Investors buy stocks with the desire for the stock price to rise and sell them for a profit. However, when you buy derivative warrants (known as “warrants”), you can have the expectation for the underlying asset price (or level if the underlying asset is an index) to rise or fall.

There are two types of warrants – call warrants and put warrants. A bullish investor may buy a call warrant to benefit from upward movements of the underlying asset price; while a bearish investor may buy a put warrant to capitalise on the downward movements of the underlying asset price.

Maximum Loss: Total Loss of Investment

Investors may lose all of their capital in the warrants if the performance of the underlying asset did not act as expected.

In general, warrants give investors the right to buy or sell the underlying asset at a predetermined price or level on or before a specified date. Currently, all warrants listed on the Hong Kong Stock Exchange are European style and cash settled, meaning they can only be exercised automatically on the expiry date with cash settlement. The theoretical price and payoff of a warrant will depend on the relationship between its strike price (or level if the underlying asset is an index) and the underlying asset price. Strike price or level is a pre-set benchmark price or level to determine the potential cash settlement payout at expiry.

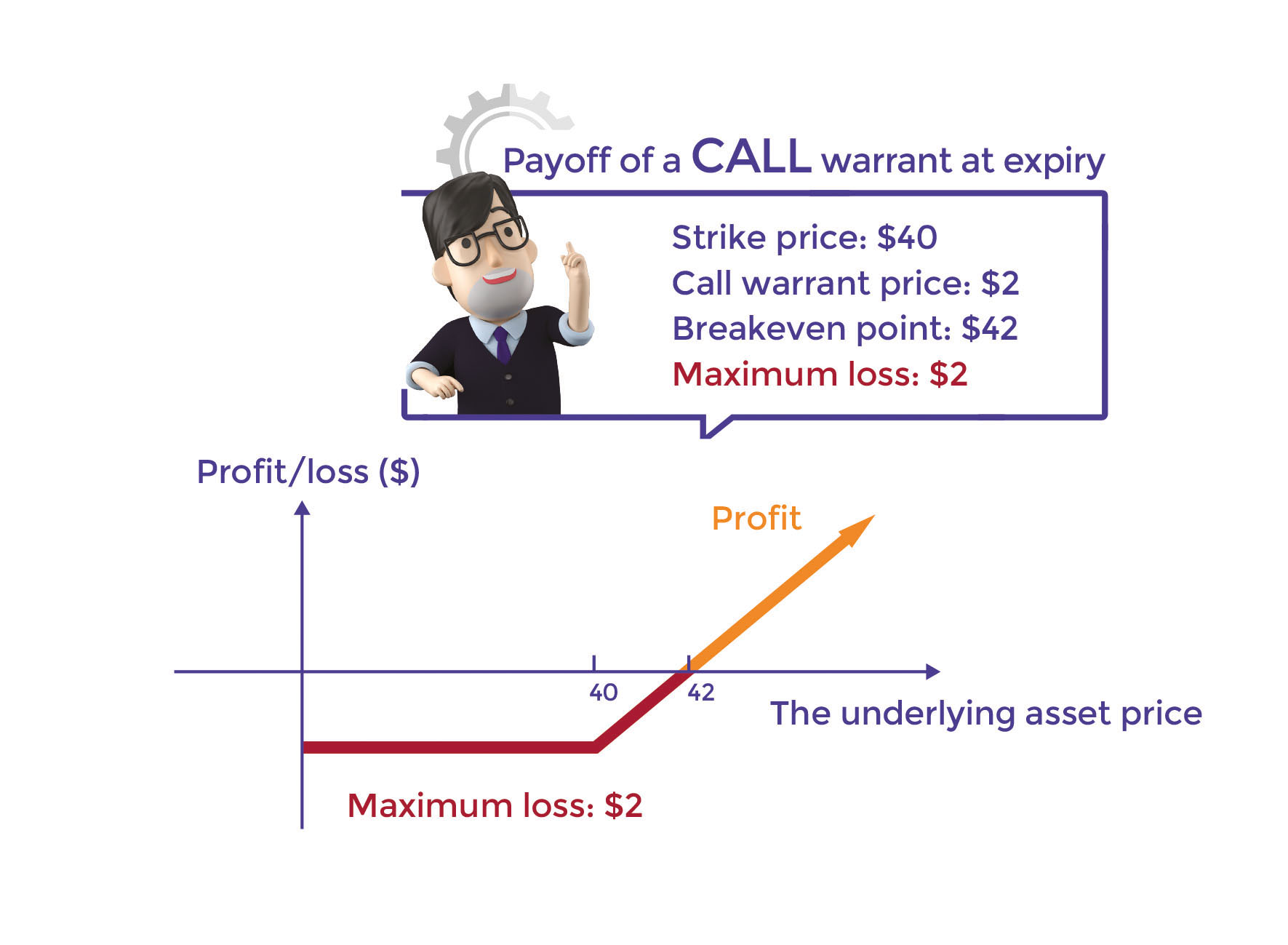

A call warrant is in-the-money if the underlying asset price is higher than the strike price. The intrinsic value and potential gain of a call warrant increase as the underlying asset price rises. On the contrary, a call warrant is out-of-the-money if the underlying asset price falls below the strike price, rendering it not exercisable. It will become worthless on the expiry date and the investor will lose all of the capital.

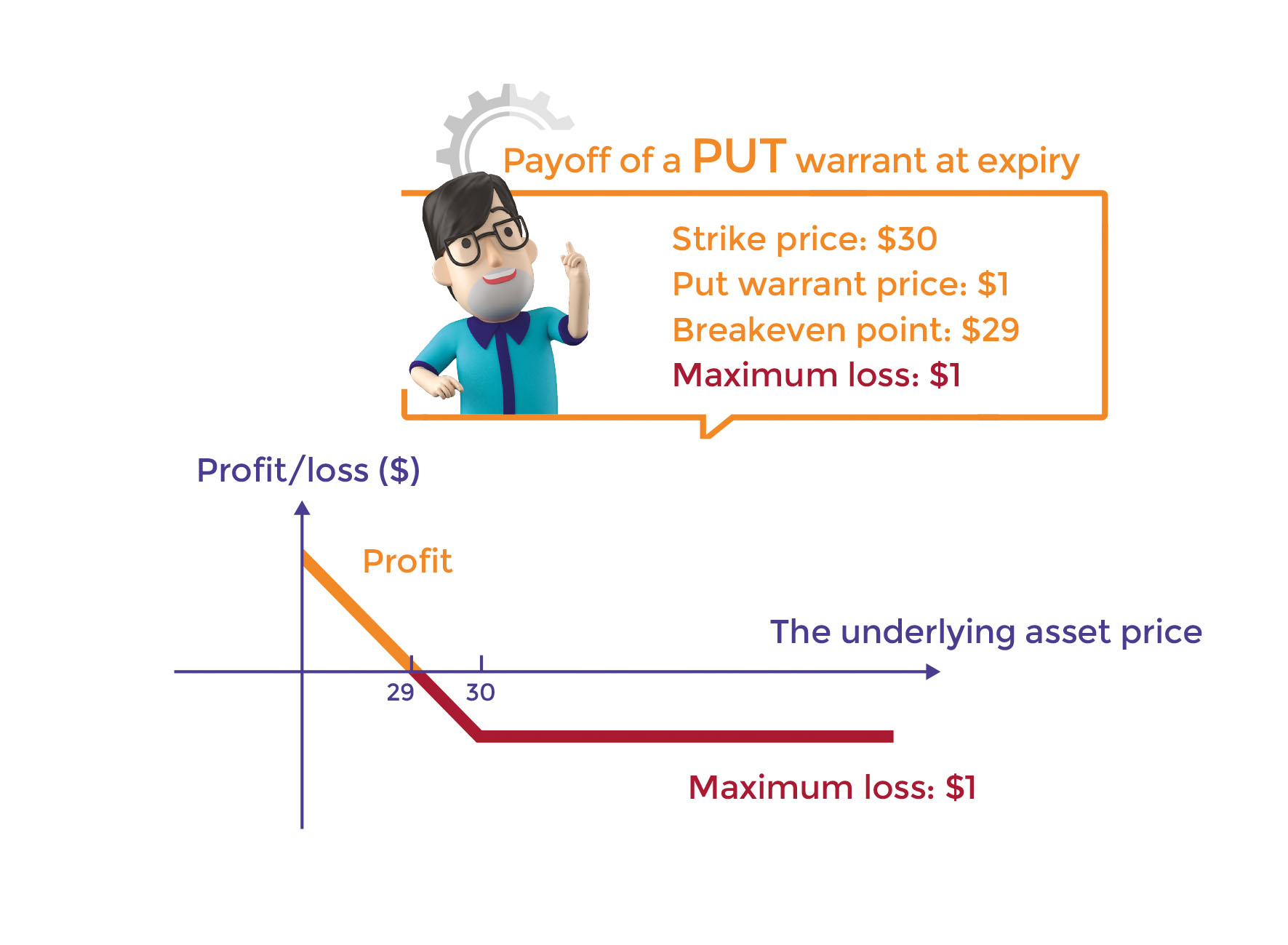

Similarly, a put warrant is in-the-money if the underlying asset price is lower than the strike price. The lower the underlying asset price, the higher the intrinsic value and potential gain of the put warrant. On the other hand, a put warrant is out-of-the-money if the underlying asset price is above the strike price and will become worthless upon expiry. The investor will then lose all of the capital invested.

Here are the common terms related to warrants:

| Strike price or level | A pre-set benchmark price or level to determine the potential cash settlement payout at expiry. |

|---|---|

| In-the-money | Call warrant: When the underlying asset price is higher than the strike price; Put warrant: When the underlying asset price is lower than the strike price. |

| Out-of-the-money | Call warrant: When the underlying asset price is lower than the strike price; Put warrant: When the underlying asset price is higher than the strike price. |

| At-the-money | When the underlying asset price is equal to the strike price. |

| Intrinsic value | The difference between the underlying asset price and the strike price of a warrant. The intrinsic value of an in-the-money warrant has a positive value; while an out-of-the-money or at-the-money warrant has zero intrinsic value. |

| Time value | Time value = warrant price – intrinsic value The warrant price is the sum of the intrinsic value and time value. The time value will decrease with time and become zero when the warrant expires. |

| Expiry date | The date on which the term of a structured product expires. |

22 January 2021