Hong Kong Ranks Top in Global Study on Financial Literacy But Fails to Translate

Knowledge into Action

Younger Generation Tends to “Live for Today”

31 October 2016

- As top scorer amongst four Asian markets surveyed, Hong Kong ranked fifth in overall levels of financial literacy among 30 countries and economies in global survey;

- Hong Kong tops the chart in financial knowledge (1st) with a good understanding of inflation, simple interest and investment risks; understanding of compound interest is weakest;

- Yet, scores on financial attitude (29th) and behaviour (8th) were low as people, especially younger generation, are more inclined to short-termism.

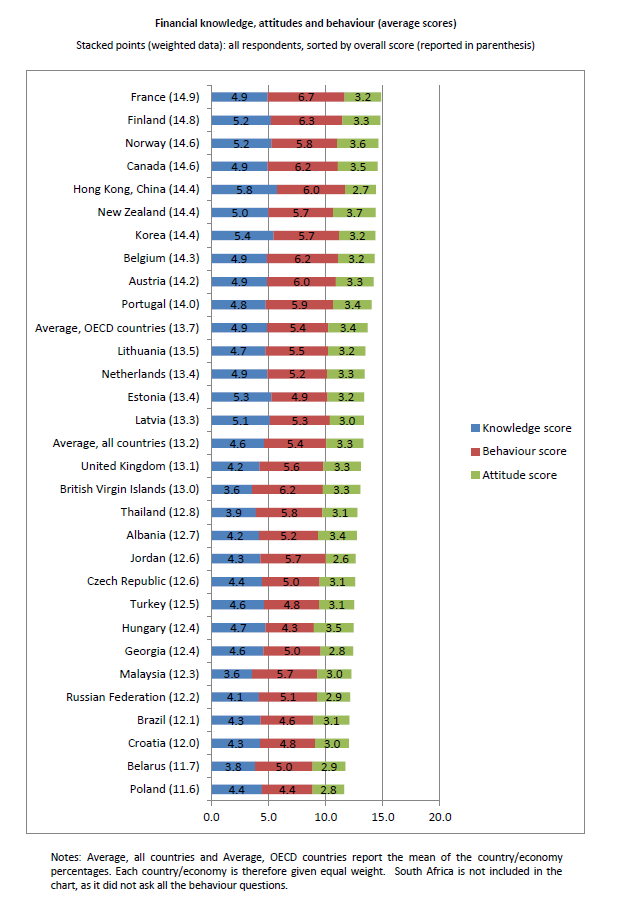

The Investor Education Centre (IEC) revealed that Hong Kong ranked fifth in a 30-economy comparison study of overall levels of financial literacy, largely driven by top scores on financial knowledge (1st). However, Hong Kongers still have room for improvement on sound money management looking at the scores on financial attitude (29th) and behaviour (8th). This global survey, entitled the OECD/INFE International Survey of Adult Financial Literacy Competencies, was coordinated by the OECD International Network on Financial Education (OECD/INFE).

A total of 51,650 adults aged 18 to 79 from 30 countries were interviewed as part of the study, measuring their levels of financial knowledge, behaviours and attitudes. Led by IEC, fieldwork in Hong Kong was conducted in June 2015 to survey 1,000 Hong Kong residents.

Hong Kong scored 14.4 (out of a possible 21) in overall financial literacy – indicated by combining scores on knowledge, attitude and behaviour – compared to an average score of 13.2 across all surveyed countries. In general, Hong Kong respondents showed good knowledge of basic financial concepts including inflation, investment risks and simple interest. Meanwhile, people showed weaker understanding of concepts including risk diversification, and only 58% correctly answered a simple question about compound interest.

Despite coming out first among the surveyed countries and economies in financial knowledge, Hong Kong people fail to translate these into actions. With a general tendency towards short-termism, Hong Kong ranked fifth in overall financial literacy. On average, fewer than 3 in 10 people indicated an attitude in favour of the longer term; in contrast, countries like Canada, Norway and New Zealand recorded more than 6 in 10. Overall, 42% of Hong Kong people surveyed did not set long term financial goals. According to the survey, younger respondents, mainly students and young working adults (aged below 30), are the least likely to have long term financial goals.

Mr David Kneebone, General Manager of the IEC, said: “The survey shows that Hong Kong is undoubtedly more financially literate than many other countries. However, their knowledge does not translate into action. Hong Kong people of all ages, in particular the younger generation, need to undertake long term financial planning. Action should include regular tracking of expenses to manage discretionary spending, household budgeting, having good saving habits and setting clear financial goals for the future.”

Younger generation weak in long-term financial planning and debt management

According to the survey, students (26%) and young working adults (27%) admitted they did not keep a close watch on personal financial affairs; this is substantially higher than other segments (Mature working adults aged 30-49: 15%; Pre-retirees aged 50 or more: 16%). Only 39% of corresponding students and 61% of the young working adults said they set long term financial goals and strove to achieve them. Echoing their “live for today” attitude, some 31% of young working adults who hold credit cards have settled card bills with partial/ minimum payment and 9% have used cash advance with their cards in the past year.

Mr Kneebone added: “With a tendency towards instant gratification, youths are more vulnerable to debt traps created by credit products. Education on proper money management and knowledge of different credit products should be enhanced among young people. This is also one of the reasons IEC launched a new financial education platform in 2016 – The Chin Family – to engage more young people and help them manage their money wisely.”

Members of the public can visit www.thechinfamily.hk to explore The Chin Family’s free and comprehensive resources on money matters. They can also subscribe to the e-newsletter or connect with The Chin Family on Facebook and YouTube.

Click here for full reports.