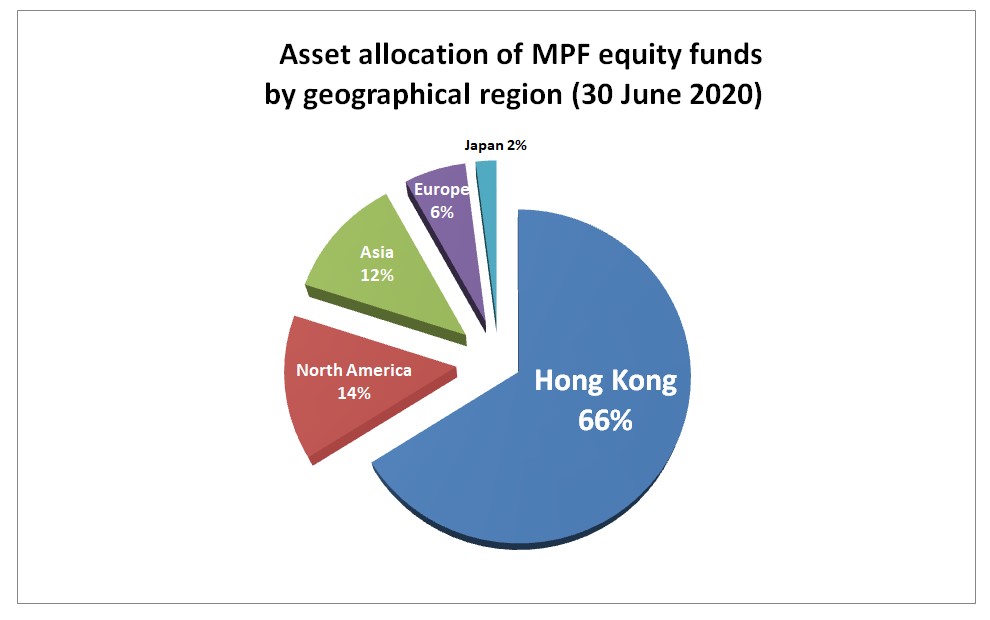

The Hong Kong market tends to be a popular choice for many when it comes to MPF fund selection. As of June 2020, 66% of all investments in equity funds (by geographic region) is placed in Hong Kong funds according to information from the MPFA. This percentage far outnumbers other markets.

The situation is known as “home bias” in the investment industry, meaning investors tend to favour their home market over foreign ones. This is mainly because most people are more familiar with their home market but know very little about overseas markets. As a result, they feel more comfortable investing in home market, or believe it offers better prospects. While the home bias is understandable, it may not be a smart investment choice.

Risk diversification is key

Just as the saying “don’t put all your eggs in one basket” goes, if you invest too heavily in a single market, your investment returns will be highly dependent on its domestic economic, political, or other factors, which could significantly increase the risks and volatility of your investment.

Diversifying your MPF investments to include different geographic locations does help to cushion the unfavourable impact brought by a single market on your investment portfolio. One of the major considerations is the correlation between different markets. For example, the Hong Kong has a higher correlation within Asian markets. As such, if you invest in both Hong Kong and Asian market funds, the degree of diversification in your portfolio may not be so significant. To achieve better diversification, you could consider allocating your investment to markets around the world or choose a global fund.

Aside from geographic diversification, diversified asset classes are just as important to your portfolio. Generally speaking, equity funds offer long-term growth potential in investment returns, yet their prices are more volatile, indicating a higher level of risks. On the other hand, lower risk products like bond funds yield lower expected returns. Allocating your assets to different asset classes is vital in can striking a balance between the long term risks and returns of your investment portfolio. Learn more: How to build your MPF portfolio?

8 February 2021