A Protection Linked Plan (PLP) is a new category of Investment-Linked Assurance Scheme (ILAS) with an embedded high level of insurance protection before the insured reaches age 65. The purpose of PLP is to introduce a product with higher mortality protection element, simple and transparent fee structure and confined investment options so as to narrow the protection gap and facilitate financial inclusion.

In comparison with other types of ILAS products, PLP has the following features:

Minimum death benefit (insurance companies may offer higher sums for client’s selection):

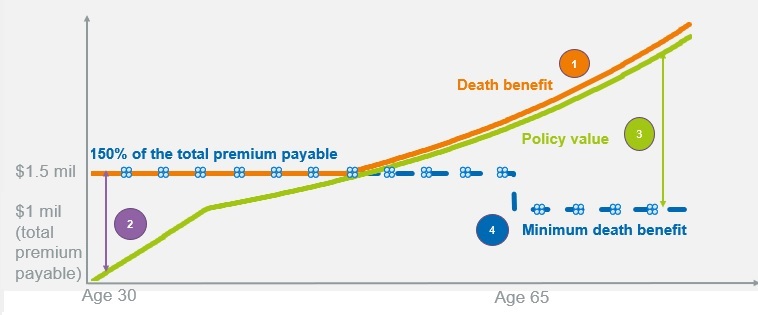

- Before the insured reaches the age of 65*, the minimum death benefit should be not less than the higher of:

- 150% of total premiums payable (less withdrawals) before age 65*; or

- 105% of account value.

*Or any ages specified in the offering documents of the PLP

- On or after the age of 65, the minimum death benefit should be not less than the higher of:

- 105% of the account value; or

- total premium paid (less withdrawals).

|

Illustration: PLP death benefit and policy value Assumptions:

|

Fees and Charges:

The policyholder may be charged either upfront charge or surrender charge, but not both. Single ongoing fee should be charged in fixed amount or based on account value at ILAS policy level.

The cost of insurance protection (COI) will reflect the embedded high level of death benefits of PLP. The COI may increase as the insured get older or when the performance of underlying investment is poor. The COI together with other fees payable to the insurance company (e.g., upfront charge and ongoing platform fee) will reduce the amount of premiums available for investment. Intermediaries selling PLP will provide a Supplementary Sheet of Benefit Illustration Statement to customer to illustrate the effect of policy charges (including COI) on the amount of premium available for investment.

Optional protection features:

Any additional protection features should be set as optional riders which require additional premium payment (i.e., unit deducting riders not allowed). Insurance company may also provide additional features to policyholders without additional charges, for example, no lapse guarantee, which will keep your policy stay in force even if the account value is insufficient to cover the fees and charges of your ILAS plan. Such feature will help you in maintaining the protection offered by the ILAS plan when the investment option(s) chosen is(are) performing below expectations due to adverse market conditions.

Investment options:

At least one investment option linked to an SFC-authorized Environmental, Social and Governance (“ESG”) fund should be provided for customers to choose. Each investment option under the PLP should be solely linked to an SFC-authorized fund. PLP may also provide investment option(s) facilitating de-risking of policy holders in a gradually reducing manner towards retirement, e.g., by re-balancing of investment towards less risky assets in an orderly manner as determined by insurance companies (i.e., life-style funds, target date funds, or arrangement that reduces investment risk as policy holders approach target retirement age, etc.).

ILAS including PLP are long-term investment-cum-life insurance products that only suitable for people who are prepared to hold the investment for a long term period. Before making a purchase decision, you should read the offering document (including the Product Key Facts Statement) and Important Facts Statement carefully to understand the risks and features, including long term features, fees and how the product works, etc.