In a business combination, the fair value of a business acquired may exceed the net fair value of its identifiable assets and liabilities. The excess or premium paid is “goodwill” and is shown separately in the consolidated balance sheet of an acquirer. Very often, the amount of goodwill is substantial and it may remain on the balance sheet for quite a long time. It is useful for investors to understand more about goodwill.

Goodwill acquired in a business combination is an asset representing “the future economic benefits arising from other assets acquired in a business combination that are not individually identified and separately recognised”. Goodwill is a non-monetary asset without physical substance. It may represent expected synergies from combining operations of the acquiree and the acquirer, or intangible assets that do not qualify for separate recognition in the financial statements. Goodwill cannot exist independently of the business, nor can it be sold, purchased or transferred separately. It differs from other intangible assets that can be divided from the company and sold, transferred, licensed, rented or exchanged, such as computer software, licences, trademarks, patents, films, copyrights and import quotas. Goodwill also does not include contractual or other legal rights.

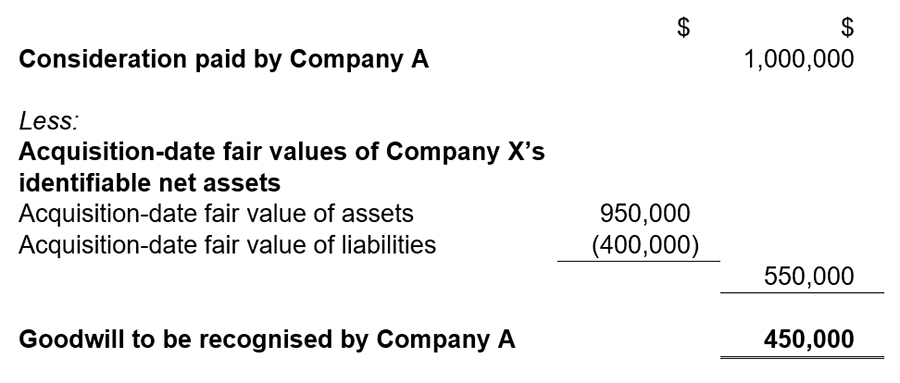

How to determine goodwill?

Assuming that a business combination involves an acquisition of a 100% equity interest in a company, goodwill is measured as the difference between the consideration transferred and the acquisition-date fair values of identifiable net assets (including the identifiable intangible assets).

The following example illustrates how to determine goodwill acquired in a business combination.

Company A acquires Company X with a consideration of $1,000,000. The acquisition-date fair values of Company X’s assets and liabilities are $950,000 and $400,000, respectively.

Goodwill is an intangible asset with an indefinite life. It is subject to an annual impairment review. Impairment of goodwill arises if there is decline in the expected benefit to be derived from the acquired business. Investors need to pay attention to subsequent impairment assessment of goodwill by management and conclusion by auditors. You can read the article "What is Asset Impairment?" to understand more about impairment of an asset.