Investor Education Centre Survey Reveals the Financial Preparedness and Money Management Attitudes of Parents in Hong Kong

Parents fall short on money management and lack long-term financial planning for parenthood

11 July 2017

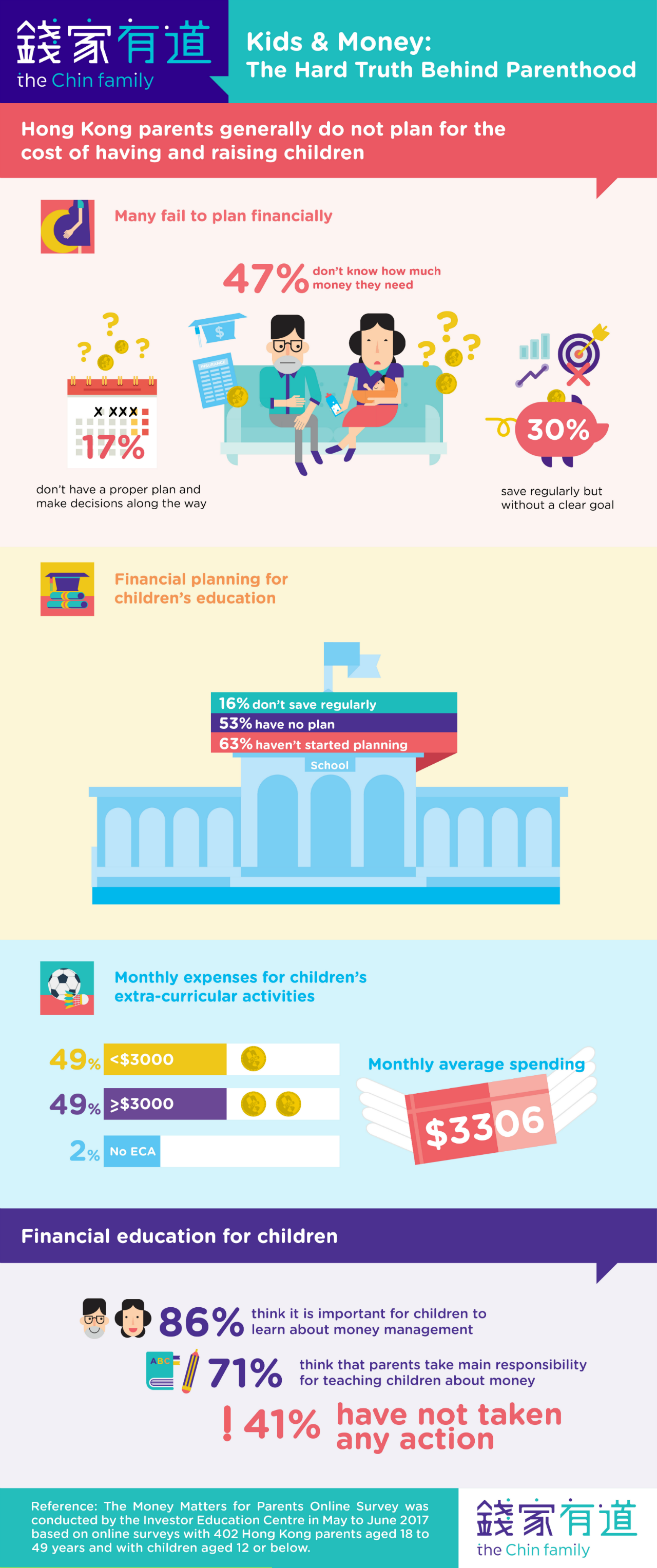

- Almost half (47%) of parents surveyed did not look into their family finances to plan and budget before getting pregnant, nor did they have a future plan. Close to one-fifth (17%) said they only took action after their children were born.

- Over half (53%) of parents surveyed are not confident that they have sufficient savings and resources to cover the different stages of their children's education needs; and many spend at least HK$3,000 a month on after-school activities, and a considerable number spend over HK$5,000.

- The vast majority (86%) of parents surveyed in Hong Kong acknowledge the importance of teaching their children money management skills; however 41% of parents surveyed have yet to take action.

A survey conducted by the Investor Education Centre (IEC) found that Hong Kong parents generally do not plan for the cost of having and raising children. Many worry about not having sufficient financial resources to meet their children's needs as they grow older. A total of 402 Hong Kong parents aged 18 to 49 with children aged 12 or below took part in the IEC's "Money Matters for Parents Online Survey" in May 2017.

Almost half (47%) of parent respondents said that they did not review their family finances before getting pregnant. Also, they did not consider how they would be paying for the pregnancy or the day-to-day expenses of raising a child. Only 30% said they saved regularly, though they did not have clear savings goals. Just under one-fifth (17%) of parents surveyed said that they planned as they went along after their children were born.

Over half (53%) of the parents did not have a long-term financial plan and were not confident how they would fund their children's education or related expenses. Sixteen per cent said they would start planning for education when their children were older.

Yet they continued to invest in their children's future by spending on extra-curricular activities. About half of parents surveyed spent at least $3,000 per month on after-school activities, of which 35% spent over $5,000 per month. On average, parents spent $3,306 per month on children's extra-curricular activities.

Out of the 47% of respondents who had a detailed financial plan, many of them (75%) were confident that they would be able to afford their children's ongoing education and living expenses. Most parents (71%) indicated that they relied on savings to pay for the educational expenses. Investing in stocks (52%) and insurance (51%) were also widely cited, with longer-term financial products favoured by parents of older children.

The survey also showed that many parents were concerned that social economic factors were adversely impacting their children's future living standard, social mobility and finances.

"As the cost of living escalates, many parents of young children are focusing only on the day-to-day financial needs," said Mr David Kneebone, General Manager of the IEC. “We encourage parents to look into long-term planning and saving for the future to better provide for their families. It is also important to regularly review and adjust your budget and savings plan as children’s needs will vary along with their ages as they grow up."

Teaching children about money and finances

Most of the parents (86%) surveyed agreed that it is important for children to learn about financial planning and concepts, and 71% indicated that parents should take main responsibility for imparting financial skills. Yet, 41% had not taken action.

When asked about the concerns on teaching children about money, many parents found it difficult to do so. Some parents were worried that they might have conflicts with their partner over parenting style on money education, and some said they tend to spoil their children and offer them whatever they want.

To get children into the habit of financial management, most parents granted a degree of financial freedom to their children to help them learn money management. Many (70%) respondents gave pocket money to their children, with 39% setting restrictions on usage, and 31% allowing their children the freedom to manage it themselves.

"It is important for Hong Kong parents to devote more attention to cultivate good financial habits in their children from a young age. Teaching children to be financially-savvy will position them well to have financially healthy and secure futures," Mr Kneebone said. "To encourage good saving and money management habits, parents can make the most of teachable moments in daily life to share age-appropriate financial knowledge."

To help parents teach their children about money management, IEC's financial education platform The Chin Family will organise Future Me, an on-the-job role play and learning activity. Taking place at Olympian City between 17 July and 31 August 2017, children aged 4 to 10 can go to work, earn an income and learn and gain basic money-related concepts on saving, spending and sharing.

The Chin Family Parenting and Money Portal is available to provide financial information and tips for parenthood and help them make teaching children about money simple and fun.