ETF Connect - Trading Arrangements

The inclusion of ETFs in Stock Connect follows the principal arrangement of stock trading under Stock Connect. For Northbound trading, most of the trading arrangements of ETFs, as well as arrangements on Broker-to-Client Assigned Number (BCAN) assignment, margin trading, securities lending, short selling and pre-trade checking, are similar to those of A share trades. ETF trading under Stock Connect can only take place in secondary market, while subscriptions and redemptions are not allowed.

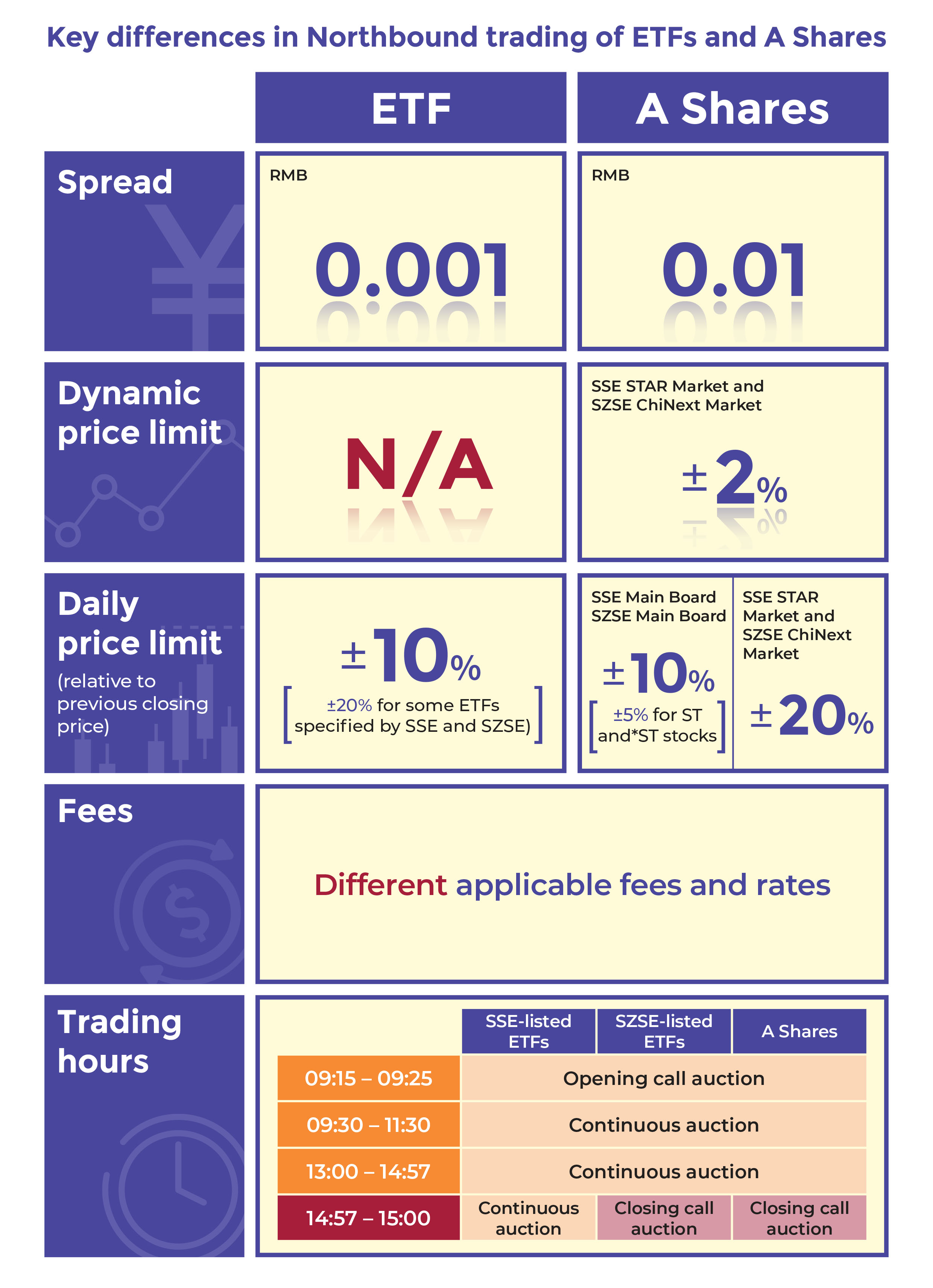

However, you should pay attention to the differences in the trading arrangements between Northbound trading of ETFs and A shares, such as the fees and trading hours.

Delisting arrangements

If an eligible ETF is delisted, it will be removed from the eligible security list from the date when it becomes delisted, while buy or sell orders will no longer be accepted. Fund managers may, according to the principles set out in the relevant requirements, liquidate assets of delisted ETFs and distribute the cash proceeds from liquidation to unit holders of such ETFs.