Crude oil futures inverse products are now listed and traded on the HKEX to give investors another investment option to gain short exposure to crude oil. Similar to crude oil futures ETFs, crude oil futures inverse products are also designed for sophisticated trading-oriented investors.

More: Characteristics and key risks of crude oil futures ETFs

As the name suggests, crude oil futures inverse products are inverse products, which invest in crude oil futures and/or swaps with an aim to deliver a daily return equivalent to an inverse return (capped at 1 time (-1x)) of the specified crude oil futures index, i.e. the underlying index.

Like other leveraged and inverse products (“L&I products”) traded on HKEX, a crude oil futures inverse product has a rather complex structure and risk exposure. You should know how it works and the risks involved before making an investment decision. The following pointers can help you understand more about this product.

- Crude oil futures markets are extremely volatile.

- A crude oil futures inverse product is a derivative product targeting sophisticated trading-oriented investors who understand the nature and risks of such products, including:

- the product is not intended for holding longer than one day as its performance over a longer period may deviate from and be uncorrelated to the inverse performance of its underlying index over the period;

- the product is designed to be used for short term trading or hedging purposes;

- Under exceptional market circumstances, the price of futures contracts may increase substantially within a short period of time and you may suffer a significant or total loss of your investment in the crude oil futures inverse product;

- the rollover operation may have an adverse impact on the net asset values of the crude oil futures inverse product; and

- the price volatility of a single commodity asset (i.e. crude oil) and/or a single futures contract may be extremely high.

- The daily inverse performance of the underlying crude oil futures index and the daily performance of the corresponding crude oil futures inverse product can significantly deviate from the daily inverse movement of crude oil’s spot price. This is because the underlying crude oil futures index is based on the price of the crude oil futures contracts, rather than the price of physical crude oil, and the product seeks to deliver a daily return equivalent to a multiple of inverse performance of the underlying index return.

- You should exercise caution when trading crude oil futures inverse products. Before investing in such inverse products, you should read this page and its offering documents carefully and fully understand its features, exposure, operation and risks. You should also have a clear understanding of how crude oil futures contracts work and the rollover mechanism involved. You should pay particular attention to the risks under exceptional market circumstances, such as significant or total loss of your investment in the crude oil futures inverse products in a short period of time and how rollover of futures contracts may adversely affect the value and performance of the inverse products.

How does a crude oil futures inverse product work?

A crude oil futures inverse product aims to seek inverse (capped at 1 time (-1x)) investment results relative to an underlying crude oil futures index on a daily basis. To achieve this investment objective, it will invest in crude oil futures contracts normally subject to a predefined rolling schedule to obtain the required exposure to the crude oil futures index and/or swaps. In the case of using swaps, the swap counterparty will be provided a fee to deliver to the crude oil futures inverse products the corresponding inverse exposure to the crude oil futures index and depending on the particular swap arrangement, may be provided with a portion of the net proceeds from subscription of units in the inverse product. Under exceptional circumstances, some managers may use their discretion to deviate from the predefined rolling schedule in the interests of investors. For details, please refer to the section “Risk of rolling futures contracts” below.

While investors invest in crude oil futures inverse products in anticipation of falling crude oil price, they should note that the price movement of crude oil futures contracts (which is what the underlying index is based on) may not always go in line with that of crude oil in the spot markets. As such, the crude oil futures inverse products may underperform a similar investment that is linked to the spot price of crude oil.

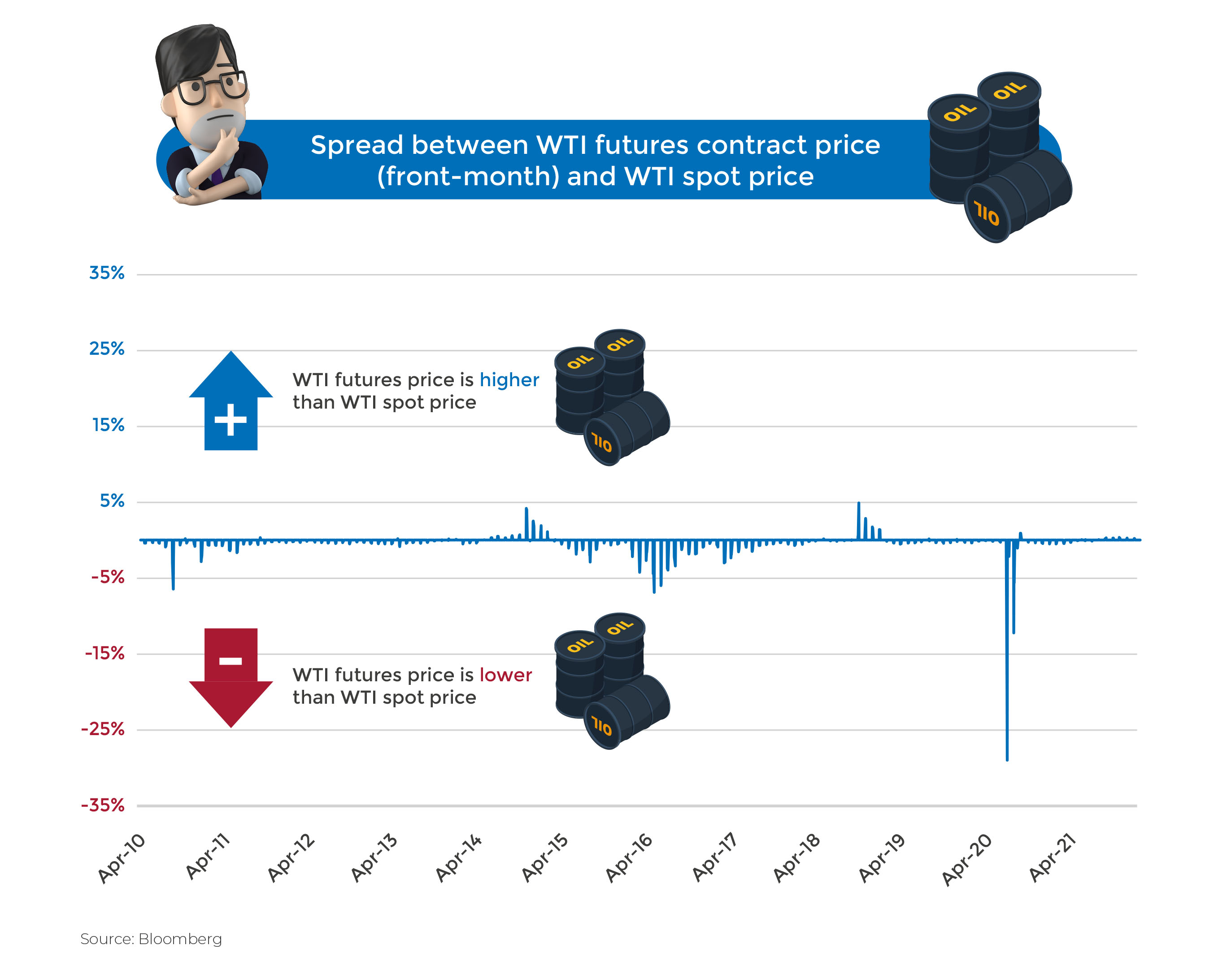

A variety of factors can lead to a disparity between the expected future price of crude oil and the spot price at a given point in time, such as the cost of storing crude oil for the term of the futures contract, interest charges incurred to finance the purchase of crude oil and expectations concerning supply and demand for crude oil. The below chart illustrates the difference between West Texas Intermediate (WTI) futures contracts price and WTI spot price. You may also make use of the performance simulation tool on the crude oil futures inverse products’ website to help yourself understand the difference.

Key risks

Before making an investment decision, it is important to understand the key risks of inverse products such as the following: investment risk, volatility risk, long-term holding risk, risk of rebalancing activities, liquidity risk, intraday investment risk, portfolio turnover risk, correlation risk, futures contracts risks, rolling of futures contracts risks, trading time differences risk (for futures-based inverse products which invest in futures traded on an overseas futures exchange), termination risk, leverage risk and unconventional return pattern.

Investors may refer to our web articles, “Leveraged and inverse products – Benefits and risks” for details.

In particular, there are several additional key risks involved in crude oil futures inverse products. Investors’ attention should be paid to the below risks.

Deviation of crude oil futures price and crude oil spot price risk:

The product does not invest in the physical crude oil. The underlying index comprising specific crude oil futures contracts whose price movements may deviate significantly from the crude oil spot price. The product does not seek to deliver an inverse return of crude oil spot price.

Risk of mandatory measures imposed by relevant parties of crude oil futures:

Regarding the futures positions in the crude oil futures inverse products, relevant parties (such as clearing brokers, execution brokers, participating dealers and stock exchanges) may impose certain mandatory measures for risk management purpose under extreme market circumstances such as Covid-19 when oil prices plummeted. These measures may include limiting the size and number of futures positions of the crude oil futures inverse products and/or mandatory liquidation of part or all of the futures positions without advance notice to the products’ manager. In response to such mandatory measures, the product manager may have to take corresponding actions in the best interest of investors and in accordance with the products’ constitutive documents, including suspension of creation of the products’ units and/or secondary market trading, implementing alternative investment and/or hedging strategies and termination of the products. These corresponding actions may have an adverse impact on the operation, secondary market trading, index-tracking ability and the NAV of the products. While the manager will endeavor to provide advance notice to investors regarding these actions to the extent possible, such advance notice may not be possible in some circumstances.

Crude oil market price volatility risk:

Crude oil prices may be highly volatile and may be affected by numerous events or factors such as crude oil production and sale, complex interaction of supply and demand of crude oil, weather, crude oil inventory level, pandemic like Covid-19, war, speculator’s activities, organization of petroleum exporting countries’ behaviour and control. Under exceptional circumstances, the oil price may increase substantially within a short period of time. There is no guarantee that the crude oil price, and the prices of crude oil futures will move in favor of a particular crude oil futures inverse product.

Risk of rolling futures contracts:

Similar to futures-based ETFs, crude oil futures inverse products need to rollover futures contracts to achieve its investment objective.

“Rollover” for inverse products refers to covering existing expiring short positions in futures and replacing them with short positions in futures with a later expiration (i.e. longer-term contracts). If the prices of the longer-term contracts are lower than those of the expiring contracts, a loss may incur over time (i.e. a negative roll yield) due to such pricing difference and would adversely affect the net asset value (NAV) of the product.

You should note that save for the transaction cost incurred, a “rollover” in itself is not a loss or return-generating event. That is, the NAV of the crude oil futures inverse product will not suffer an immediate loss or enjoy an immediate gain due to “rollover”.

Backwardation risk

A crude oil futures inverse product rollovers futures contracts to achieve its investment objective by covering the current short positions in existing expiring future contracts and shorting the longer-term futures contracts.

If the futures market is in backwardation (i.e. the price of near-term contracts is higher than the price of longer-term contracts), a negative roll yield may be realized over time and reflected in the NAV of the crude oil futures inverse product when the crude oil futures inverse product repeatedly covers the short positions in the near-term contracts at a price higher than the price of the longer-term contracts. As such, the NAV of the crude oil futures inverse product may be adversely affected.

Price limit risk:

If the price of the futures contracts included in the crude oil futures inverse products’ portfolio hit certain price limits, depending on the time of the day and the limit being reached, the trading of the futures contracts may be limited within the set price limits, suspended for a short period of time, or suspended for the remainder of the trading day. This may affect the crude oil futures inverse products’ tracking of the inverse of the daily performance of the index, and if a trading halt takes place near the end of a trading day, may result in limitations in daily rebalancing.

Risk of volatility of a single commodity asset or a single futures contract:

The crude oil futures inverse products have risk exposures concentrated in the crude oil futures market and are subject to the price volatility of a single asset only (i.e. crude oil). Such volatility may be extremely high and substantially higher than the volatility experienced by equity indices or a commodity index which is made up of multiple types of commodities. If a crude oil futures inverse product holds only a single futures contract (e.g. the product holds only the near-month futures contract), this may result in large concentration risk and the price volatility of the product may be higher than that of a product which holds futures contracts with different expiry months.

Investors should also refer to our web article, “Futures-based ETF” to understand the risks involved for investing in futures-based product such as risk of statutory restrictions on number of futures contracts being held. Where the manager may adopt a swap-based synthetic replication strategy, investors should also pay particular attention to the below risks.

Synthetic replication risk and counterparty risk:

The crude oil futures inverse products may suffer significant losses if the counterparty fails to perform its obligations under the swaps. The value of the collateral assets may be affected by market events and may diverge substantially from the performance of the crude oil futures index, which may cause the crude oil futures inverse products’ exposure to the swap counterparty to be under-collateralised and therefore subject to credit risk and potentially significant losses.

The crude oil futures inverse products may bear the swap fees, which are subject to the discussion and consensus between the manager of the crude oil futures inverse products and the swap counterparty based on the actual market circumstances. In extreme market conditions and exceptional circumstances, the swap counterparty’s costs of financing for the underlying hedge may increase significantly and in return increase the swap fees.

1 December 2021