Improvement in Hong Kong Financial Literacy Levels

Young Generation Financially Fragile

23 March 2020

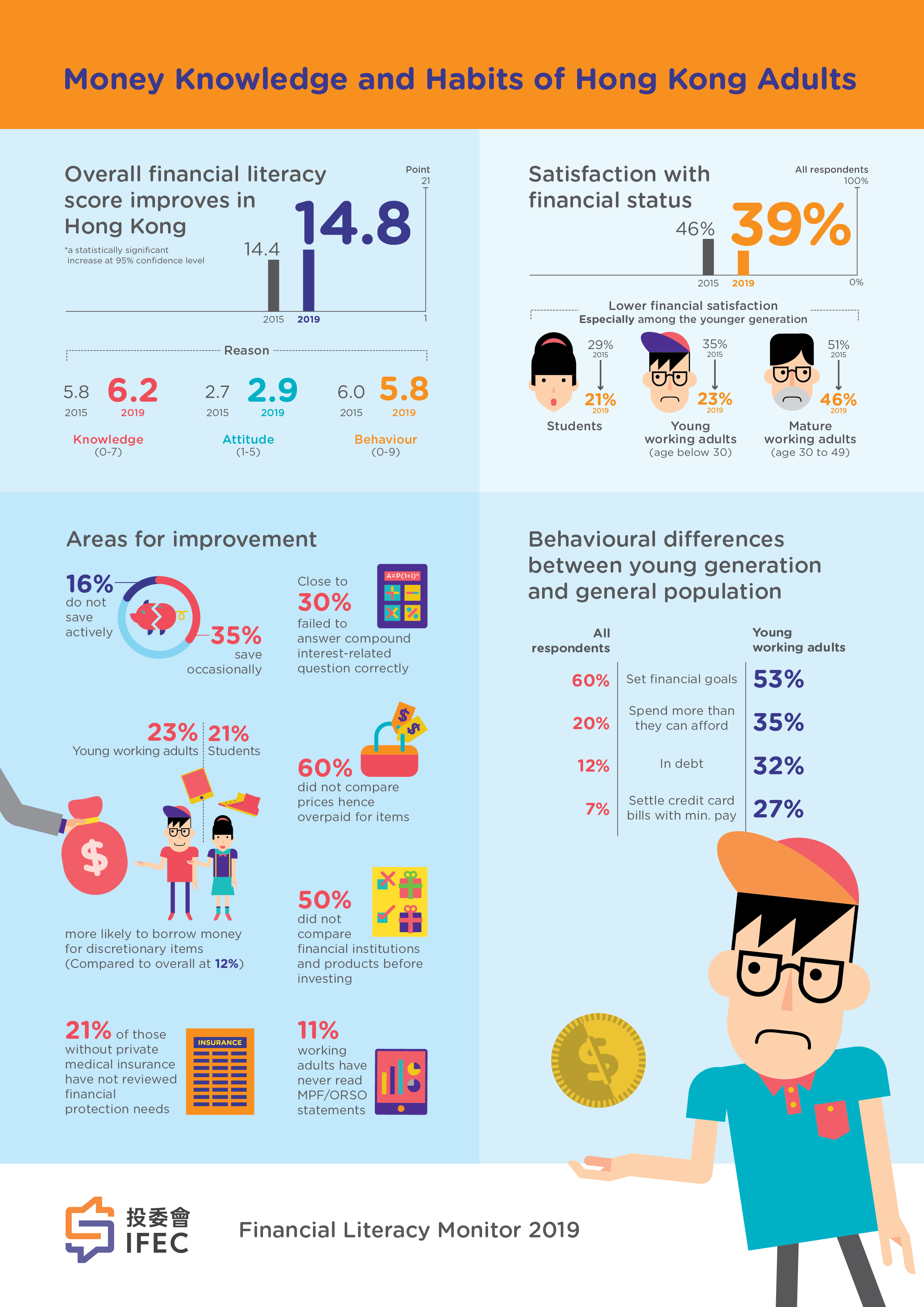

- Hong Kong adults have shown improvement in financial literacy in the areas of financial knowledge and attitude, but behaviour scores have dropped

- By segment, pre-retirees demonstrated a marked overall improvement while young working adults had difficulties with money and debt management

- 39% of respondents were satisfied with their financial status, down from 46% in 2015, and among the young working adults the number was even lower at 23%

The latest findings from a tracking survey conducted by the Investor and Financial Education Council (IFEC) revealed that Hong Kong adults have shown improvement in financial literacy, bolstered by better financial knowledge and attitude scores compared to four years ago. However, it was also found that financial behaviour score was weaker.

The IFEC conducted the Financial Literacy Monitor with 1,002 Hong Kong adults in November 2019 to measure financial literacy across three areas; Knowledge, Attitude and Behaviour, as part of an international comparison study coordinated by the OECD International Network on Financial Education (OECD/INFE). This was a repeat of a similar exercise of a 30-economy comparison study conducted in 2015.

On a scale of 1 to 21, the financial literacy score of Hong Kong people went up from 14.4 in 2015 to 14.8 in 2019 as a result of improvement in the areas of financial knowledge (from 5.8 to 6.2) and attitude (from 2.7 to 2.9). The build-up of financial knowledge is evident across all population segments, notably with the mature segments, such as mature working adults (age 30 to 49), pre-retirees (age 50 or above) and retirees, contributing to the higher financial attitude score. In contrast, the average financial behaviour score across all population segments dropped from 6.0 in 2015 to 5.8 in 2019.

Sentiment Towards Personal Finances and Areas for Improvement

According to the survey, only 39% of respondents were satisfied with their financial status, a drop from the 46% in 2015. The number was even lower (23%) among young working adults below the age of 30. Close to half (48%) of the surveyed young adults felt that their financial situation limited their ability to do things of importance to them. The student and young working adult segments were more likely to be financially concerned about whether they could cover day-to-day expenses.

Economic uncertainties have driven people to give more consideration to emergency funds. The number of respondents with enough emergency savings to last for six months or more has grown from 37% in 2015 to 55% in 2019. On another positive note, respondents with financial goals went up from 52% in 2015 to 60% in 2019, with mature working adults (82%) and pre-retirees (70%) being more proactive when compared with students (32%) and young working adults (53%). However, there was some resistance among respondents overall in materialising their financial goals - when asked if they kept a closed watch over their financial affairs, overall percentage fell from 82% in 2015 to 75% in 2019. Only 54% said they proactively work towards their financial goals, a slight drop from 58% in the previous findings.

The survey findings also provided insights into areas of improvement for the general public, such as making conscious purchase decisions, paying bills in a timely manner, and keeping a better watch over one’s personal financial affairs.

Other less desirable financial behaviours include not actively managing MPF/ORSO schemes - less than half (47%) of working adults reviewed their MPF/ORSO statements, while 11% admitted that they had never read these statements; not reviewing financial protection needs - among those without individual health insurance policies , one in five said they had not considered their protection needs; and not comparing and making informed investment decisions when purchasing financial products - only 50% compared product offerings from different financial institutions before making a purchase in the past two years.

IFEC Chairman Mr Lester Huang said, “We all have a keen desire to manage our money better, hence it is important to have good personal finance habits that can positively impact our lives and financial wellbeing. Given the current recession and economic uncertainties, healthy financial habits and discipline around budgeting, saving, borrowing, spending and investing become ever more critical.”

Financial Challenges Affecting the Young Generation

Distinct financial behaviour patterns can be seen across generations. The more mature generation plans and manages their finances more prudently, while in contrast the younger generation tends to put financial planning aside in favour of a ‘live for today’ attitude.

Younger people are more likely to overspend and end up in debt. According to the survey, one-fifth of all respondents spend more than they can afford at times, while 12% are in debt. Among young working adults, the numbers rose to 35% and 32% respectively. Young working adults are more likely to settle their credit card bills with minimum payment. Some 27% of them have done so at least once in the past year, compared with 7% of all respondents. This segment is less likely to set financial goals (53%) when compared with all respondents (60%).

”While each life stage comes with a different set of financial goals and challenges, our research shows that the young generation is more financially vulnerable. This is the generation that will play an increasingly pivotal role in our economy, and we need to provide them with the financial education and support to help them secure their future.”

“The IFEC is committed to providing financial education that equips and empowers individuals to improve their finances, thus enabling them to deal with various challenges in life. Insights from this survey help us to better identify and formulate life stage-specific financial education programmes, while continuing our collaboration with various stakeholders to reach the wide-spread Hong Kong population.” Mr Huang added.

The full research report is available here.