Crude oil futures ETF

Crude oil is a commodity with an investment value, apart from being an essential energy resource. You may wonder how retail investors can invest in crude oil. Unlike an oil company, you can’t buy and stock up barrels of crude oil.

Crude oil futures exchange-traded fund (ETF) provides a way for retail investors to invest in this kind of commodity, instead of investing directly in crude oil. It is a passive investment vehicle which aims to track the performance of a specified crude oil futures index, ie the underlying index, by primarily investing in crude oil futures contracts.

You should know how it works and the risks involved before making an investment decision. The following pointers help you understand more about this type of products.

- Crude oil futures markets are extremely volatile. A crude oil futures ETF is a derivative product and is targeted at investors who understand the nature and risks of such products, including the risks that:

- the price of futures contracts may drop to zero or a negative value in a short period of time;

- the rollover operation may have an adverse impact on the net asset value of the ETF; and

- the price volatility of a single commodity asset (i.e crude oil) and/or a single futures contract may be extremely high.

- The performance of the underlying crude oil futures index and the crude oil futures ETF can significantly deviate from the spot price of crude oil because the underlying index is based on the price of the crude oil futures contracts and not on the price of physical crude oil.

- You should exercise caution when trading a crude oil futures ETF. Before investing in such ETF, particularly if you wish to adopt a buy-and-hold strategy, you should read this page and its offering documents carefully and fully understand its features, exposure, operation and risks. You should also have a clear understanding of how oil futures contracts work and the rollover mechanism involved. You should pay particular attention to the risks under exceptional market circumstances, such as significant or total loss of your investment in the ETF in a short period of time and how rollover of futures contracts may adversely affect the value and performance of the ETF.

What is the ETF tracking?

Many varieties of crude oil are produced around the world, each traded at its own price. Due to the wide variety, crude oils are priced and traded relative to well-known benchmarks. The two most well-known benchmark types of crude oil are the West Texas Intermediate (“WTI”) and the Brent Blend ("Brent"). The WTI is the major benchmark for the crude oil in the Americas and the Brent is the primary benchmark for the crude oil in Europe or Africa.

Different crude oil futures contracts are traded on various exchanges including the New York Mercantile Exchange, Inc. (“NYMEX”), Intercontinental Exchange, Inc. (“ICE”) and the Dubai Mercantile Exchange Limited. The WTI crude oil futures contracts and the Brent crude oil futures contracts, which are traded on the NYMEX and the ICE Futures Market in London respectively, are the two most liquid crude oil futures contracts.

A crude oil futures ETF aims to track the performance of an underlying index comprising specific crude oil futures contracts such as the WTI and Brent crude oil futures contracts.

How does a crude oil futures ETF work?

A crude oil futures ETF aims to replicate the performance of an underlying crude oil futures index by investing in the corresponding crude oil futures contracts. Depending on the index methodology and the ETF’s investment strategy, it can invest in futures contracts with short-term or long-term (eg 12 months) maturities or a mixture of different maturities.

You should note that the performance of the underlying crude oil futures index and the crude oil futures ETF can significantly deviate from the spot price of the crude oil because the underlying index is based on the price of the crude oil futures contracts and not on the price of physical crude oil. The prices of crude oil futures contracts may not always go in line with the price of crude oil in the spot markets. For further details, please refer to the section "Risk of rolling futures contracts" below.

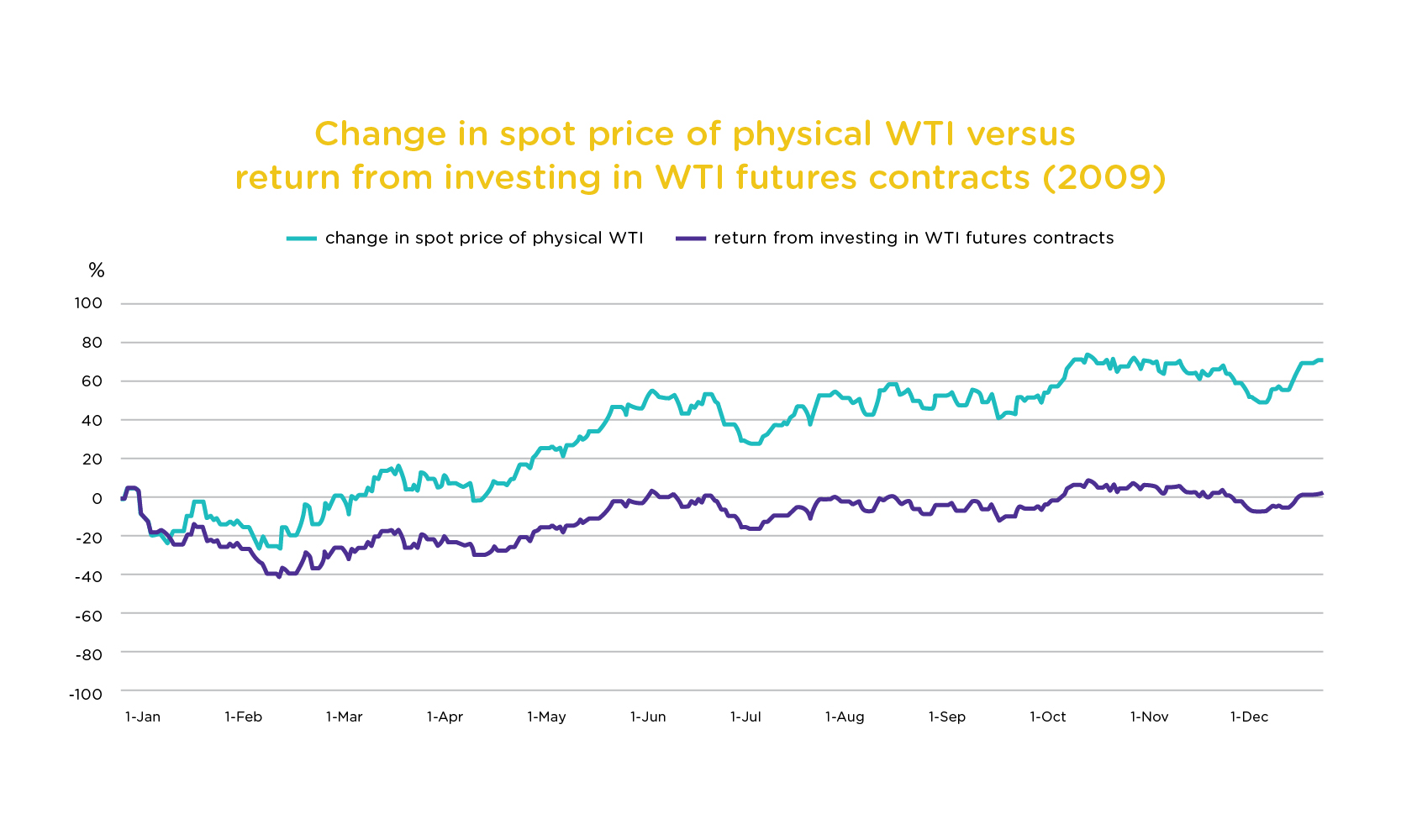

For illustrative purpose, the chart below shows the change in spot price of physical WTI against the return from investing in WTI futures contracts (note) in 2009. During the period, the spot price increased by approximately 71% while the return of the WTI futures contracts was approximately 3%. You may also utilize the performance simulation tool on the crude oil futures ETF’s website to help yourself understand the above mentioned difference.

What are the risks of investing in the crude oil futures ETF?

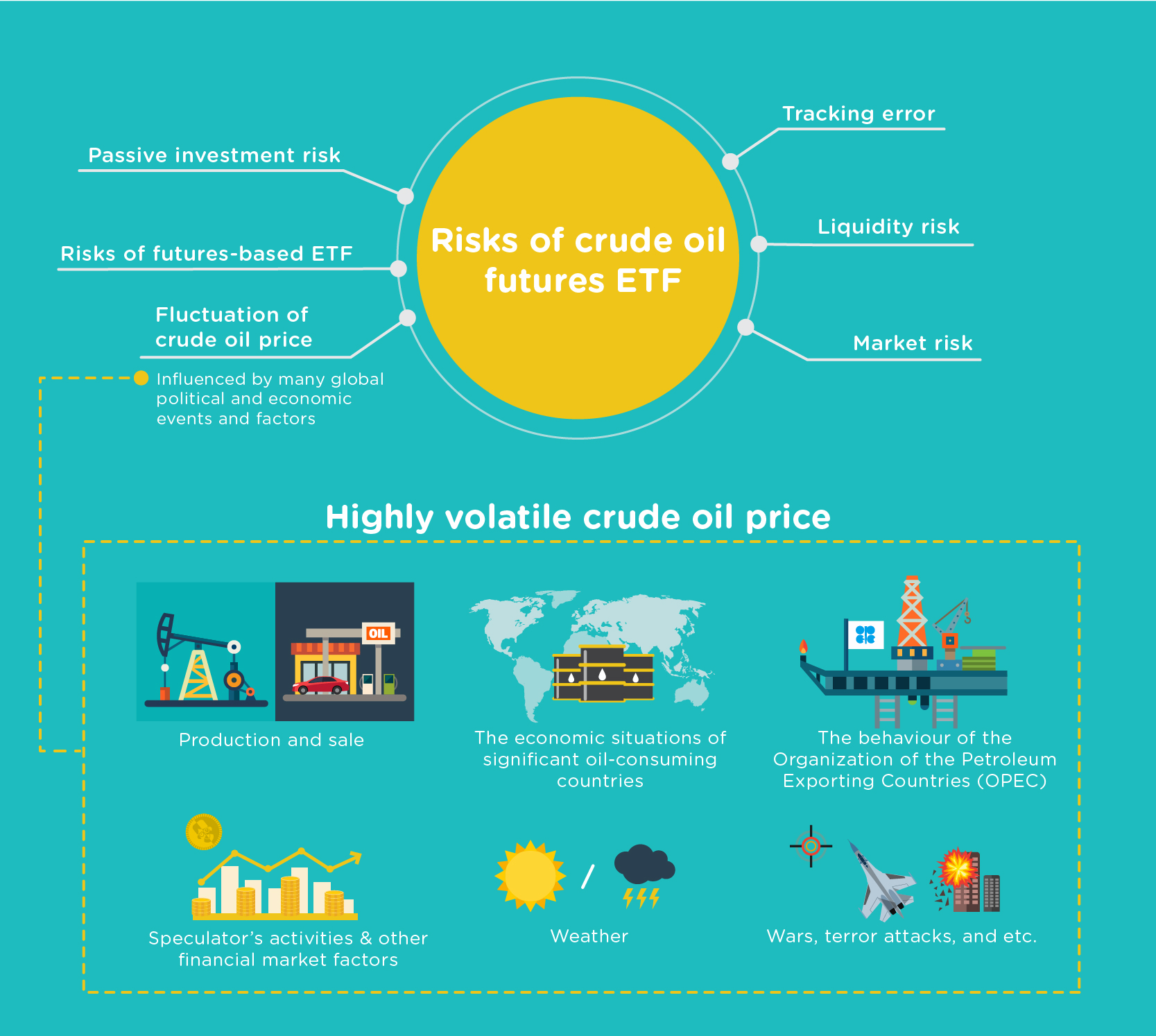

There are a number of risks associated with ETFs that are also applicable to crude oil futures ETFs. You may refer to the "ETF-major risks" (see recommended reading below) to learn more about the major risks of ETF.

Crude oil futures ETFs also have the same characteristics and risk profile as a futures-based ETF. Set out below are the key risks that you should pay particular attention to:

Risk of extreme price movements of futures contracts:

Under exceptional market circumstances, the price of futures contracts may drop to zero or a negative value in a short period of time. In this case, you could suffer a total loss of your investment in the ETF.

Risk of rolling futures contracts:

A crude oil futures contract is a commitment to buy or sell a predefined amount of the underlying crude oil at a predetermined price on a specified future date with the contract settled in cash. "Rollover" means selling existing futures contracts that are about to expire and replacing them with futures contracts that will expire at a later date (ie longer-term contracts). If the prices of the longer-term contracts are higher than those of the expiring contracts, the proceeds from selling the expiring contracts will not be sufficient to buy the same number of longer-term contracts. Given that a futures-based ETF needs to rollover the futures contracts for the purpose of replicating the underlying futures index, a loss may incur (ie a negative roll yield) and would adversely affect the net asset value of the ETF. In other words, roll yield is reflected in the performance of the underlying futures index that a crude oil futures ETF tracks. You should fully understand this risk before you invest in a crude oil futures ETF, particularly if you wish to adopt a buy-and-hold strategy.

You should note that save for the transaction cost incurred, a “rollover” in itself is not a loss or return-generating event. That is, the NAV of the crude oil futures ETF will not suffer an immediate loss or enjoy an immediate gain due to “rollover”. To illustrate, let’s consider an example that a crude oil futures ETF with NAV $100 is holding 5 crude oil futures contracts expiring in June whose price is $20. Currently, the spot price and price of crude oil futures contracts expiring in July is $25. If the ETF carries out “rollover” by replacing the June futures contracts with July futures contracts, assuming no transaction cost, the ETF will close out 5 June futures contracts at $20 and buy 4 July futures contracts at $25. In this case, the NAV of the ETF will remain at $100 although the number of crude oil futures contracts it holds will decrease from 5 to 4.

Subsequently, if the futures market is in contango (i.e. the price of near-term contracts is lower than the price of longer-term contracts), a negative roll yield may be realized over time and reflected in the NAV of the ETF when the ETF repeatedly buys the longer-term contracts at a price higher than the selling price of the near-term contracts and the price of the futures contracts moves down over time to converge to the spot price.

There is a variety of crude oil futures indices which could be different in multiple respects, and most notably, in their rolling strategies. The strategy would affect how closely the index correlates to the price of crude oil in the spot markets, and the roll yield and the net asset value of the crude oil futures ETFs. Investors should carefully study the crude oil futures index used by the ETF. For more details about the nature and major risks of a futures-based commodity ETF, you may refer to the "Futures-based ETF" (see section "More" below).

Risk of volatility of a single commodity asset or a single futures contract:

Unlike conventional ETFs that track equity indices which are typically diversified, a crude oil futures ETF is subject to the price volatility of a single asset only (i.e. crude oil). Such volatility may be extremely high and substantially higher than the volatility experienced by equity indices or a commodity index which is made up of multiple types of commodities. If a crude oil futures ETF holds only a single futures contract (e.g. the ETF holds only the near-month futures contract), this may result in large concentration risk and the price volatility of the ETF may be higher than that of an ETF which holds futures contracts with different expiry months.

What should you do before making an investment decision?

You should first read the product key facts statement and the offering document to fully understand the nature, investment objective and strategy, the underlying index, fees and charges, features and major risks of a crude oil futures ETF.

You should then consider carefully whether the product suits your investment objective, the amount of investment required and your risk capability. If you have any questions, do ask your intermediaries to make sure that the product is really suitable for you before making an investment decision.

You may find out the definition of some terminologies used in this article in the "Glossary" section.

(Note): The return of the WTI futures contracts is calculated based on (i) changes in the price of the nearest WTI futures contracts; and (ii) the gain and loss resulting from the rolling of the nearest contracts to the next nearest contracts as the nearest contracts approach maturity.

28 April 2020