ETF Connect - Eligible ETFs

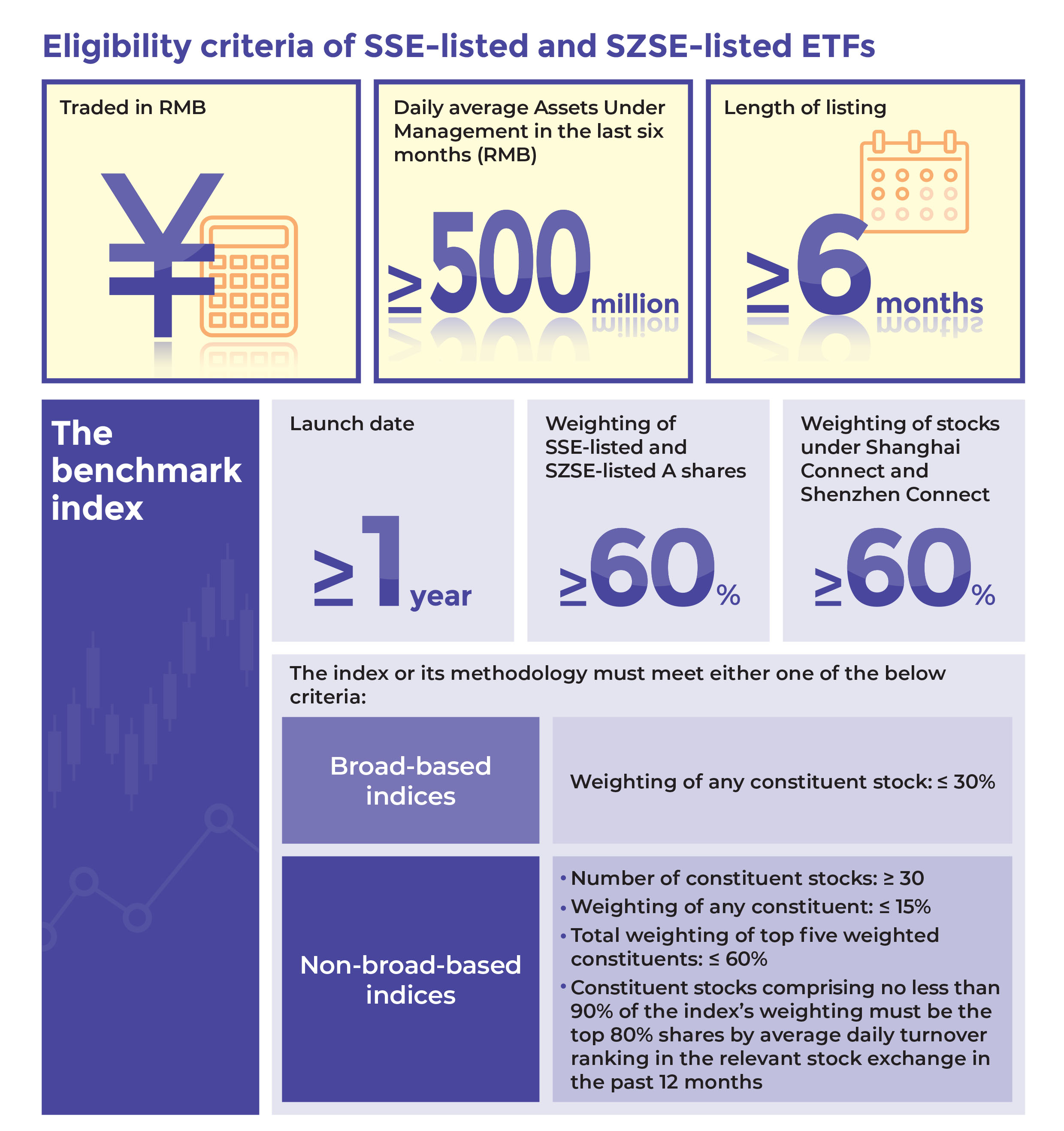

Like stocks, not all ETFs listed in Shanghai, Shenzhen and Hong Kong can be eligible for trading under Stock Connect. These ETFs must be reviewed and considered have met certain criteria, such as requirements on their trading currencies, asset sizes, length of listing and specific conditions related to the benchmark indices. Synthetic ETFs and leveraged and inverse products listed in Hong Kong are not eligible securities under Stock Connect.

You can access the full list of eligible securities and sell-only securities of Northbound trading on the HKEX website.

The list of eligible ETFs will be reviewed and adjusted every six months. Eligible SSE-listed and SZSE-listed ETFs meeting any of the following criteria upon regular reviews will be designated as sell-only securities and restricted from buying.

- The ETF’s daily average Assets Under Management in the last six months falls under RMB400 million;

- The total weighting of SSE-listed and SZSE-listed stocks in the benchmark index falls under 55%, or the total weighting of Northbound eligible constituents in the benchmark index falls under 55%; or

- The benchmark index and its methodology fulfil either of the below criteria:

- Applicable to broad-based indices: A constituent stock exceeds 30% of the index’s weighting

- Applicable to non-broad-based indices: The number of index constituent stocks falls under 30; or a constituent exceeds 15% of the index’s weighting or the total weighting of the top five weighted constituents exceeds 60%; or the constituent stocks which are the top 80% shares by average daily turnover ranking in the relevant stock exchange in the past 12 months falls under 90% of the index’s weighting.