In times of economic downturn, many companies encountered challenges and uncertainties in their business. The impact of the downturn may adversely affect or impair the value of assets.

What is an impairment loss for an asset?

An asset is initially recognised in a company’s financial statements at cost. It will then either be carried at cost less deductions to address its consumption (if any) through use and the impairment (if any) of its value or it may be revalued at each reporting date. The requirement in this respect vary for different types of assets according to the applicable accounting standards.

For assets that are not revalued at fair value, they are considered impaired if their carrying amount exceeds the higher of the values that can be recovered through their use (value in use) or immediate sale (fair value less cost of disposal) (i.e. the recoverable amount). Value in use is the present value of the future cash flows expected to be derived from using the asset. Fair value is the price at which it could be sold in an orderly market. The difference between the carrying amount and the recoverable amount is an impairment loss which is immediately recognised in the profit or loss or in other comprehensive income if the asset is carried at revalued amount other than fair value.

How to identify an asset that may be impaired?

Companies have to assess at the end of each reporting period whether there is any indication that an asset may be impaired. If any such indication exists, it should estimate the recoverable amount of the asset. Examples of indications of impairment include:

- decline in asset’s market value

- reduction in credit worthiness (financial assets)

- adverse changes in the technological, market, economic or legal environment

- increase in market interest rates

- company’s net assets value is higher than its market capitalisation

- obsolescence or physical damage of an asset

- asset is idle, plans to discontinue or restructure operation or to dispose of an asset

- asset’s economic performance is worse than expected.

Irrespective of whether there is any indication of impairment, companies have to conduct annual impairment assessment for the following assets:

- goodwill acquired in a business combination

- intangible asset with an indefinite useful life

- intangible asset not yet available for use.

How to determine impairment loss?

When there is an indication of impairment or when otherwise required, companies need to perform an impairment assessment. Where an asset does not generate cash inflows that are largely independent of those from other assets, a company has to determine the recoverable amount of the smallest identifiable group of assets that generates cash inflows independently (i.e. cash-generating unit) to which the asset belongs.

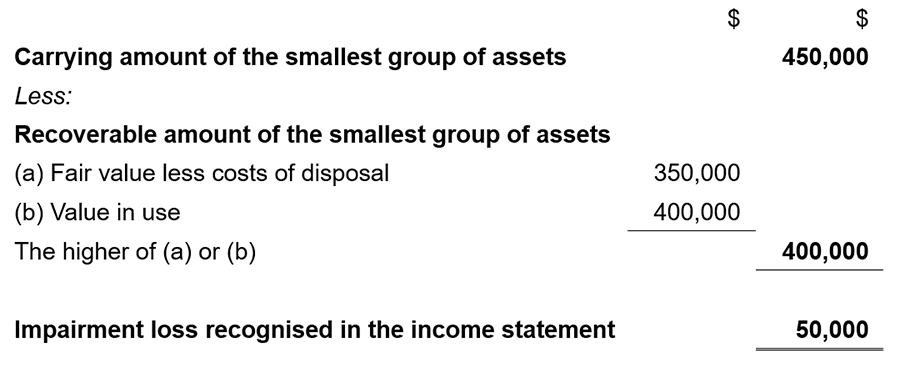

The following example illustrates how to determine an impairment loss of a cash-generating unit.

A company operates software manufacturing business. Management considers that the smallest group of assets of the company that generates cash inflows independently is the manufacturing business which comprises property, plant and equipment and a licence. The impairment assessment is set out below:

Companies should disclose the events and circumstances that led to the impairment and key assumptions used in the impairment assessment, such as the expected growth rate in sales, terminal growth rate and the discount rate for value in use. These disclosures provide useful information on corporate risk management, which investors may factor into their investment decision-making process.