Cross-boundary WMC – operational arrangements for the Northbound Scheme

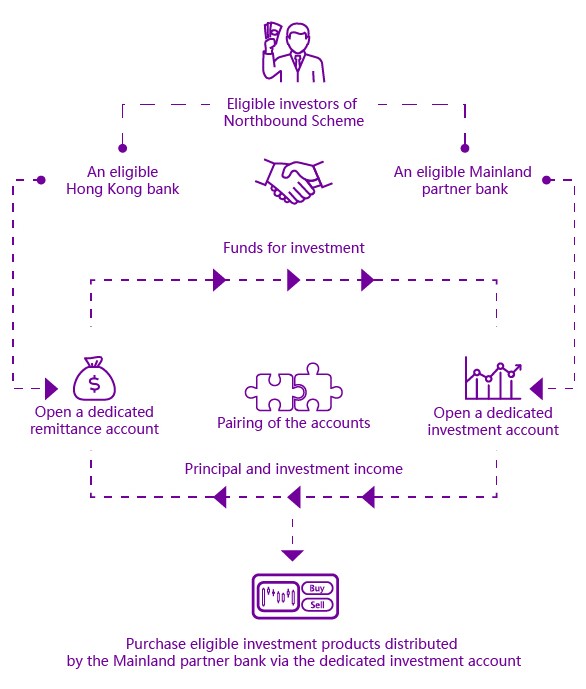

Under the Northbound Scheme, Hong Kong investors need to open an account for remittance purpose ("dedicated remittance account") with a Hong Kong bank and/or broker, and open an account for investment purpose ("dedicated investment account") with a Mainland bank and/or broker. Subsequent to the successful pairing of the dedicated remittance account with the dedicated investment account, Hong Kong investors may, through the dedicated remittance account, remit renminbi funds to the dedicated investment account to invest in the eligible investment products on the Mainland.

Eligible investors

- Hold a Hong Kong Identity Card (including both permanent and non-permanent residents);

- Invest in their personal capacity (but not as joint-name or corporate customers); and

- Be assessed by Hong Kong banks as not being a vulnerable customer (Vulnerable customer refers to a customer whose ability to understand the associated risks of his/her investment and withstand the potential losses of the investment is limited).

Closed-loop funds flow management

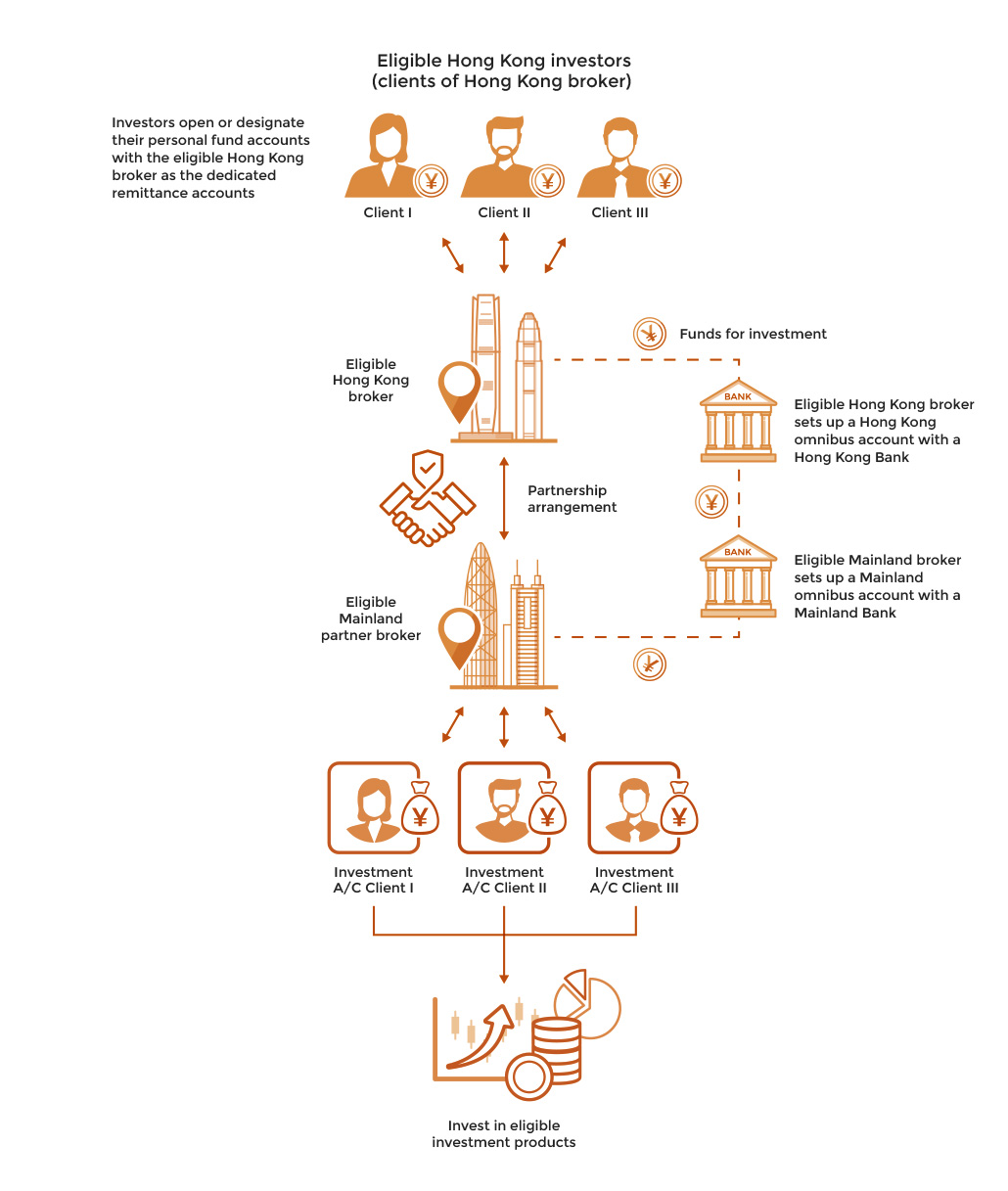

The flow of funds between the dedicated remittance account and dedicated investment account will be subject to closed loop management. That means the dedicated remittance account is the only source of investment principal in the dedicated investment account, and the only account to which funds (including investment principal, interests, and proceeds received from redemption or upon maturity of investment products) are remitted back via the same route. For clients who participate in the Cross-boundary WMC through brokers, their funds will also go through the omnibus bank account of their Hong Kong broker and Mainland broker.

Moreover, all cross-boundary remittances between the dedicated remittance account and the dedicated investment account should be conducted in renminbi and subject to quota management.

Investing through bank channel

Investing through broker channel

Quota management

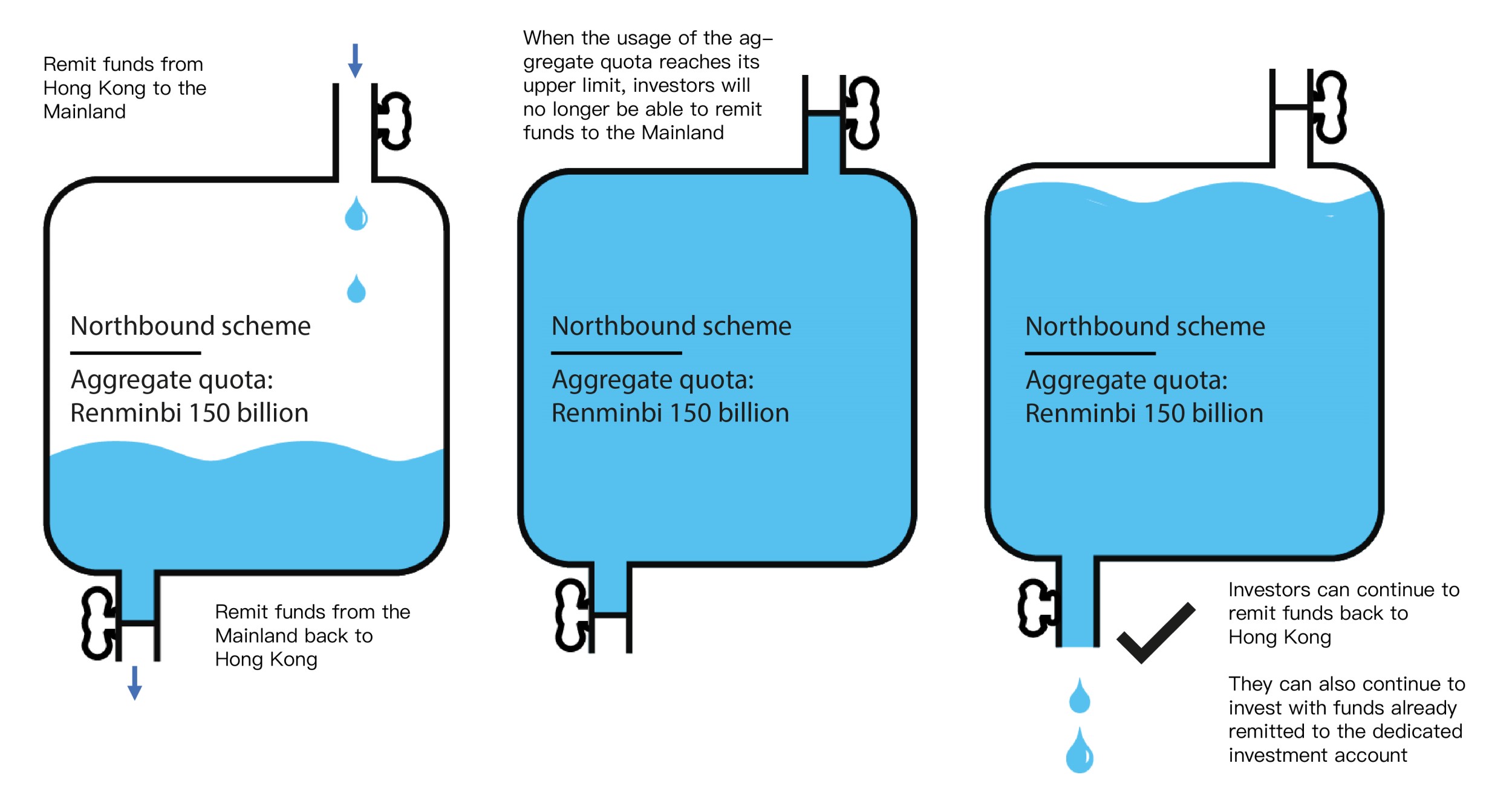

The aggregate quota under the Northbound Scheme is RMB150 billion. The individual investor quota is RMB3 million. If an investor simultaneously selects both the bank and broker channels for investment, the individual investor quota allocated between the bank channel and broker channel will each be RMB1.5 million.

The usage of both the aggregate quota and the individual investor quota is calculated on a net cross-boundary remittance basis.

For example, a "Northbound Scheme" investor remits RMB0.8 million to the Mainland to purchase investment products. Then the usage of his/her individual investor quota will be RMB0.8 million. If the investor subsequently sells part of the investment and remits some of the gains and principal, say RMB0.2 million, back to Hong Kong, his or her individual investor quota usage will be RMB0.6 million (i.e. RMB0.8 million - RMB0.2 million = RMB0.6 million).

When the usage of the aggregate quota or the individual investor quota under the Northbound Scheme reaches its upper limit, the investor will no longer be able to remit funds to the Mainland from Hong Kong under the Northbound Scheme. However, remittances from the Mainland back to Hong Kong will not be affected, and investors can continue to invest with funds already remitted to the dedicated investment account.

The Guangdong Provincial Branch and Shenzhen Branch of the People’s Bank of China will update the usage of the aggregate quota on each trading day on their websites.

Cross-boundary renminbi remittance to the Mainland under the Northbound Scheme is not subject to the daily maximum quota per person for individual Hong Kong residents’ inward remittance to bank accounts under the same name on the Mainland. For details, please refer to the Regulatory Requirements on the Northbound Scheme announced by the HKMA.

26 February 2024