Understand ESG ratings

Ratings can be viewed as a shortcut to understand the performance of a company in a particular aspect, such as credit ratings and ESG (environmental, social and governance) ratings.

What are ESG ratings?

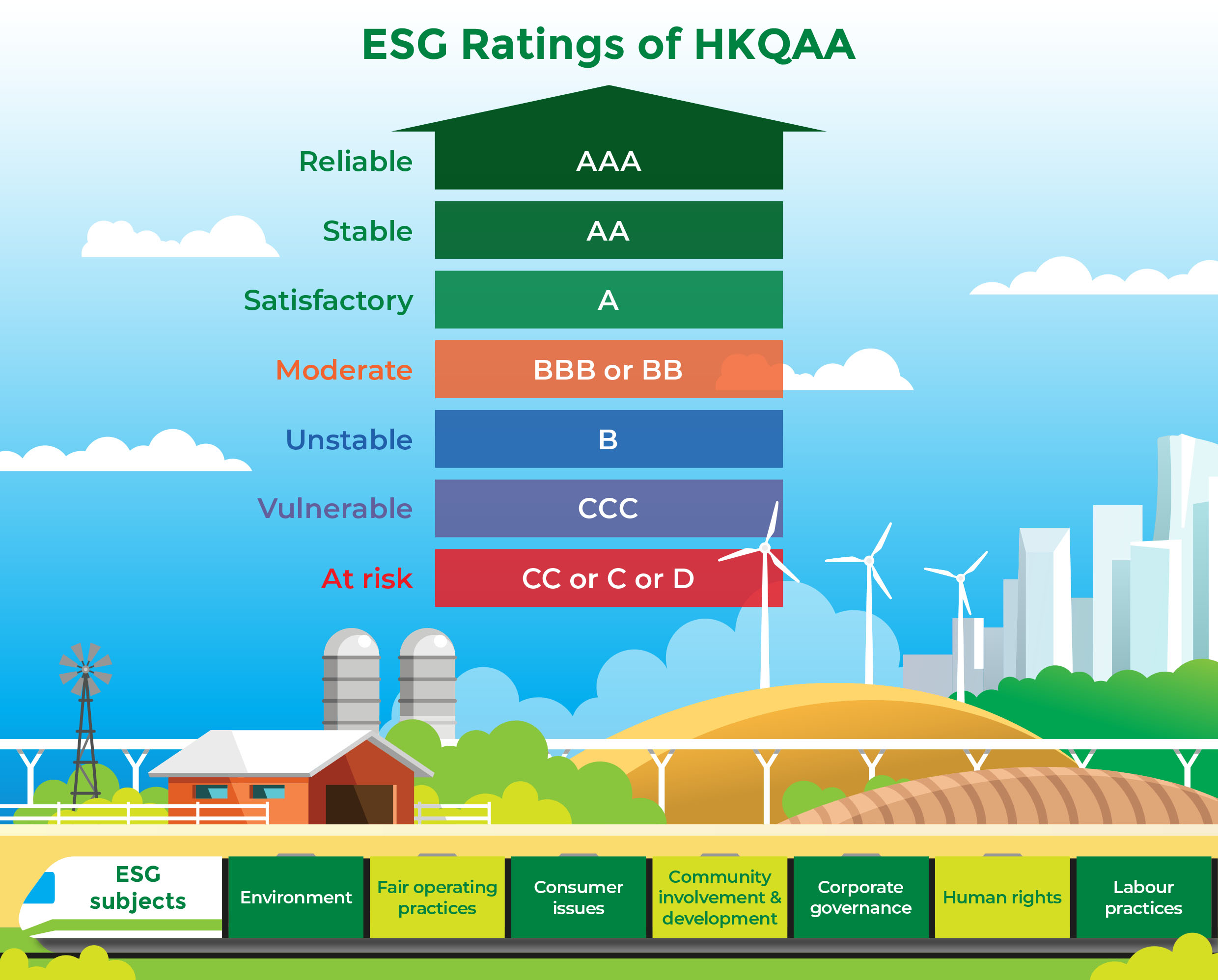

ESG investments concern factors relating to the long term value of a company, and yield both opportunities and risks. However, it is not easy for retail investors to analyse the ESG performance of a company, and this is where ESG ratings come into the picture. Currently, many rating agencies, index providers and investment management companies provide ESG ratings. Hang Seng Indexes Company Limited has also commissioned the Hong Kong Quality Assurance Agency (HKQAA) to provide ratings for 500 Hong Kong-listed and 1,200 A-shares listed companies. Taking into account seven ESG aspects, HKQAA assesses a company’s ESG system maturity and risk exposure.

Investors can get a sense of a company’s ESG performance from its ESG rating. Typically, a company with high ESG ratings has not been involved in major ESG incidents with negative impact, with good systems in place to manage ESG opportunities and risks, and is transparent with its ESG disclosures.

However, it is important to understand that a rating is just the opinion and evaluation of a rating agency. At present, without the presence of a standardised ESG rating system, each ESG rating agency has its own research and analysis framework. Therefore, the ESG ratings or risk levels given by different agencies to the same company can vary greatly. Investors using ESG ratings as one of their stock selection criteria may need to look at the rationale behind the ratings carefully to see if they are consistent with their own views.

8 July 2021