Iron ore futures ETF

The combination of “Iron ore futures” and “ETF” (exchange-traded fund) may sound novel to many investors. While we know that an ETF is typically a passive investment vehicle tracking the performance of an underlying index, many of us may be unfamiliar with iron ore market and iron ore futures index, which is what iron ore futures ETFs track.

You should know how iron ore futures ETF works and the risks involved before making an investment decision. The following pointers help you understand more about this type of products.

- Iron ore futures markets are extremely volatile. An iron ore futures ETF is a derivative product and is targeted at investors who understand the nature and risks of such products, including the risks that:

- the price of futures contracts may drop to zero or a negative value in a short period of time;

- the rollover operation may have an adverse impact on the net asset value of the ETF; and

- the price volatility of a single commodity asset (i.e iron ore) and/or a single futures contract may be extremely high.

- The performance of the underlying iron ore futures index and the iron ore futures ETF can significantly deviate from the spot price of iron ore because the underlying index is based on the price of the iron ore futures contracts and not on the price of physical iron ore.

- You should exercise caution when trading an iron ore futures ETF. Before investing in such ETF, particularly if you wish to adopt a buy-and-hold strategy, you should read this page and its offering documents carefully and fully understand its features, exposure, operation and risks. You should also have a clear understanding of how iron ore futures contracts work and the rollover mechanism involved. You should pay particular attention to the risks under exceptional market circumstances, such as significant or total loss of your investment in the ETF in a short period of time and how rollover of futures contracts may adversely affect the value and performance of the ETF.

Iron ore key facts

- Raw material: Iron ore is the key raw material of steel, which is widely used in different sectors such as real estate, transportation, car manufacturing, energy supply networks, machineries, ship building and home appliances. It is the second-largest global commodity by trade value after crude oil.

- Demand: The demand of iron ore is mainly determined by steel production. China is the major iron ore importer in the world.

- Supply: Australia, Brazil, Russia, China and India are the top countries sharing large portion of the world’s iron ore reserves. A few companies from Australia and Brazil dominate the global iron ore production.

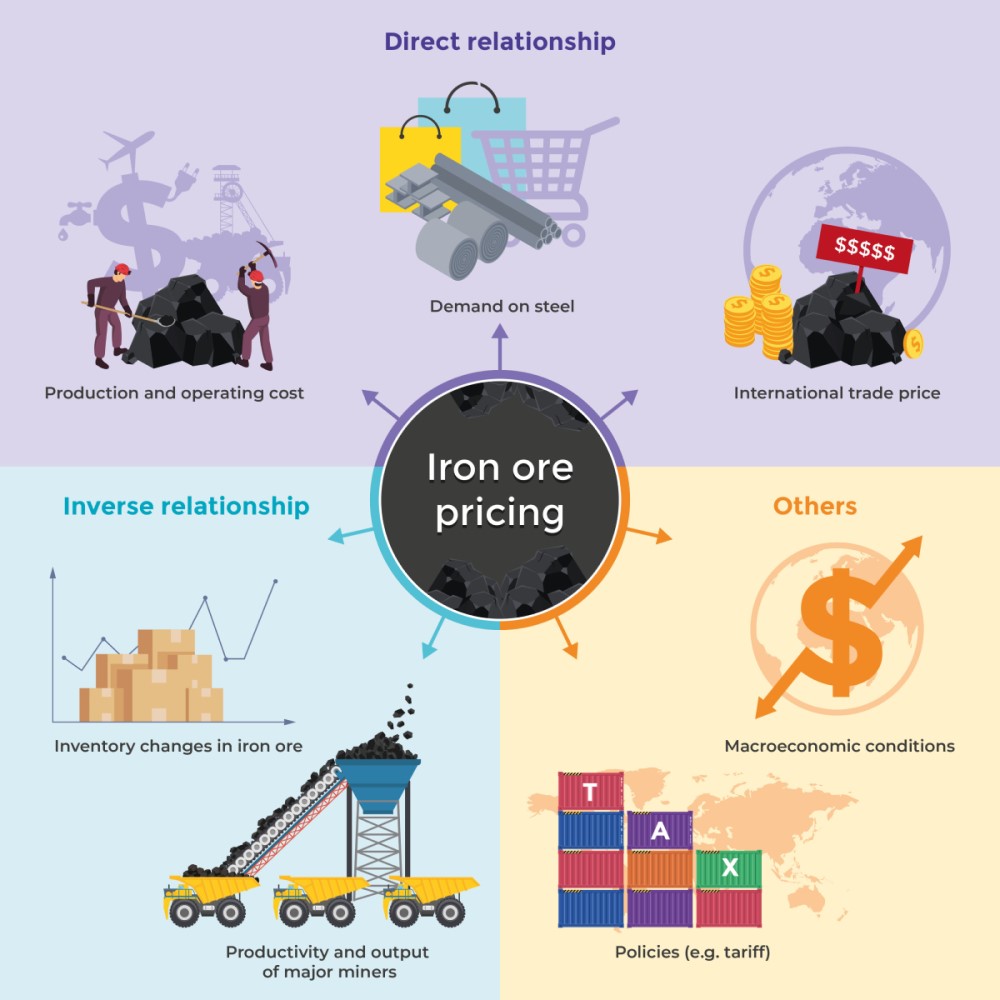

- Pricing: While the major reference for iron ore pricing is the Platts index, there are many other factors influencing iron ore pricing concurrently.

- Derivatives market: Iron ore investors including iron ore producers and steel producers trade derivatives in order to hedge the risk of spot price movements of iron ore. Trading of iron ore derivatives take place in different exchanges worldwide including Dalian Commodity Exchange (DCE), Singapore Exchange Limited, Chicago Mercantile Exchange and The Stock Exchange of Hong Kong Limited, among which the iron ore futures contracts traded on DCE are the most liquid.

How does an iron ore futures ETF work?

An iron ore futures ETF aims to track the performance of an underlying index comprising specific iron ore futures contracts, such as the DCE iron ore futures contracts. To do so, the ETF manager normally invests in the corresponding iron ore futures contracts according to their weightings in the underlying index. Depending on the index methodology and the ETF’s investment strategy, the fund manager may invest in futures contracts with short-term or long-term (eg 12 months) maturities or a mixture of different maturities. Under exceptional circumstances, some ETF managers may use their discretion to deviate from the predefined rolling schedule of the underlying index in the interests of investors.

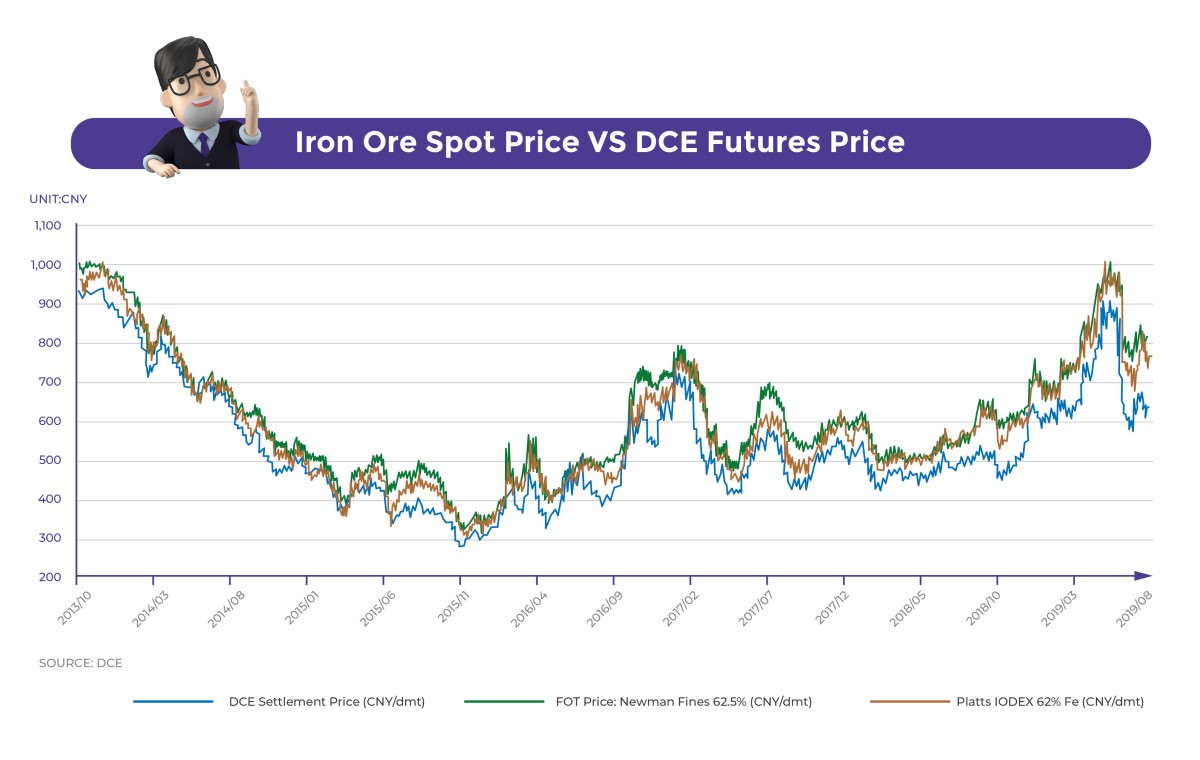

While such ETF offers investors a way to gain exposure to iron ore, investors should understand that the performance of the underlying iron ore futures index and the iron ore futures ETF can significantly deviate from the spot price of iron ore. This is because the underlying index is based on the prices of iron ore futures contracts but not on the spot price of iron ore. The price of iron ore futures contracts may not always go in line with the spot price and there are risks involved in rolling over the futures contracts (please refer to the section “Key risks” below for more details). The chart below shows the change in spot price of iron ore against DCE settlement prices (note) from October 2013 to August 2019. You may also utilize the performance simulation tool on the iron ore futures ETF’s website to help yourself understand the abovementioned difference.

(Note): DCE settlement prices refer to settlement prices of dominant DCE iron ore futures contracts.

Key risks

Apart from the major risks of ETFs and the specific risks involved in futures-based ETFs, investors should be aware of the below risks when trading iron ore futures ETFs.

Risk of extreme price movements of futures contracts:

Under exceptional market circumstances, the price of futures contracts may drop to zero or a negative value in a short period of time. In this case, you could suffer a total loss of your investment in the ETF.

Risks of rolling futures contracts:

An iron ore futures contract is a commitment to buy or sell a predefined amount of the underlying iron ore at a predetermined price on a specified future date. "Rollover" means selling existing futures contracts that are about to expire and replacing them with futures contracts that will expire at a later date (ie longer-term contracts). If the prices of the longer-term contracts are higher than those of the expiring contracts, the proceeds from selling the expiring contracts will not be sufficient to buy the same number of longer-term contracts. Given that a futures-based ETF needs to rollover the futures contracts for the purpose of replicating the underlying futures index, a loss may incur (ie a negative roll yield) and would adversely affect the net asset value of the ETF. In other words, roll yield is reflected in the performance of the underlying futures index that an iron ore futures ETF tracks. You should fully understand this risk before you invest in an iron ore futures ETF, particularly if you wish to adopt a buy-and-hold strategy.

You should note that save for the transaction cost incurred, a “rollover” in itself is not a loss or return-generating event. That is, the NAV of the iron ore futures ETF will not suffer an immediate loss or enjoy an immediate gain due to “rollover”. To illustrate, let’s consider an example that an iron ore futures ETF with NAV $100 is holding 5 iron ore futures contracts expiring in June whose price is $20. Currently, the spot price and price of iron ore futures contracts expiring in July is $25. If the ETF carries out “rollover” by replacing the June futures contracts with July futures contracts, assuming no transaction cost, the ETF will close out 5 June futures contracts at $20 and buy 4 July futures contracts at $25. In this case, the NAV of the ETF will remain at $100 although the number of iron ore futures contracts it holds will decrease from 5 to 4.

Subsequently, if the futures market is in contango (i.e. the price of near-term contracts is lower than the price of longer-term contracts), a negative roll yield may be realized over time and reflected in the NAV of the ETF when the ETF repeatedly buys the longer-term contracts at a price higher than the selling price of the near-term contracts and the price of the futures contracts moves down over time to converge to the spot price.

There is a variety of iron ore futures indices which may differ in various respects, and most notably, in their rolling strategies. The strategy would affect how closely the index correlates to the price of iron ore in the spot markets, and the roll yield and net asset value of the iron ore futures ETF. Investors should carefully study the iron ore futures index used by the ETF. For more details about the nature and major risks of a futures-based commodity ETF, you may refer to the "Futures-based ETF" and "Commodities funds".

Risk of volatility of a single commodity asset or a single futures contract:

The ETF has risk exposure concentrated in the iron ore market. Unlike conventional ETFs that track equity indices which are typically diversified, an iron ore futures ETF is subject to the price volatility of a single asset only (i.e. iron ore). Such volatility may be extremely high and substantially higher than the volatility experienced by equity indices or a commodity index which is made up of multiple types of commodities. If an iron ore futures ETF holds only a single futures contract (e.g. the ETF holds only the near-month futures contract), this may result in large concentration risk and the price volatility of the ETF may be higher than that of an ETF which holds futures contracts with different expiry months.

Iron ore price volatility risk:

Iron ore prices may be highly volatile and may be affected by numerous events or factors.

Government intervention and restriction risks:

There may be substantial government intervention in the economy, including restrictions on investment in companies or industries deemed sensitive to relevant national interests. Governments and regulators may also intervene in the financial markets. Such interventions may be unpredictable, affecting the trading, operation and market making activities and may also lead to an increased tracking error for the iron ore futures ETFs

Similar to investing in other ETFs, investors should gain full understanding of the features and risks of an iron ore futures ETF from primary sources such as product key facts statement and the offering document before making an investment decision.

2 June 2020