Understand sustainability indexes

Index is important to investors as it gives indication of the latest market trends and movements.

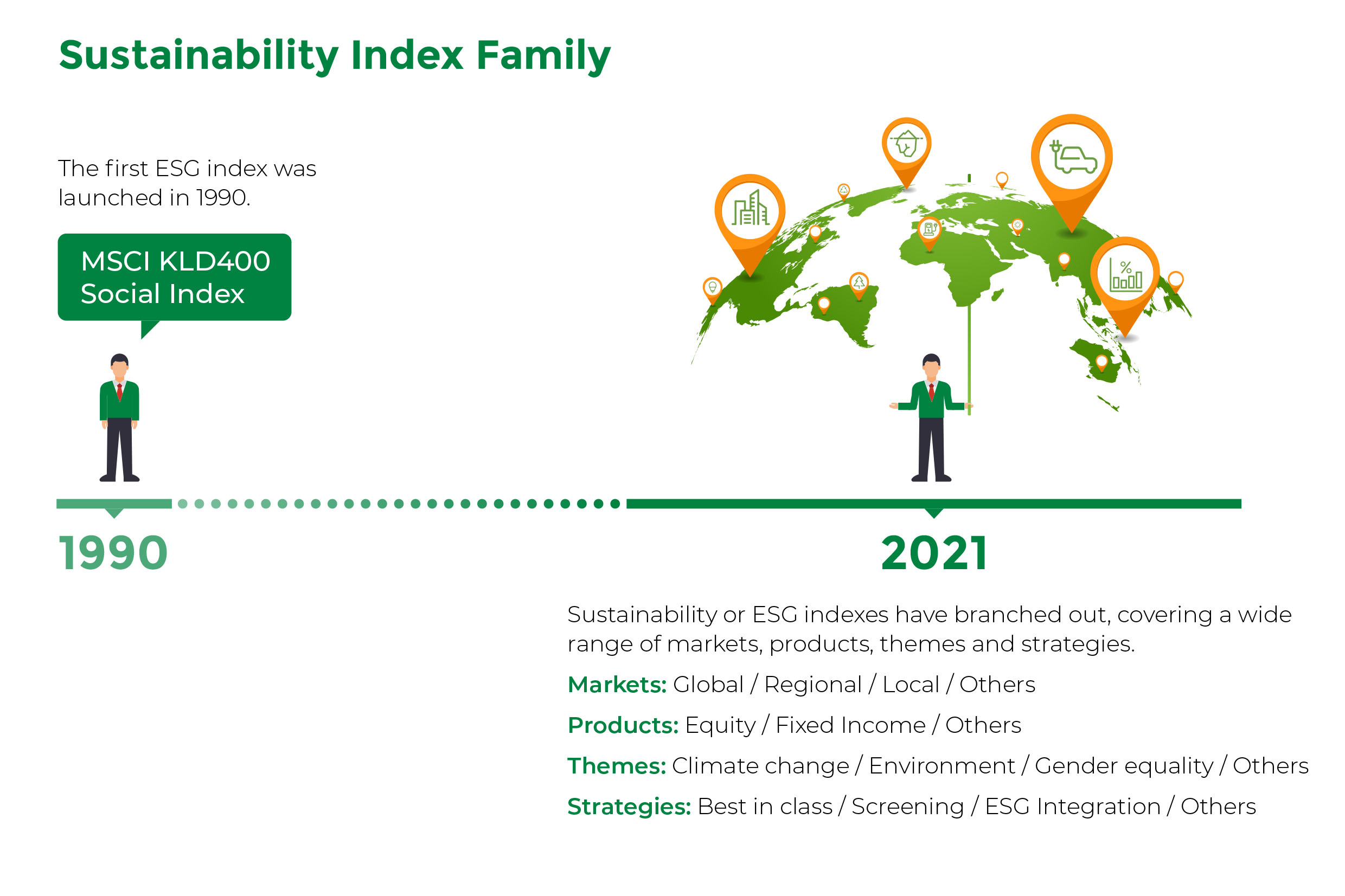

When an investment concept has earned enough attention, related indexes will be spun off. As green and sustainable investing is gaining popularity, related indexes are booming as well. Index provider MSCI (Morgan Stanley Capital International) states it now has more than 1,500 ESG (environmental, social and governance) indexes covering equities and fixed income. Hong Kong’s index provider, Hang Seng Indexes Company Limited, has also developed a set of ESG indexes for the local market.

We can understand an investment market, sector or topic from its indexes. For example, the Hang Seng Index, which is familiar to local investors, can give us an idea of the performance of the Hong Kong stock market and individual constituents. While some retail investors are unfamiliar with investing concepts such as green, sustainability, ESG and climate changes, their related indexes may help investors better understand leading ESG players in different investment markets and sectors, as well as sustainable investing strategies and themes.

Is sustainable investing beating the market?

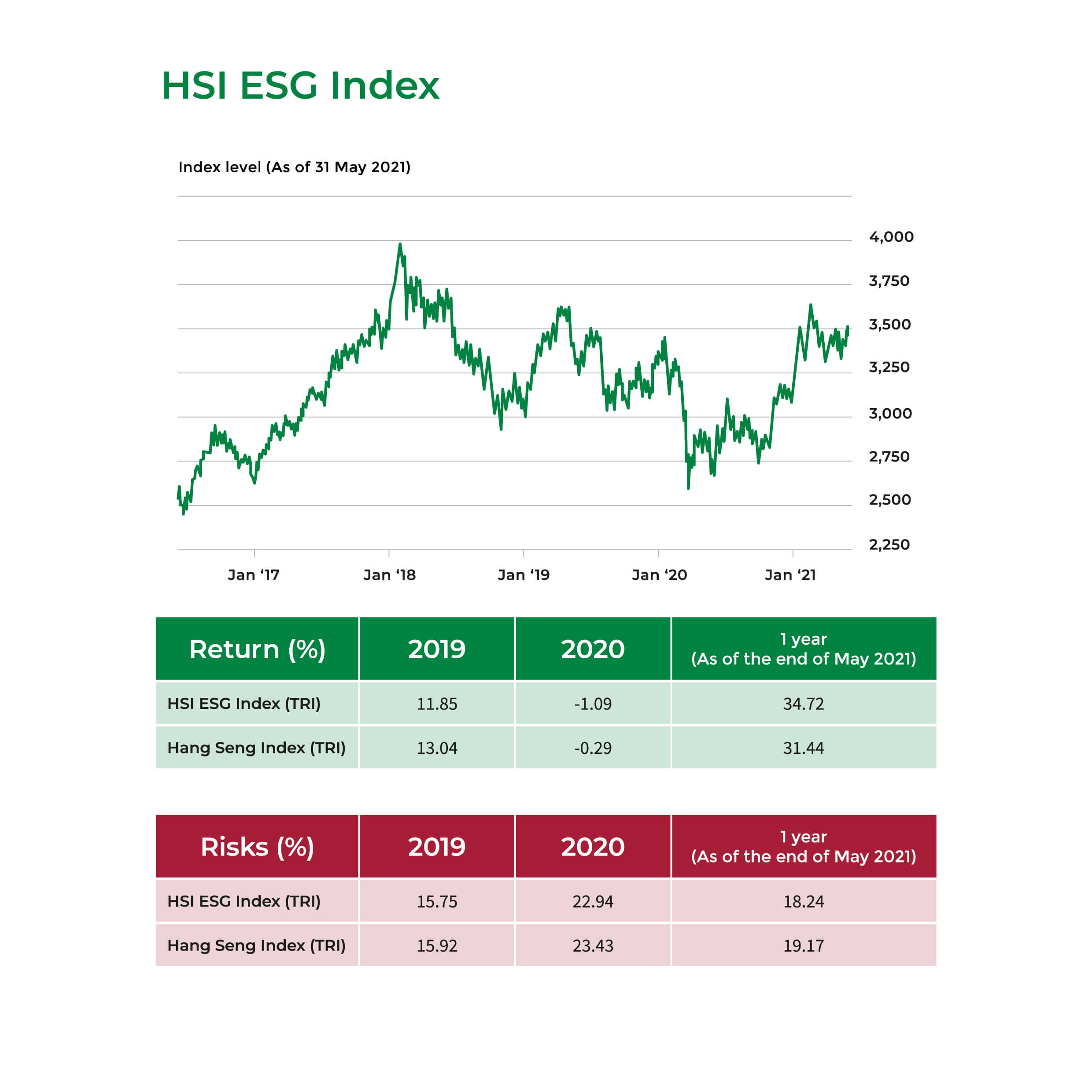

People often ask how sustainability affects the risks and returns of our investments, and the answers may as well lie in the indexes.

An index can be regarded as a benchmark while index level movements indicate the performance of the market, product or theme. In addition, we can compare the performance of an index with other indexes. Many sustainability or ESG equity indexes are spun off from parent equity indexes, which are typically traditional blue chip indexes. For example, the S&P 500 ESG index comes from the S&P 500 index but with an ESG element. In Hong Kong, the HSI ESG Index originates from the Hang Seng Index, but the weighting of constituent stocks is adjusted according to ESG factors. Comparing the ESG Index to its parent index gives us an idea whether the ESG investment is outperforming or underperforming traditional investments.

For each index, there is a factsheet stating its key information, including the objectives, constituents, compilation method and index level. If you want to understand a sustainability or ESG index, factsheets can be your starting points.

8 July 2021