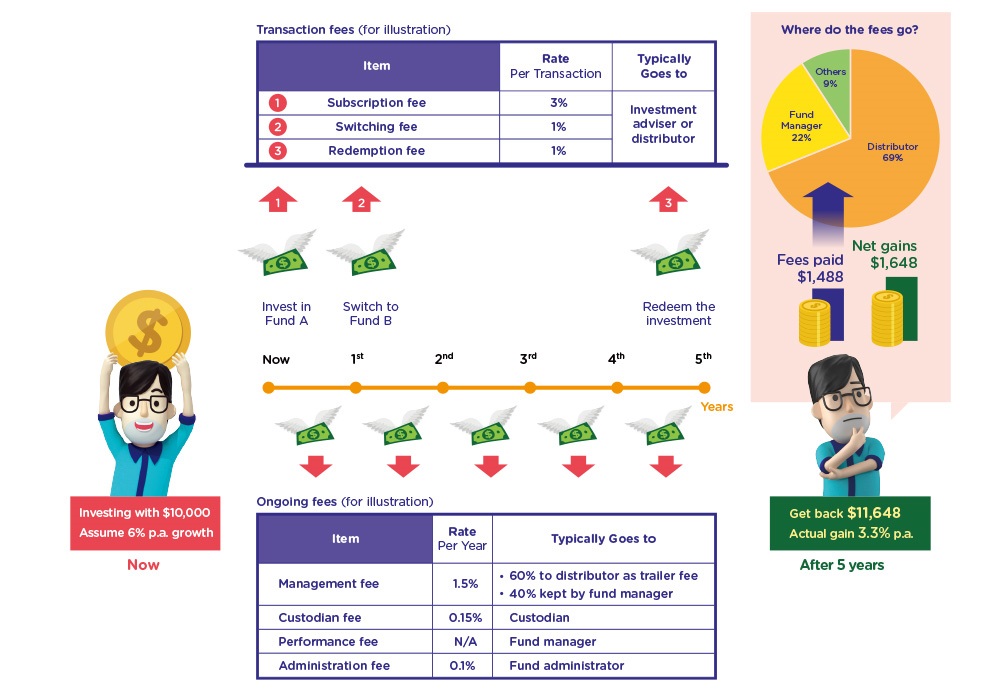

Examples of fund transaction fees and ongoing fees

(1) Transaction fees

| Subscription fee |

|

|---|---|

| Switching fee |

|

| Redemption fee |

|

(2) Ongoing fees (deduct from the fund's asset)

| Management fee |

|

|---|---|

| Custodian fee |

|

| Performance fee |

|

| Administration fee |

|

An example – How much are the total fees paid and where do the fees go?

Scenario: Mr Chin invests $10,000 in Fund A, and then switch to Fund B after one year. He continues holding the investment and redeem it at the end of the 5th year. Assume the investment gain is 6% per year over the whole investment period. How much are the total fees paid and where do the fees go?

Investors should note:

- Fees and charges will reduce the return of your investment. In the above example, though the investment gain is 6% per year, the actual annual return is only 3.3% due to the various fees and charges.

-

The transaction fees and a portion of the ongoing fees are typically taken up by the investment advisers / distributors as commission of selling the investment products to you. In the above example, 69% of the total fees went to the investment adviser /distributor. This may give rise to potential conflicts of interest and affect your own interest.

Learn more about:

Commissions on investment products and potential conflicts of interest

Enhanced disclosure of investment advisers when selling investment products

13 August 2018