As the new school year approaches, parents may be busy preparing books and stationery for their children. However, children may lack a concrete understanding of these expenses. Parents can use this opportunity to teach them about budgeting and managing money. Try to get children involved in back-to-school budgeting to help them understand the value of money and develop thoughtful spending habits.

Create a budget for school items together and encourage your child to explore ways to save money. For example, when shopping for school supplies, guide your child to think about what they really need and compare prices and discounts at different shops. Parents can also explore other options with their children, such as buying second-hand uniforms or books, checking local community groups online for giveaways, or reusing pencil cases and folders.

Work out the budget and expenses together

Create a list of the back-to-school items with your child and stick to both the budget and the list. Help your child to decide which item can be cut back if overspend. This way, they can learn to spend within their means.

List of back-to-school expenses

| Items | Estimated expenses (HKD) | Actual expenses (HKD) |

|---|---|---|

| School fee | ||

| Books | ||

| Learning materials | ||

| Extracurricular activity costs | ||

| Uniform | ||

| Shoes | ||

| Stationery | ||

| School bag | ||

| Computer and other digital products | ||

| Water bottle and lunch box | ||

| School bus/ Transportation fees | ||

| Others | ||

| Total estimated expenses | ||

| Total actual expenses | ||

|

Think of ways to reduce the actual expenses. |

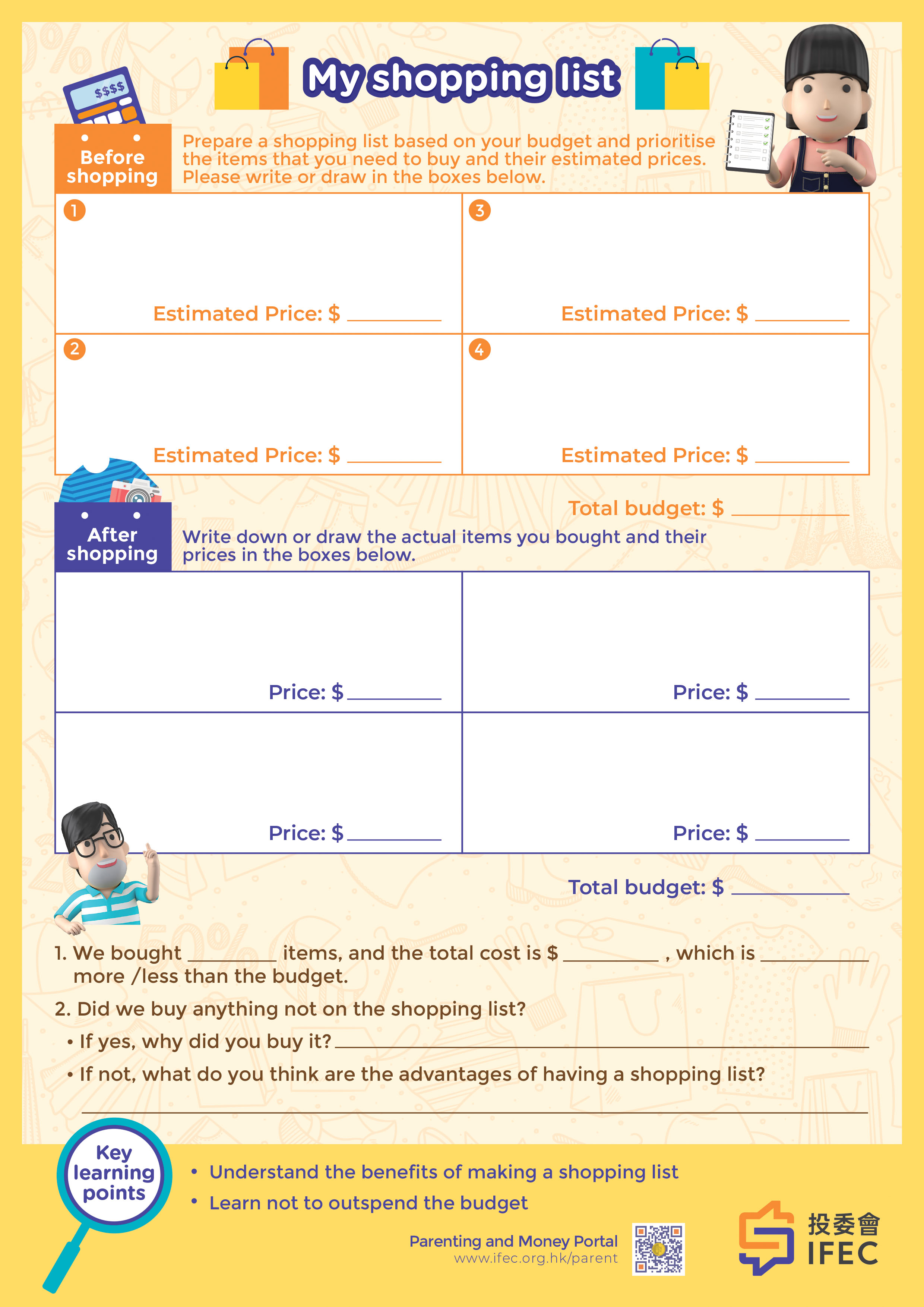

Worksheet: My Shopping List (Download)

Prepare a shopping list with your children so that they can remind each other of not buying anything unnecessary.

Worksheet: Proper and Correct Spending Attitude (Download)

Guide your children to think about their attitude towards spending and develop a proper money concept.

Download the IFEC Money Tracker App to plan a budget for learning items with your children. Use the app to create a shopping list based on the item priorities and set expense limits to stay within budget.

31 July 2025