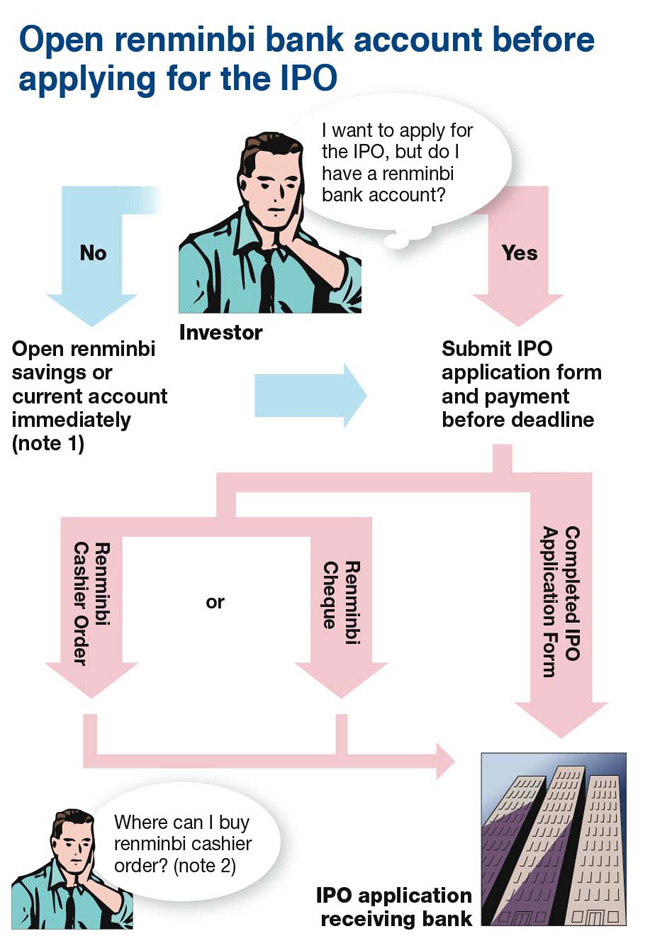

IPO application

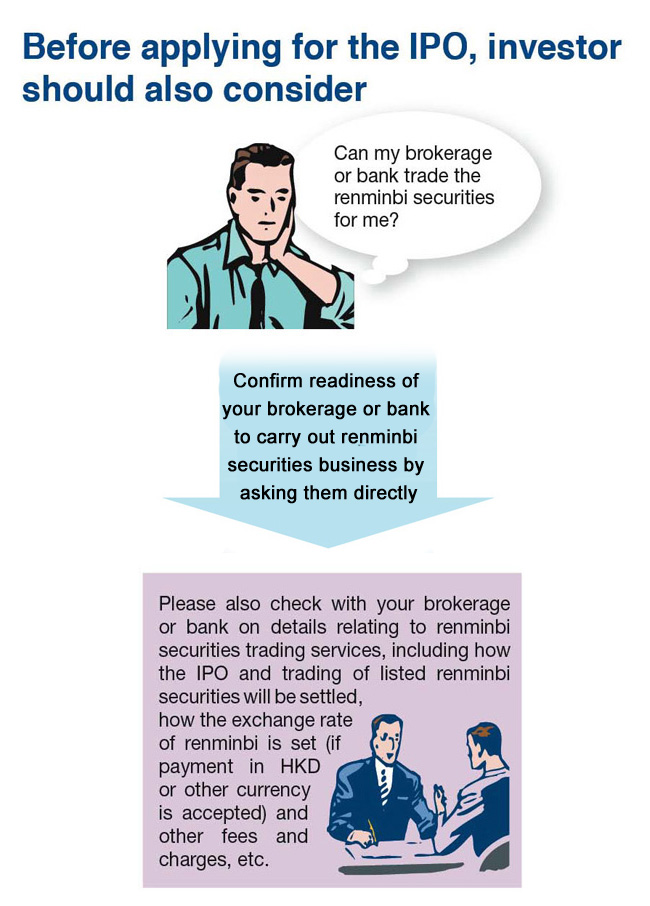

As an upcoming class of products, listed renminbi securities are likely to come on the market shortly through initial public offering (IPO). If you are to apply for a renminbi IPO using a white form, note the following:

|

Note 1: ask about details of renminbi bank account, as this may affect your IPO application and transaction settlement in future:

- Is there any third-party transfer limit for these renminbi bank accounts?

- Can I receive renminbi cheque book before IPO application deadline?

- Is there any upper limit set for each renminbi cheque drawn?

Note 2: check beforehand whether your bank can provide renminbi cashier order service.

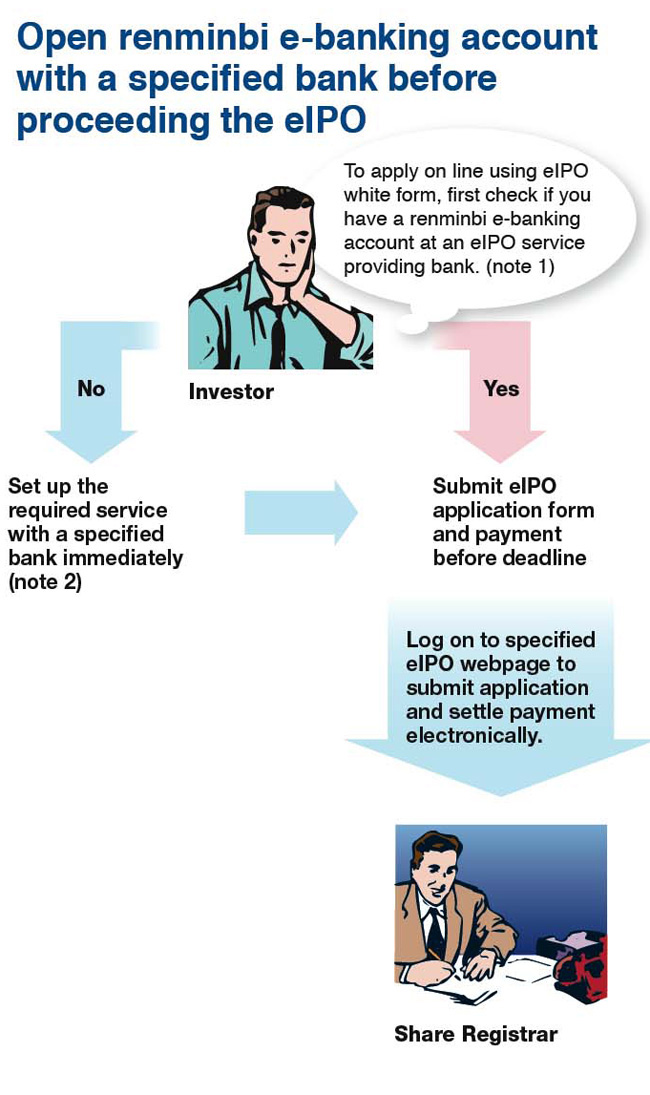

Listed renminbi-denominated securities - white form eIPO

If you are to apply on line using eIPO white form, first find out from the IPO prospectus whether your bank is one of the eIPO service providing banks. Besides, make sure your internet banking service and renminbi bank account are ready for proceeding the eIPO.

|

Note 1: the IPO prospectus will specify the eIPO service providing banks and the related webpages.

Note 2: please check with the bank whether there is any payment limit set for e-payment in renminbi.

|

After IPO results are announced, the share registrar will deliver physical certificates of renminbi securities to successful applicants. In case of partial or unsuccessful allotment, investors will receive refunds from the share registrar.