Structured products such as derivative warrants (known as “warrants”), inline warrants and CBBCs are very complicated financial instruments that come with many misconceptions. If you are interested in investing in these products, you should have a clear understanding so as to minimise the risk of making mistakes in your investment.

Do not underestimate the risk of leverage

When retail investors purchase structured products, which are leveraged products, they tend to focus on the gearing ratio (please see below). It should be noted that while leverage can multiply the profit, it too can amplify the loss.

Under the leverage effect, even a slight change in the underlying asset price (or level if the underlying asset is an index) will cause a sharp fall or rise in the price of the related structured product.

Check the effective gearing

There are two types of gearing ratios: Simple gearing and effective gearing. Which one should a structured products investor refer to?

For warrants and CBBCs, simple gearing measures the ratio at which the underlying asset costs more than the related warrants or CBBCs. For example, if the underlying asset price is $8, warrant price is $1 and the conversion ratio is 1, the simple gearing is $8 / ($1 X 1) = 8, which means the cost of buying the warrant is one eighth of the underlying asset cost.

Simple gearing for warrants and CBBCs = Underlying asset price / (Warrant or CBBC price x Conversion ratio)

For inline warrants, simple gearing is the maximum payoff of inline warrants at expiry, i.e. $1 divided by the price of the inline warrant, i.e. approximately between $0.25 and $1.

Simple gearing for inline warrants = Maximum payoff of inline warrant at expiry / Inline warrant price

On the other hand, effective gearing measures the expected percentage change in the theoretical structured products price with respect to a 1% change in the underlying asset price, which has the same purpose as the delta. Compare with simple gearing, effective gearing provides more information, for example, it allows investors to determine the potential risks and returns of structured products. The higher the effective gearing, the higher the risks and returns of the structured products.

Effective gearing = Simple gearing x hedge value (i.e. delta)

Although higher gearing may give you higher returns, it may also expose you to higher downside risks. Keep in mind that the level of gearing may change as the underlying asset price changes.

Do not pick stocks based on premium

For warrants and CBBCs, premium indicates how much extra you are paying to buy the warrants or CBBCs instead of buying the underlying asset directly:

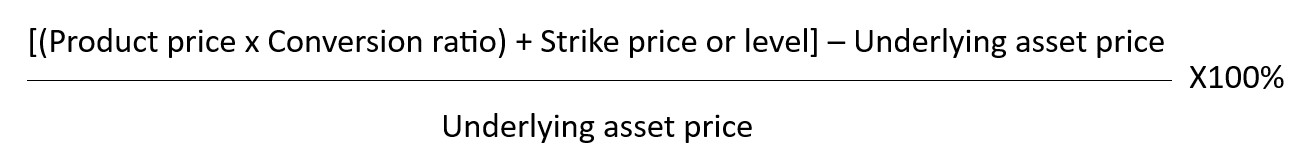

Premium of call warrants or bull CBBCs:

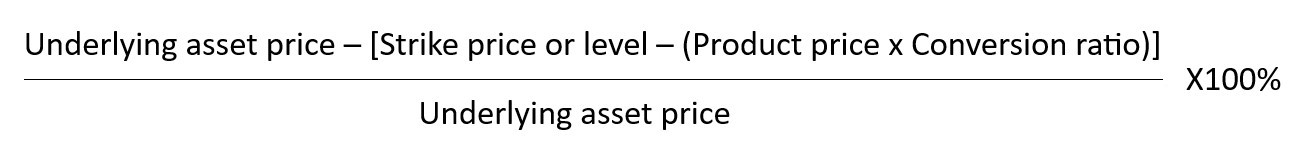

Premium of put warrants or bear CBBCs:

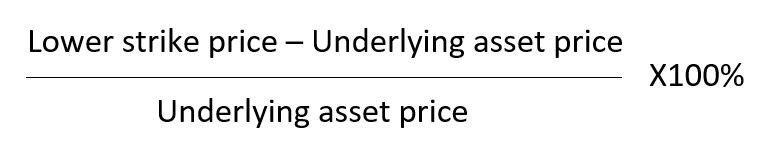

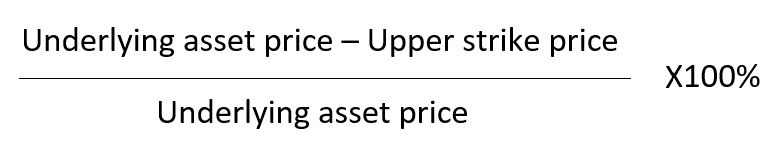

For inline warrants, premium measures the degree (%) by which the underlying asset price needs to move so that investors can receive the pre-determined fixed payoff of $1 at expiry.

Premium of inline warrants when the underlying asset price is below the lower strike price (or level if the underlying asset is an index):

Premium of inline warrants when the underlying asset price is above the upper strike price:

When the underlying asset price is at or between the upper and lower strike prices, investors can receive the pre-determined fixed payoff of $1 at expiry even the underlying asset price does not change. Hence, the premium for inline warrants when underlying asset price is at or between the lower and upper strike prices or levels is 0%.

When the underlying asset price is at or between the upper and lower strike prices, investors can receive the pre-determined fixed payoff of $1 at expiry even the underlying asset price does not change. Hence, the premium for inline warrants when underlying asset price is at or between the lower and upper strike prices or levels is 0%.

The premium does not tell you whether a structured product is a bargain or not. When you compare warrants, CBBCs or inline warrants of different terms, you may not be able to tell which one is cheaper simply by comparing their premium.

Proper risk management

Risk management is of vital importance when it comes to investing. Avoid buying too many structured products and exposing yourself to excessive risks. You should also set the floor and ceiling price limits, and decide whether to close your position before the structured product expires. Discipline is the most important rule here.

Many retail investors choose structured products based on the recommendations from financial experts. However, those experts do not take into account the investors’ personal circumstances when offering suggestions and recommending investment strategies. What’s more, they may not be neutral since the financial programmes may be sponsored by structured product issuers. It is important to understand the assumptions behind every recommendation and never rely solely on a single piece of advice when making an investment decision.

Understand the Credit Capacity of Warrants Issuers

Investors may only look at the quality of quotes provided by liquidity providers, and become unaware of the fact that uncollateralised structured products are not asset backed. In the event that the issuer becomes insolvent or defaults on its obligations under the structured products, investors can only claim as unsecured creditors. In such event, you may not be able to recover all or even part of the amount due under the structured products.

Disclosure of the credit rating, credit risk and credit capacity of an issuer can be found in its listing documents published on the HKEXnews website, while credit ratings of issuers are available on the HKEX website. If an issuer is subject to a downgrade, it will be required to publish an announcement on the HKEXnews website.

22 January 2021