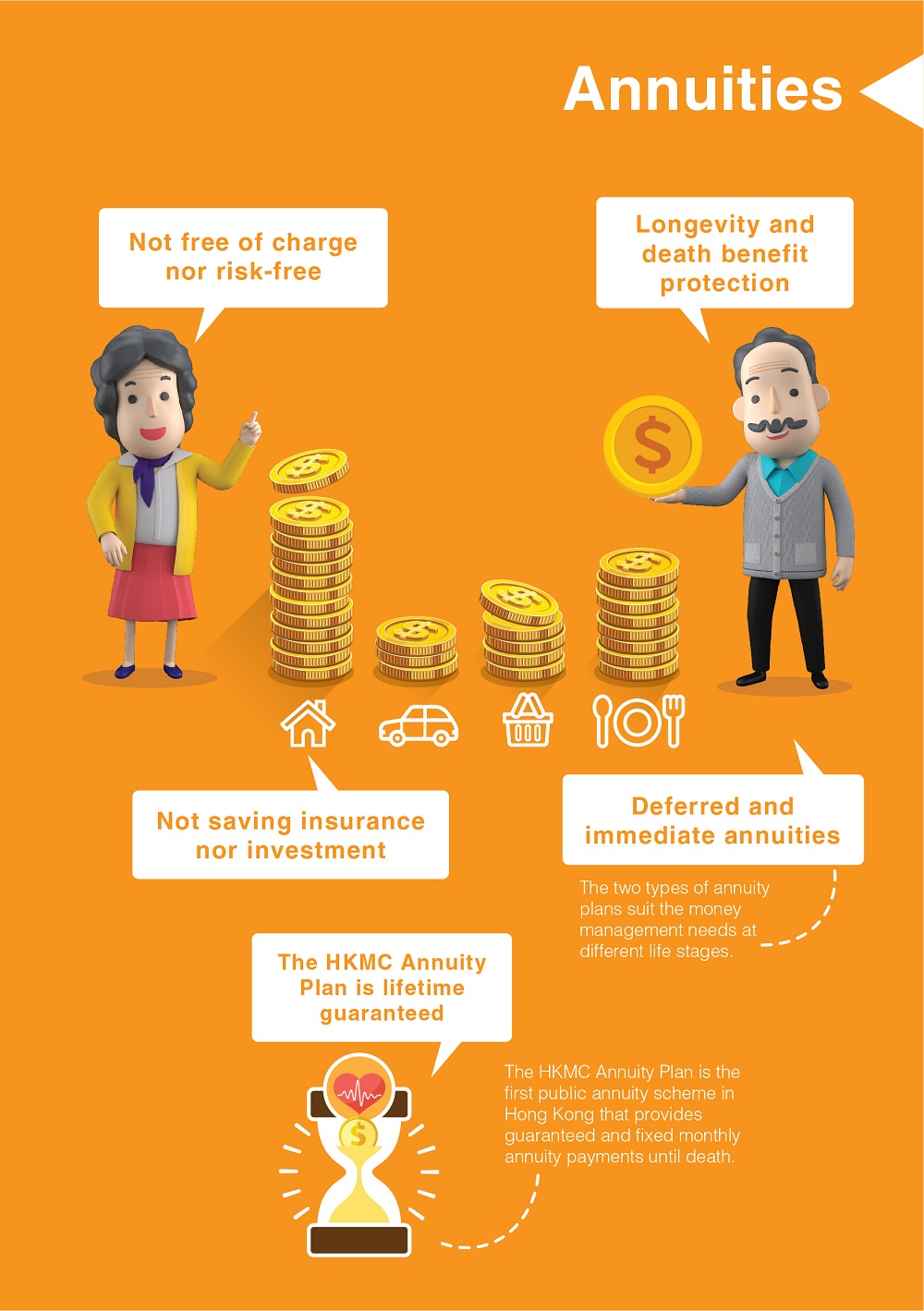

Annuities

It would be ideal to create a steady stream of income after retirement. As a retirement wealth management tool, annuities offer the annuitant a steady stream of income within a fixed term or lifelong period.

Longevity and death benefit protection

Annuities are life insurance products that can provide protection against financial risk arising from longevity. As they also include a life insurance component, they can offer death benefit protection during the premium payment period or the annuity period (depending on the policy terms).

Deferred and immediate annuities

Immediate annuities allow the annuitants to receive their annuity once the premium payments are completed. Deferred annuities have an accumulation phase for the insurance company to invest to accumulate the cash value. Younger people can opt for deferred annuities, while those who are retired or close to retirement can opt for immediate annuities.

Not free of charge nor risk-free

You need to pay premium for insuring a public or private annuity plan. It is necessary to understand the features, e.g. inflation and surrender risks, premium term, guaranteed and non-guaranteed returns, death benefit protection, as well as the tax deduction on the premium paid to the qualifying deferred annuity policy.

The HKMC Annuity Plan is lifetime guaranteed

The HKMC Annuity Plan sets a minimum guaranteed return of 105% of the premium paid. The longer the insured lives, the more annuity the insured receives and the higher the return. The guaranteed return may be outstripped. If the insured passes away within the Guaranteed Period, the designated beneficiary/ies will receive a death benefit.

Not saving insurance nor investment

Endowment life insurance focuses on the guaranteed and non-guaranteed cash values obtained at its maturity. Although these cash values can mimic monthly annuity payments, the amount may be insufficient and will not protect against longevity risk. We should not compare the return of annuities with investments such as stocks, bonds and time deposits.

24 April 2019