High-tech companies listed in Hong Kong

In Hong Kong, the financial services and property sectors once dominated the stock market in terms of market capitalisation. However, with the growing importance of innovation and technology, the weight of relevant sectors has been on the rise in recent years. The Information Technology industry is now the largest industry (in terms of market capitalisation) on the Exchange’s market (Source: HKEX, based on Hang Seng Industry Classification of Hong Kong listed companies as at 30 June 2023).

In recent years, new economy companies have been a popular investment choice. To attract these companies to list in Hong Kong, HKEX underwent a reform in 2018 to allow eligible pre-revenue biotech companies and large innovative companies with weighted voting rights (WVR) structure to list in Hong Kong, and to create a new concessionary secondary listing route for eligible Greater China and international companies. In March 2023, HKEX also introduced a listing regime for Specialist Technology Companies, allowing eligible Specialist Technology Companies to go public in Hong Kong.

The listing requirements

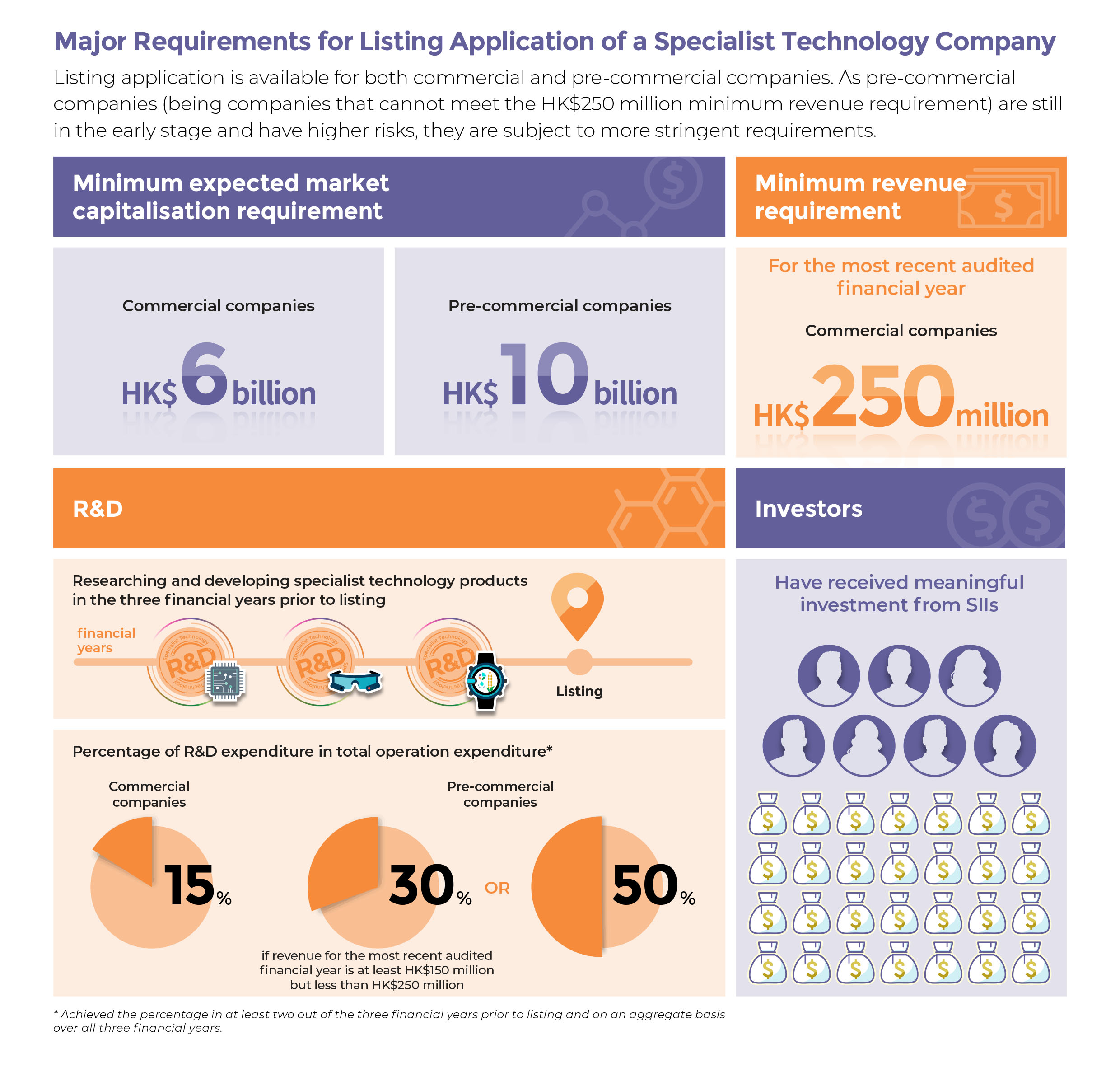

In general, when a company applies to list on the main board of HKEX, it will need to pass one of the financial eligibility tests, either the profit test, the market cap/revenue/cash flow test, or the market cap/revenue test. Many Specialist Technology Companies need substantial R&D and capital investments, and may not have any products or services available in the market yet. Consequently it is difficult for them to pass the ordinary financial eligibility tests and list in Hong Kong. The new listing regime enables eligible Specialist Technology Companies to apply for listing in Hong Kong as long as they meet the alternative requirements as set out in Chapter 18C of the listing rules which include, among others, requirements on minimum market capitalisation, R&D expenditure and investment from sophisticated independent investors (SIIs).