Qualification of professional investors

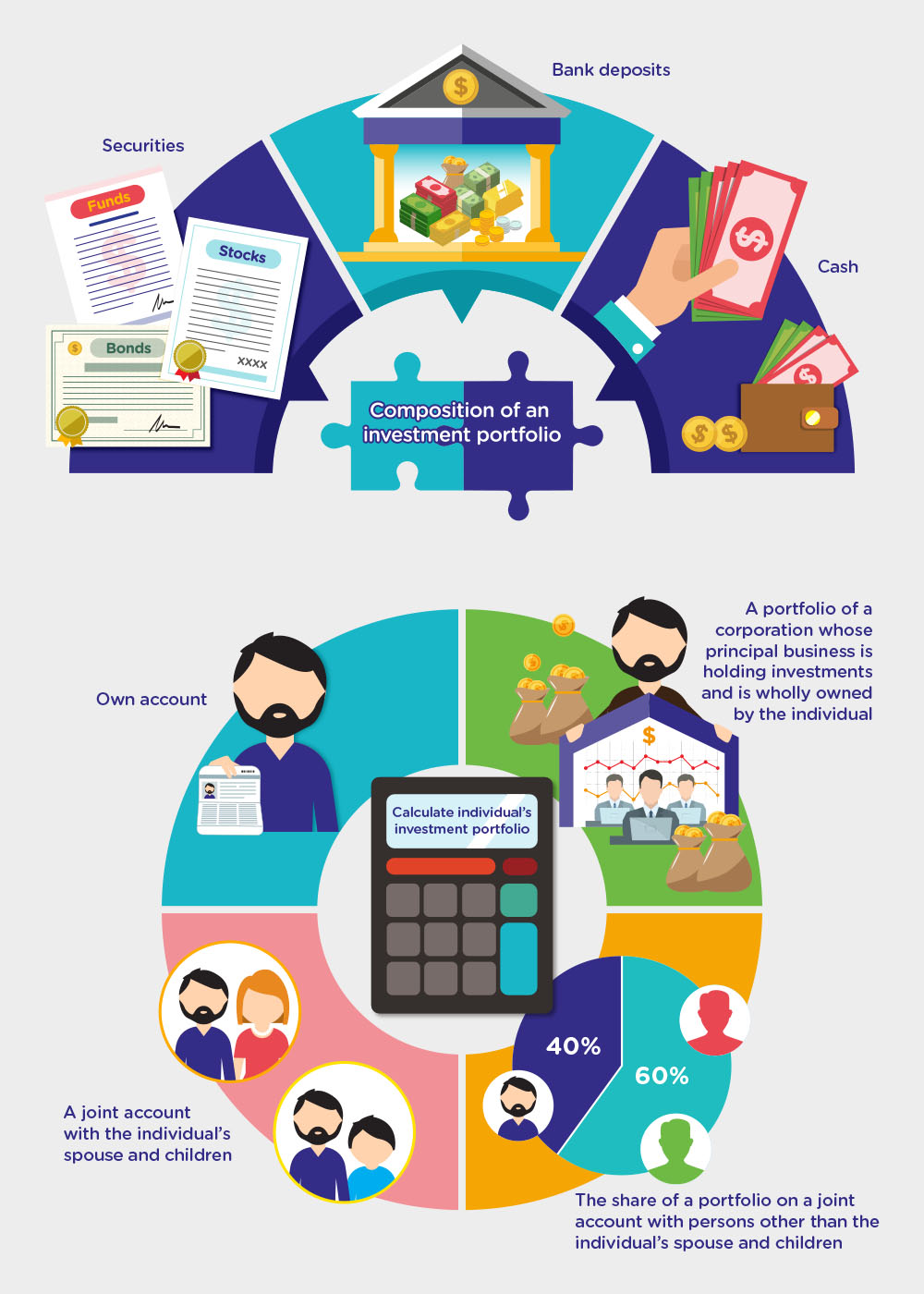

Besides the institutional professional investors designated under the Securities and Futures Ordinance, any individuals, corporations, trust corporations or partnerships with assets or a portfolio meeting the specified amount will also be defined as professional investors.

The Hong Kong Stock Exchange, banks and brokerage firms, insurance companies, collective investment schemes and MPF schemes and management companies of these schemes, are examples of institutional professional investors designated under the Securities and Futures Ordinance. Given they are the market practitioners, it is generally assumed that these investors have extensive investment knowledge and experience.

Monetary threshold for individual professional investors: $8 million

The Ordinance also defines individuals, corporations, trust corporations and partnerships who have assets or a portfolio of a specified amount as professional investors.

-

Individual: A portfolio of not less than $8 million

-

Corporation or partnership: A portfolio of not less than $8 million or total assets of not less than $40 million

-

Trust corporation: Total assets of not less than $40 million

For corporate professional investors, in addition to the above-mentioned monetary threshold, if its principal business is to hold a portfolio and is wholly-owned by any one or more professional investors, then it will also be defined as a professional investor. In addition, any holding company that wholly owns a corporate professional investor will automatically become a corporate professional investor.

Calculation of individual investment portfolio

31 October 2018