Carbon futures ETF

Many countries are stepping up their decarbonisation ambitions by reducing greenhouse gas (“GHG”) emissions to combat climate change. Carbon emission allowances could be one of the means to help countries to achieve the national emissions targets.

Exchange-traded fund (ETF) investing in carbon emission allowances futures (commonly known as carbon futures ETF) provides retail investors’ access to the carbon market. While we know that an ETF is typically a passive investment vehicle tracking the performance of an underlying index, many of us may be unfamiliar with carbon emission allowances market and carbon emission allowances futures (commonly known as carbon futures) index, which is what carbon futures ETFs track.

Carbon futures ETF aims to track the performance of carbon futures index and it may not have a direct impact on the reduction of, or an objective to reduce, carbon footprint. As such, carbon futures ETF may not incorporate ESG factors as a key investment focus and thus is not an ESG fund.

You should know how carbon futures ETF works and the risks involved before making an investment decision. The following pointers help you understand more about this type of products.

- Carbon futures markets are extremely volatile. A carbon futures ETF is a derivative product and is targeted at investors who understand the nature and risks of such products, including the risks that:

- the price of futures contracts may drop to zero or a negative value in a short period of time;

- the rollover operation may have an adverse impact on the net asset value of the ETF; and

- the price volatility of a single commodity asset (i.e. carbon emission allowances) and/or a single futures contract may be extremely high.

- The performance of the underlying carbon futures index and the carbon futures ETF can significantly deviate from the spot price of carbon emission allowances because the underlying index is based on the price of the carbon futures contracts and not on the spot price of carbon emission allowances.

- You should exercise caution when trading a carbon futures ETF. Before investing in such ETF, particularly if you wish to adopt a buy-and-hold strategy, you should read this page and its offering documents carefully and fully understand its features, exposure, operation and risks. You should also have a clear understanding of how carbon futures contracts work and the rollover mechanism involved. You should pay particular attention to the risks under exceptional market circumstances, such as significant or total loss of your investment in the ETF in a short period of time and how rollover of futures contracts may adversely affect the value and performance of the ETF.

Carbon emission allowances key facts

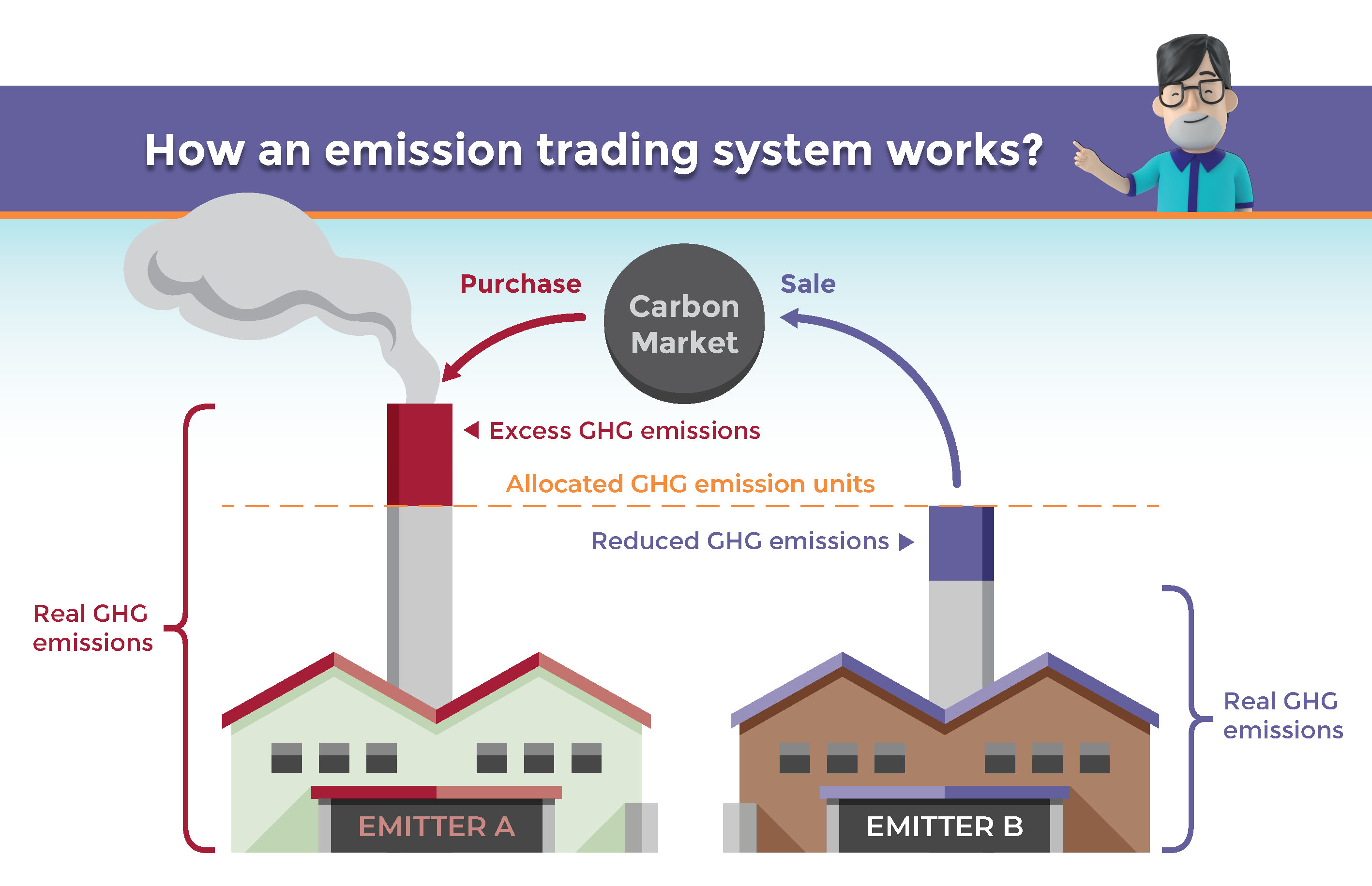

Carbon emission allowances are carbon credits issued by national or international governmental organizations under an emission “cap and trade” regulatory programme.

Each allowance permits the holder (e.g. companies such as industrial manufacturers, energy producers, aviation industry) to produce one metric tonne of carbon dioxide or carbon equivalent GHG. Among them, European Union Allowances (“EUA”) are carbon emission allowances issued by EU member states under EU ETS (as defined below). Allowances are either auctioned or given to the emitters (known as free allocation).

Under the “cap and trade” principle, the total amount of certain GHG that can be emitted by the companies covered by the emission trading system is limited by the mandated cap. The cap is reduced over time so that total emissions fall.

Within the cap, some of the companies produce less emissions than the number of carbon emission allowances they are allotted, thus resulting surplus of carbon emission allowances. However, some companies produce more emissions than the number of carbon emission allowances they receive each year can cover. These companies need to purchase carbon emission allowances to fully offset their emissions to avoid heavy penalty imposed, thereby creating a carbon market.

The price of carbon emission allowances would be impacted by the cap level each year, as well as the level of demand, which may be affected by factors such as the efficiency of energy usage, economic growth, relative commodity prices, and seasonal weather patterns. An increase in demand for carbon emission allowances may lead to an increase in price of carbon emission allowances, and vice versa.

Carbon markets and emission trading systems exist worldwide. Besides the European Union Emissions Trading System (“EU ETS”), there are national or sub-national emissions trading system in countries including Canada, China, Japan, New Zealand, South Korea, Switzerland and the United States.

There are futures contracts on carbon emission allowances, for example, EUA futures contracts trading on different exchanges such as ICE Endex, European Energy Exchange (“EEX”) and Nasdaq Oslo. Each of these EUA futures contract is euro-denominated and represents a lot of 1,000 EUAs that are deliverable to or from the Union Registry under the EU ETS. They may be used as a hedging instrument by industrial operators, to lock-in their carbon emission costs, or by speculators to bet on carbon emission allowance prices in light of the increasing awareness and controls towards environmental protection.

How does a carbon futures ETF work?

A carbon futures ETF aims to track the performance of an underlying index comprising specific carbon futures contracts, such as the ICE EUA futures contracts traded on ICE Endex. To do so, the ETF manager normally invests in the corresponding carbon futures contracts according to their weightings in the underlying index. Depending on the index methodology and the ETF’s investment strategy, the fund manager may invest in futures contracts with short-term or long-term (e.g. 12 months) maturities or a mixture of different maturities. Under exceptional circumstances, some ETF managers may use their discretion to deviate from the predefined rolling schedule of the underlying index in the interests of investors.

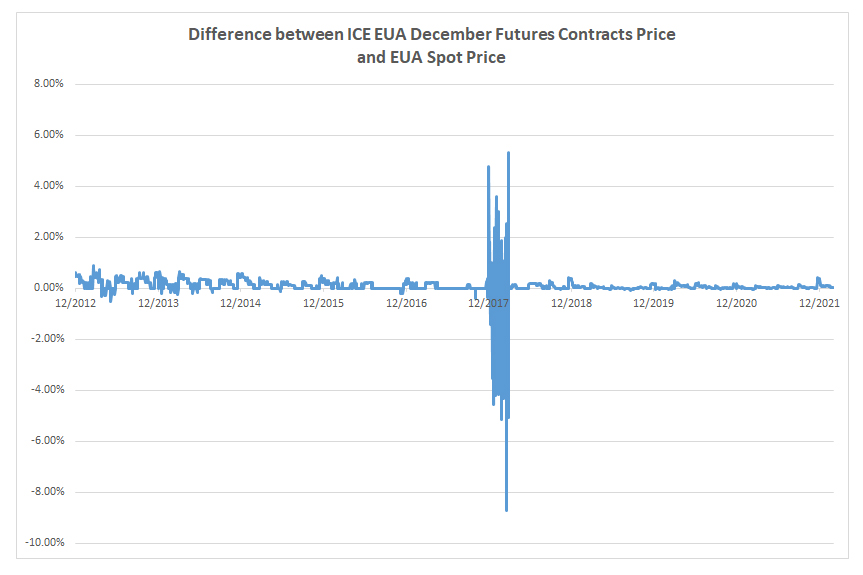

While such ETF offers investors a way to gain exposure to carbon emission allowance, investors should understand that the performance of the underlying carbon futures index and the carbon futures ETF can significantly deviate from the spot prices of carbon emission allowance. This is because the underlying index is based on the prices of carbon futures contracts but not on the spot price of carbon emission allowance. The price of carbon futures contracts may not always go in line with the spot price and there are risks involved in rolling over the futures contracts (please refer to the section “Key risks” below for more details). As an illustrative example, the chart below shows the difference between the ICE EUA December Futures Contracts Prices and the EUA spot prices from December 2012 to February 2022. You may also utilize the performance simulation tool on the carbon futures ETF’s website to help yourself understand the abovementioned difference.

Key risks

Apart from the major risks of ETFs and the specific risks involved in futures-based ETFs, investors should be aware of the below risks when trading carbon futures ETFs.

Risk of extreme price movements of futures contracts

Under exceptional market circumstances, the price of futures contracts may drop to zero or a negative value in a short period of time. In this case, you could suffer a total loss of your investment in the ETF.

Risks of rolling futures contracts

A carbon futures contract is a commitment to buy or sell a predefined amount of the carbon emission allowances at a predetermined price on a specified future date. "Rollover" means selling existing futures contracts that are about to expire and replacing them with futures contracts that will expire at a later date (i.e. longer-term contracts). If the prices of the longer-term contracts are higher than those of the expiring contracts, the proceeds from selling the expiring contracts will not be sufficient to buy the same number of longer-term contracts. Given that a futures-based ETF needs to rollover the futures contracts for the purpose of replicating the underlying futures index, a loss may incur (i.e. a negative roll yield) and would adversely affect the net asset value of the ETF. In other words, roll yield is reflected in the performance of the underlying futures index that a carbon futures ETF tracks. You should fully understand this risk before you invest in a carbon futures ETF, particularly if you wish to adopt a buy-and-hold strategy.

You should note that save for the transaction cost incurred, a “rollover” in itself is not a loss or return-generating event. That is, the NAV of the carbon futures ETF will not suffer an immediate loss or enjoy an immediate gain due to “rollover”. To illustrate, let’s consider an example that a carbon futures ETF with NAV $100 is holding 5 carbon futures contracts expiring in December current year whose price is $20. Currently, the price of carbon futures contracts expiring in December next year is $25. If the ETF carries out “rollover” by replacing the current year December futures contracts with next year December futures contracts, assuming no transaction cost, the ETF will close out 5 current year December futures contracts at $20 and buy 4 next year December futures contracts at $25. In this case, the NAV of the ETF will remain at $100 although the number of carbon futures contracts it holds will decrease from 5 to 4.

Subsequently, if the futures market is in contango (i.e. the price of near-term contracts is lower than the price of longer-term contracts), a negative roll yield may be realized over time and reflected in the NAV of the ETF when the ETF repeatedly buys the longer-term contracts at a price higher than the selling price of the near-term contracts and the price of the futures contracts moves down over time to converge to the spot price.

There is a variety of carbon futures indices which may differ in various respects, and most notably, in their rolling strategies. The strategy would affect how closely the index correlates to the price of carbon emission allowances in the spot markets, and the roll yield and net asset value of the carbon futures ETF. Investors should carefully study the carbon futures index used by the ETF. For more details about the nature and major risks of a futures-based commodity ETF, you may refer to the "Futures-based ETF" and "Commodities funds".

Risk of volatility of a single commodity asset or a single futures contract

The ETF has risk exposure concentrated in the carbon emission allowances market. Unlike conventional ETFs that track equity indices which are typically diversified, a carbon futures ETF is subject to the price volatility of a single asset only (i.e. carbon emission allowances). Such volatility may be extremely high and substantially higher than the volatility experienced by equity indices or a commodity index which is made up of multiple types of commodities. If a carbon futures ETF holds only a single futures contract (e.g. the ETF holds only a single month carbon futures contracts), this may result in large concentration risk and the price volatility of the ETF may be higher than that of an ETF which holds futures contracts with different expiry months.

Carbon emission allowances price volatility risk

Carbon emission allowances prices may be highly volatile and may be affected by numerous events or factors including global and local supply and demand of carbon emission allowances, the inclusion of new industries in the carbon emission trading system, global or regional political, economic or financial events and situations, investors’ expectations with respect to future rates of economic activity and inflation, and investment and trading activities of industrial emitters as well as investors. The NAV of the carbon futures ETF may be affected by the foregoing.

Energy sector risk

The energy sector is a major emitter of GHG and its activities may thus significantly impact the supply and demand of carbon emission allowances. For instance, further advances in renewable energy technology, improved efficiency of energy usage and/or unusually warm weather patterns may result in an increase in supply and/or decrease in demand for such allowances which in turn may have a negative impact on the NAV of the carbon futures ETF.

“Cap and trade” principle risk

Under the “cap and trade” principle, a cap is set on the total amount of certain GHG that can be emitted by the companies covered in the emissions trading system, and companies trade carbon emission allowances within such cap which is reduced over time. If the rate or level of reduction in such cap be lower than market expectations, the prices of carbon emission allowances, and thus the underlying index level and the NAV of the carbon futures ETF, may be negatively affected. Where GHG emitting companies is unable to pass on the cost of emission allowances to their consumers, the financial health of these companies may deteriorate thus decreasing the demand and the prices for emission allowances. In addition, a “cap and trade” system may lead to greater volatility in carbon emissions prices, and there is no guarantee that there is adequate liquidity in the carbon futures contracts market for its participants. The “cap and trade” principle may not continue to exist. These features of the “cap and trade” system may have an adverse impact on the NAV of the carbon futures ETF.

Government intervention and restriction risks

There may be substantial government and regulator intervention in the financial markets and carbon emission allowances related markets. Such interventions may be unpredictable, affecting the trading, operation and market making activities and the performance of the underlying index and the carbon futures ETFs.

Similar to investing in other ETFs, investors should gain full understanding of the features and risks of a carbon futures ETF from primary sources such as product key facts statement and the offering document before making an investment decision.

23 March 2022