family has developed a series of seven short videos in collaboration with the artiste Tat Gor. The video series discusses financial issues commonly faced by young working adults. Launched today at www.thechinfamily.hk, the first episode outlines what the young people know about investments.