How to build your MPF portfolio?

Choosing the right mix for your MPF investment portfolio is crucial because it has a direct impact on your accrued benefits by the time you retire. Some people make decisions based solely on gut feel about risk and return expectations. For example, those afraid of losing money might only choose low risk funds. Those seeking returns on the other hand, might have their eyes on high risk funds only.

In fact, you should neither be too conservative nor too aggressive with your MPF investments. By being too conservative, you may be able to dodge investment risks but not the impact of inflation over the long run. If you are too aggressive, you may suffer substantial losses from the high volatility of the stock market; this is particularly risky for those who are approaching retirement as they may not be able to make up for the losses due to their shorter investment horizon.

Generally speaking, there is a positive correlation between potential risk and potential return. Assets that offer higher potential returns, like equity, will come with higher potential risks. Although equity funds generally offer higher returns over a long period of time, this does not guarantee returns at any specific point of time. In an extreme scenario like the global financial crisis in 2008, there could be drastic declines in value. Whereas, bond funds and MPF Conservative Funds may have lower potential risks, their returns are also low and may not outpace inflation. Therefore, to balance the long term risk and return, it is important to allocate assets amongst high and low risk funds according to our risk tolerance.

Devising a MPF investment portfolio according to age

Our age can in fact serve as a point of reference for our MPF investment portfolio. As MPF scheme members normally withdraw their benefits at the age of 65, the investment period for a young person can be as long as 30-40 years, which is a long enough horizon to withstand short-term market volatility. With higher risk tolerance, young people can consider allocating a higher percentage of their portfolio to more aggressive funds, like equity funds or balanced funds with higher equity portion, in exchange for capital appreciation. A middle-aged person who is approaching retirement (i.e. has a shorter investment period) should reduce asset allocation in equity funds, and increase weighting on bond funds or other low risk funds to protect the accumulated MPF. The general principle is to gradually reduce the investment portfolio’s risk level as one ages.

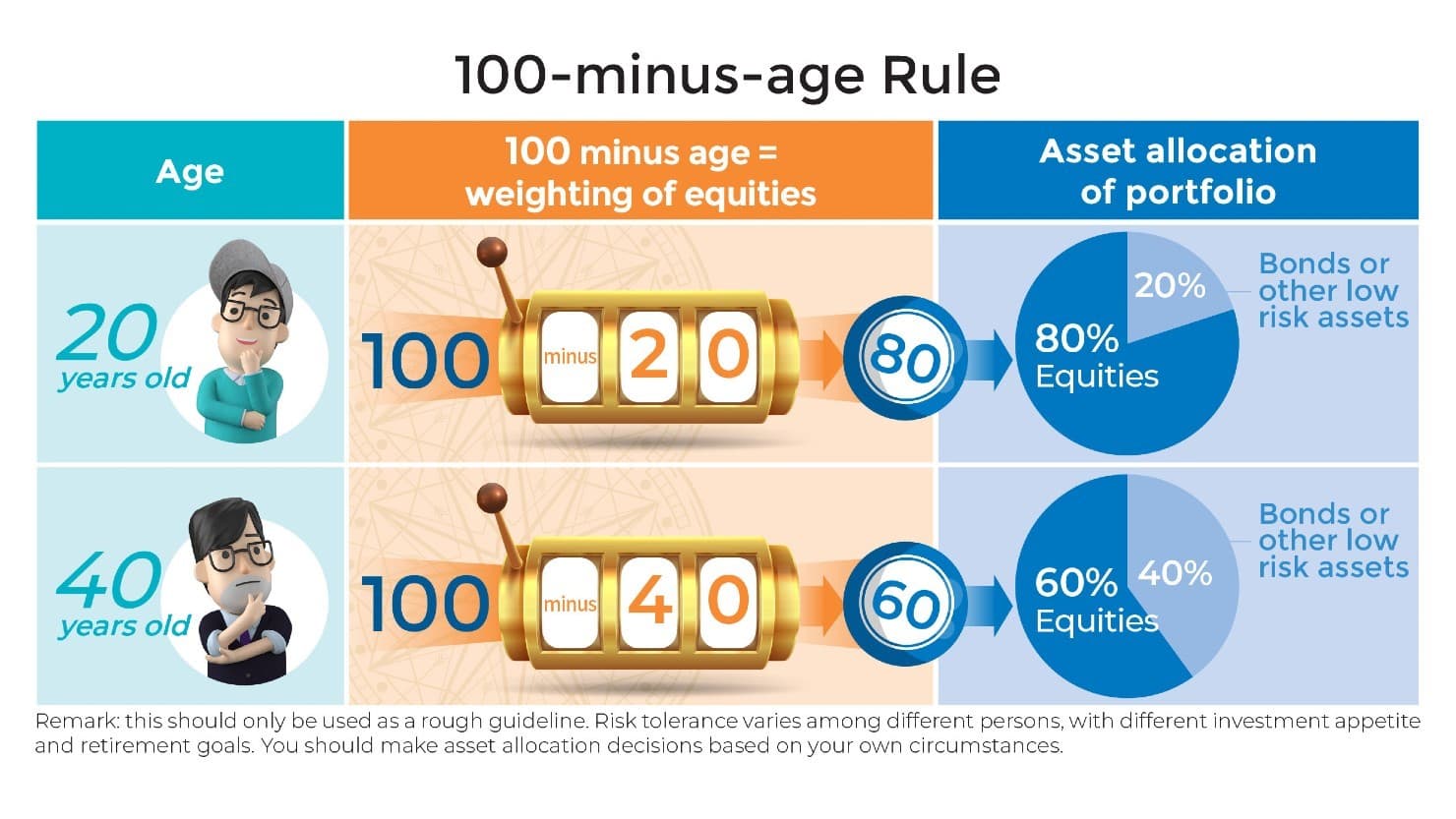

There are also simple, “rule of thumb” types of formulas out there, such as the “100-minus-age rule”, to assess the optimal percentage of equity to include in a portfolio. For a young person at the age of 20, equity can make up 80% of the investment portfolio (100 - 20 = 80), with bonds or other low risk assets allocated in the remaining 20%. For a person aged 40, equity can make up 60% of the investment portfolio (100 – 40 = 60), with the remaining 40% allocated to bonds or other low risk assets. This formula, however, should only be used as a rough guideline. Risk tolerance varies among different persons, with different investment appetite and retirement goals. There is simply no such a thing as a “one size fits all” investment portfolio. You should review your MPF portfolio regularly to make asset allocation decisions based on your own circumstances.

13 January 2021