Overview of the regulatory regime

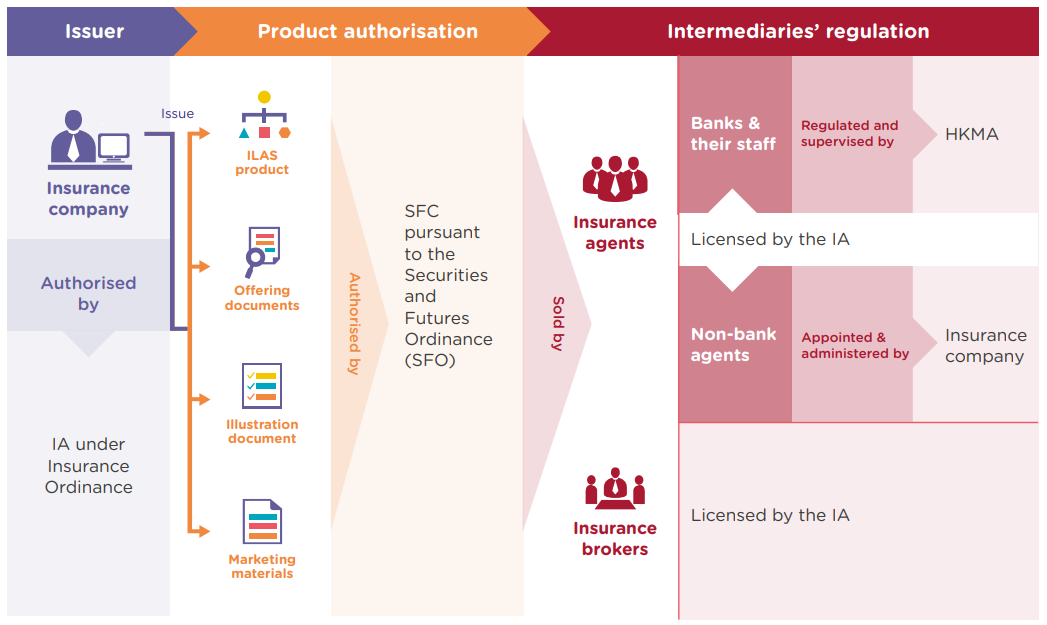

ILAS products and their offering documents (including the Product Key Facts Statement), illustration documents and marketing materials must be authorized by the Securities and Futures Commission (SFC) before they can be offered to the public in Hong Kong, unless an exemption under the Securities and Futures Ordinance (SFO) applies.

The investment options of ILAS products offered for consumers to select may link to retail funds that are authorized by the SFC pursuant to the Code on Unit Trusts and Mutual Funds and other portfolios that are internally managed by the insurance company on a discretionary basis.

Insurance companies issuing ILAS policies are authorized and regulated by the Insurance Authority (IA).

According to the guidelines issued by the IA, insurance companies should comply with the comprehensive requirements for underwriting ILAS business in all aspects, ranging from product design, clarity of policy documents/publications, remuneration structure and disclosure, sales process to post-sale controls.

Under the Insurance Ordinance (IO), any person who carries on a regulated activity must possess a valid licence under the IO, unless exempted. Regulated activity includes negotiating or arranging a contract of insurance; inviting or inducing, or attempting to invite or induce, a person to enter into a contract of insurance; inviting or inducing, or attempting to invite or induce, a person to make a material decision; and giving regulated advice.

The licensing of insurance intermediaries and complaints about their misconduct are handled by the IA. In selling ILAS products, banks and their staff are regulated and supervised by the Hong Kong Monetary Authority (HKMA).

Regulatory mapping: