Pick up money management skills during the summer holidays

Summer is a time when parents often busy themselves organising various activities to keep their children occupied during the holidays. While they are happy to see their children master new knowledge and skills, they can also end up spending a significant amount of money on different activities. As such, striking a balance between practicality and affordability is key.

In fact, bringing a happy and meaningful summer for children need not cost a lot. Here are some tips for parents and children to enjoy a wonderful summer on a budget while learning about money concepts through everyday activities.

Money Challenge Kit - Learn through play

Parents and children can work together to plan free and enriching activities such as visiting parks, picnicking, cycling or exploring the free games and resources available on The IFEC Chin Family Parenting and Money Portal. These simple activities help children understand that happiness doesn’t have to come with a price tag.

Parents can also guide their children to complete the "Money Challenge Kit" during the summer. The kit contains easy-to-understand financial challenges, such as setting savings goals, designing a family budget, simulating shopping scenarios, etc. These activities not only help children learn how to manage money but also enhance parent-child interaction. By completing these tasks, children can develop a basic understanding of money management and learn how to allocate resources wisely.

Money Challenge Kit: 5 Money management activities for your children! (Download)

Teach children about money when shopping

Bring children to supermarkets or wet markets and shop using cash. Let them learn how to compare prices, calculate amounts accurately, and make payments. During the process, they can also learn to distinguish between “needs” and “wants”. Parents can also introduce their children to online shopping, highlighting its advantages and risks. By using a series of worksheets on shopping, parent can help children develop financial management skills in their daily lives.

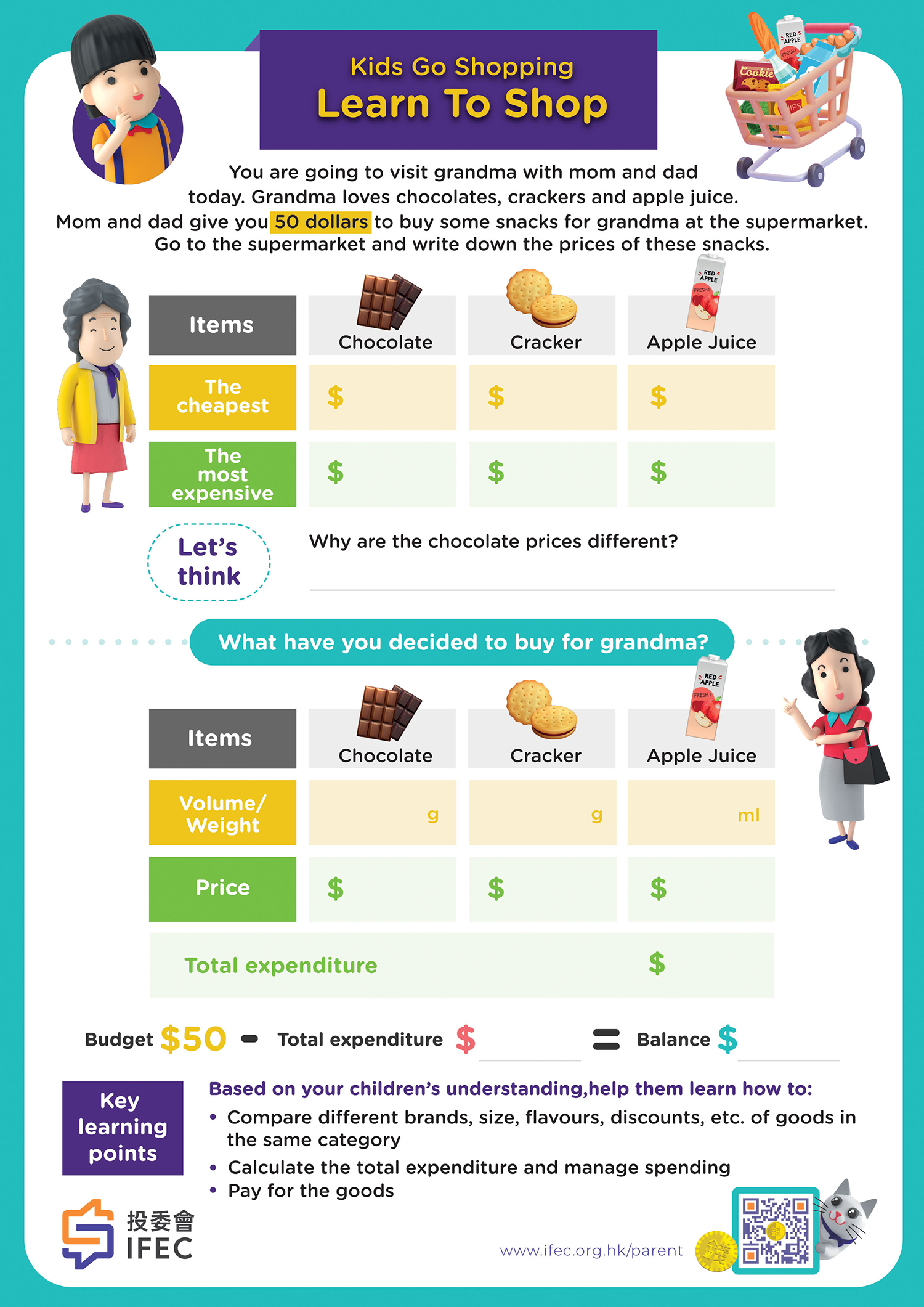

Worksheet: Learn to Shop (Download)

Designed for children aged 6 to 9, this worksheet focuses on simple shopping tasks to help children become familiar with basic money calculation skills and understand the process of payment and receiving change.

Worksheet: Shopping Around (Download)

Designed for children aged 8 to 11, this worksheet uses simulated shopping situations to teach them how to compare prices and understand the key things to consider beyond price when shopping.

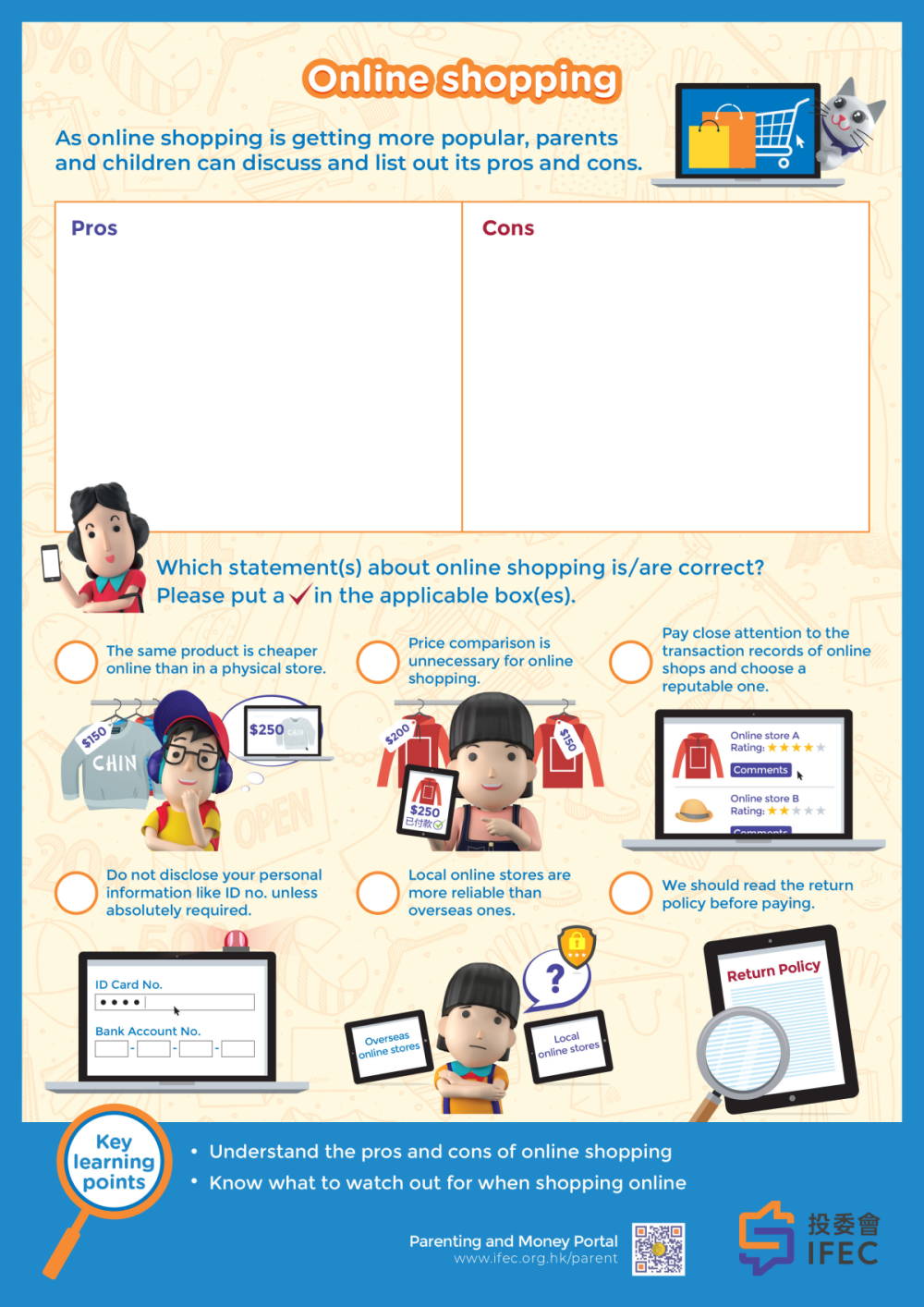

Worksheet: Online Shopping (Download)

Designed for children aged 8 to 11, this worksheet helps them understand the pros and cons of online shopping and develop secure online shopping habits, such as identifying trustworthy websites.

Free resources for fun learning

An effective way for children to learn is through hands-on activities and games that spark their interest in money matters. Parents can make use of the free educational resources available on The IFEC Chin Family Parenting Portal. Designed to cater to the needs of different age groups, these resources help parents and children to learn about financial management in a fun and engaging way through interesting stories and interactive games.

e-stories: Manage Money with The Chin Family (Aged 4-7)

Designed for children aged 4 to 7, this interactive story series introduces basic financial management concepts, such as the importance of saving and sharing.

e-stories: The Chin Family’s Tips (Aged 8-11)

Designed for children aged 8 to 11, this story series guides them in setting savings goals and learning rational spending.

Online game: Chin-tective Bootcamp (Aged 6-8)

Designed for children aged 6 to 8, this game helps them learn money management and savings skills through clue-finding tasks.

Online game: Detective Chin Chin Money Management Adventures (Aged 9-11)

Designed for children aged 9 to 11, this game helps them learn prudent spending and saving by solving financial challenges.

A great holiday spot: The IFEC FinEd Hub

In addition to online resources, parents can also take their children to visit the IFEC FinEd Hub (The Hub). The Hub uses an immersive and interactive environment that integrates simulated situations into games. Through these immersive activities, parents and children can learn about financial management in a fun and engaging way.

Book to visit the IFEC FinEd Hub

19 Jun 2025